Foreign Central Banks are switching to gold

The price of gold topped $2,300 per troy ounce. Who is buying? Answer: Central Banks.

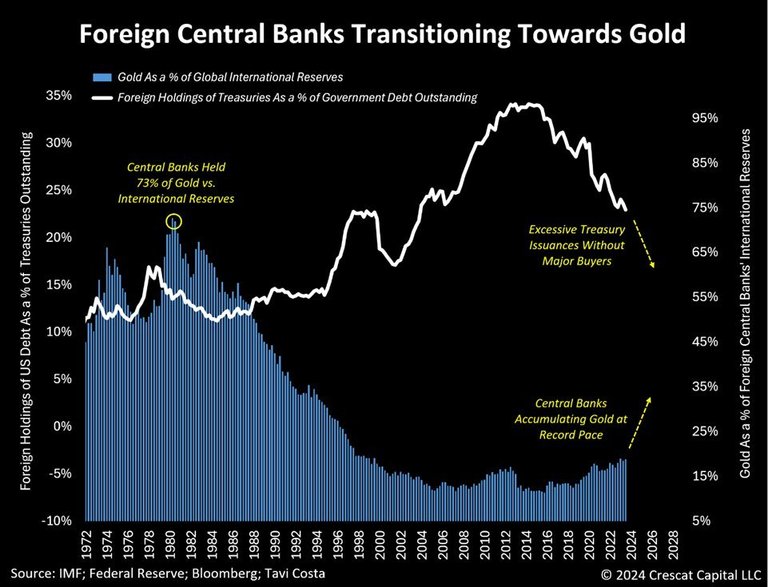

Here is the chart of central bank gold holdings compared to their holdings of US Treasuries.

The US came off the gold standard in 1971. As central banks no longer needed to hold gold to settle trade balances, they began to sell the gold and buy dollars - you needed dollars to pay for oil, copper and other commodities. They parked their excess trade dollars in US Treasuries.

Central banks still need to hold dollars to settle their trade balances, but they are beginning to use their excess dollars to buy gold.

This has been triggered by the Biden administration threatening to confiscate Russia's dollar reserves. Freezing reserves is one thing; when the rogue country's leader is replaced with someone better, you unfreeze it and give it back.

Confiscation is pure theft, the money belongs to the people of that country, not their current temporary leader.

There is something else at play too: the world is alarmed at the rate the US govt is accruing debt. It's not sustainable. Central banks are accumulating gold in case the dollar implodes - the gold should allow them to carry on doing business regardless.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @rose98734, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Do you want to win SOME BEER together with your friends and draw the

BEERKING.