The Bitcoin Crash - A Lesson in Volatility and Survival. A Real Bad Chain Reaction.

Until recently, optimism dominated the market. On January 20, Bitcoin reached an all-time high of 109,000 $, an explosion of enthusiasm amid Donald Trump's promises to relax regulations and create a strategic national reserve of BTC. But in just six weeks, that hope evaporated, replaced by panic. On this Friday, Bitcoin had sunk by more than 25% of its value. A collapse of confidence, an episode written in the blood of investors who had perhaps forgotten that the history of cryptocurrencies is cyclical, cruel and unpredictable.

The reason? A volatile mix of politics and economics. On the one hand, the new wave of trade taxes imposed by Trump on China and additional tariffs applied to Canada and Mexico. On the other hand, a massive cyberattack on the Bybit platform, after which $1.5 billion disappeared. Disparate events, but which, together, managed to shake the market's confidence. Investors seem to no longer flee to Bitcoin as a digital refuge, but are starting to see it as a burden that is too risky.

This scenario has been playing out for years. Lightning increases, followed by steep declines. A rollercoaster where some made fortunes and others lost them overnight. And yet, something seems to be different this time. Panic is no longer limited to the crypto markets – it is reverberating throughout the global economy. In the US, investors are eagerly awaiting GDP and PCE price index data, trying to guess the Fed's next move. A reduction in interest rates could stabilize Bitcoin, but in the absence of clear signals, fear will certainly reign.

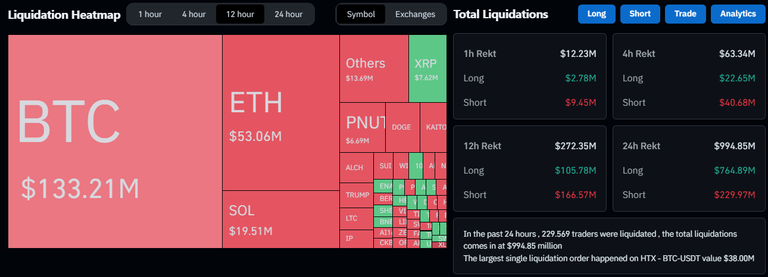

With Bitcoin, Ether, XRP, and the rest of the market fell. Portfolios turned red, and panic selling began to fuel the crash. Anyone who has been through previous market cycles knew that such moments are inevitable, but that doesn’t make them any easier to bear.

At times like these, i always think of two forces that govern financial markets: fear and greed. When prices rise, we convince ourselves that the upward trend will continue indefinitely. When the market falls, we fear that everything will collapse for good. The truth lies somewhere in the middle, but collective psychology rarely recognizes this balance.

There was much talk about Bitcoin’s inclusion in the new US sovereign wealth fund, and this seemed to provide a certain stability. But with economic and political uncertainties, this certainty has become illusory. The crypto market, still young and volatile, remains at the mercy of external events and collective emotions.

At such a moment, the decision for every investor is clear: run or stay. Today may be one of the hardest days for cryptocurrencies, but if the past has taught us anything, it is that the market neither forgets nor forgives, but always rises again.

- I keep thinking, maybe this storm will be followed by a new dawn. The question is - who will have the patience to wait?

People make a big deal out of the dips but the reality is that they are a great opportunity to buy more. If you believe in Bitcoin then you should be happy with the opportunity.

Yep😊.... Notice that you have a positive attitude – that's good and thank you for your perspective. You're right, for many investors, dips can be a good buying opportunity. However, at the moment, i am personally reevaluating my position and enthusiasm towards Bitcoin. I think it is important to adapt our investment strategies to the current economic and personal situations.