The Fed looks like it will soon end QT

In the most recent Federal Reserve press conference, Fed Chairman Jerome Powell said, "It is appropriate to slow pace of asset runoff soon." By run-off, he means letting maturing bonds run off the Fed's books. "Slowing it down", means repurchasing new bonds to replace those that matured - in other words slowly ending QT.

Why would they want to do that when inflation isn't yet under control?Answer: the bond market has liquidity problems. Specifically, the US Treasury is having trouble finding buyers for the tsunami of new bonds it is issuing.

The Fed's QT strategy was dependant of the Biden administration showing fiscal restraint. But instead they've been borrowing like drunken sailors. The Bank of England and the European Central Bank are having an easier time of it as the UK and European governments are trying to restrain spending.

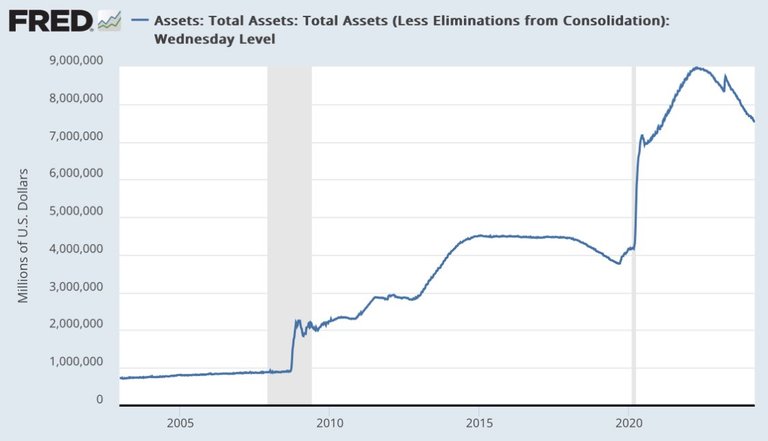

Only 16% of total global Covid QE has been removed so far. If the Fed stops QT, it'll take the world even longer to get back to pre-pandemic conditions.

You can see from the following chart how little progress has been made by the Fed in reversing QE.

Congratulations @rose98734! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 15000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: