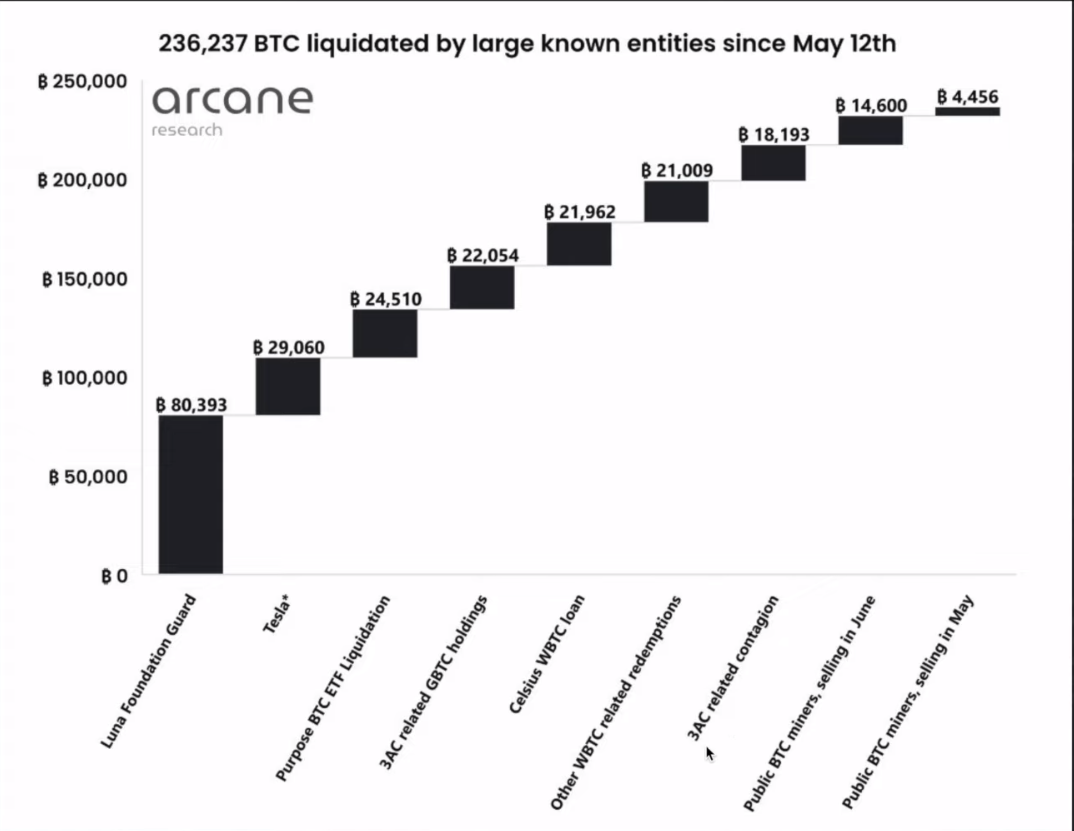

What liquidation in #BTC looks like

Imagine leverage.. liquidations.. SURPRISE!

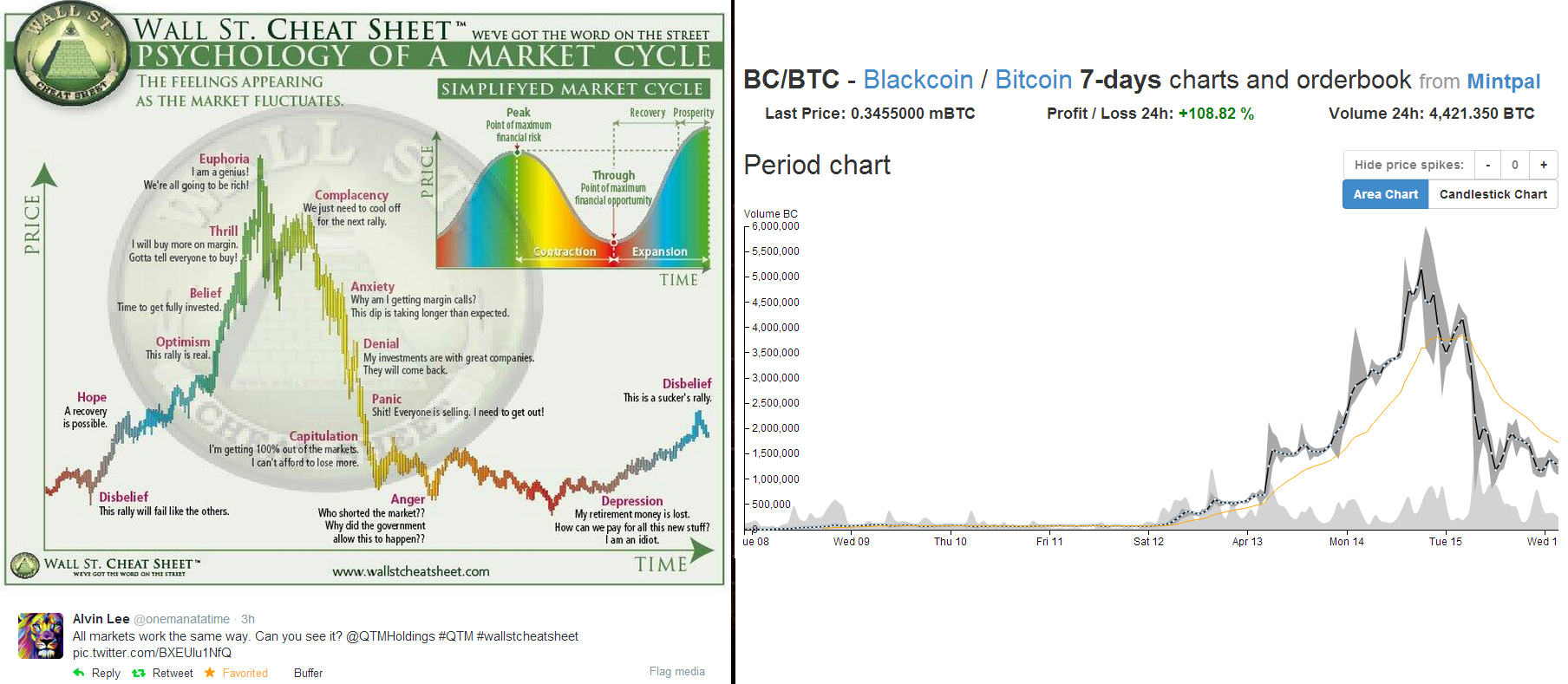

Right now #BTC and the rest of the shit-coins are trending sideways in an ascending triangle. Higher lows, Lower Highs! Anyone trading looks at the charts to predict the future. Moving traders aside we all saw about 1.2 TRILLION $USD leave the crypto market.

What happened? Well we had many many failures that cascaded into that sweet #LUNA chart. Hero to ZERO!

- LUNA Foundation Collapse

- Tesla Dumps

- Purpose BTC ETF Liquidation

- 3 Arrows Capital Bankrupcty

- Celsius Bankruptcy

- BTC miners dumping

Here is a great example of not only FUD, but contagion. Unlike traditional legacy markets, Bitcoin doesn't have a too big to fail backing. It's almost like ponzi's don't get bailed out!

In all honesty yes of course margin calls based on leverage pump a market up. Even for BITCOIN the canary in the coalmine could still be tether which acts very much like fractional reserve banks. However it is not too big to fail. Many say the money will just pour into #BTC and other #ALTS. What we do see is from that overall last chart how much in reality 1 #BTC is worth. Could it go sub-10k? It really depends on when the easy money pivots. In reality this is a nice portion of capitulation.

It's possible we hit a bottom. It's also not guaranteed. We raised another 0.75 basis points but if there are more to come you can guess what the market will puke.

Hope you enjoyed my #BTC analysis up until this point.

Posted Using LeoFinance Beta

I think that the digital currency partnership in the economic, even football, fields will have positive results in the future.

The flow of money into all BTC will not be good because it will make the bid and supply price vary greatly. I think the crypto investment strategy is actually a nice solution.

Good article....the vast majority of liquidations from overleverage have likely been seen, which bodes well for avoiding nasty sell offs, but certainly does not mean it is not possible.

Posted Using LeoFinance Beta

@tipu curate

Upvoted 👌 (Mana: 3/43) Liquid rewards.