THE CASHLESS POLICY IN A DEPRESSED ECONOMY – NIGERIA TODAY

Hello friends in this Rant community of Hive,

How are you all doing, hope you are coping fine, as for me I want to talk about a problem that is greatly affecting everyone in my country today. It is generally called CASHLESS and that is what is on every lip today both young and old. Here me out as you read on.

It was announced by the Central Bank of Nigeria (CBN) on Wednesday October 16, 2022, that a new Naira currency note will be introduced and everyone should return and deposit every old currency to the bank so as to receive the new note. The release of the new notes to the public through the banks in Abuja the Federal Capital Territory Nigeria, was on Dec. 15, 2022 but the general public did not see the money in circulation.

Then the Senate asked the CBN to extend the deadline for the withdrawal of old naira notes from circulation from January 31, 2023..

The Supreme Court faulted the naira redesign policy by the Central Bank of Nigeria (CBN), declaring the naira notes swap implementation invalid and an affront to the 1999 Constitution

These new policy has caused a lot of problems and woes to the Nigerian economy and the public as a whole. Everything – socially, economically and otherwise has been grounded leaving a lot of hardship to the poor masses as they flock the banks across the country.

Following the announcement, everyone started spending their old notes and depositing them back to the banks in order to get the new notes in exchange but the reverse is the case. No cash.

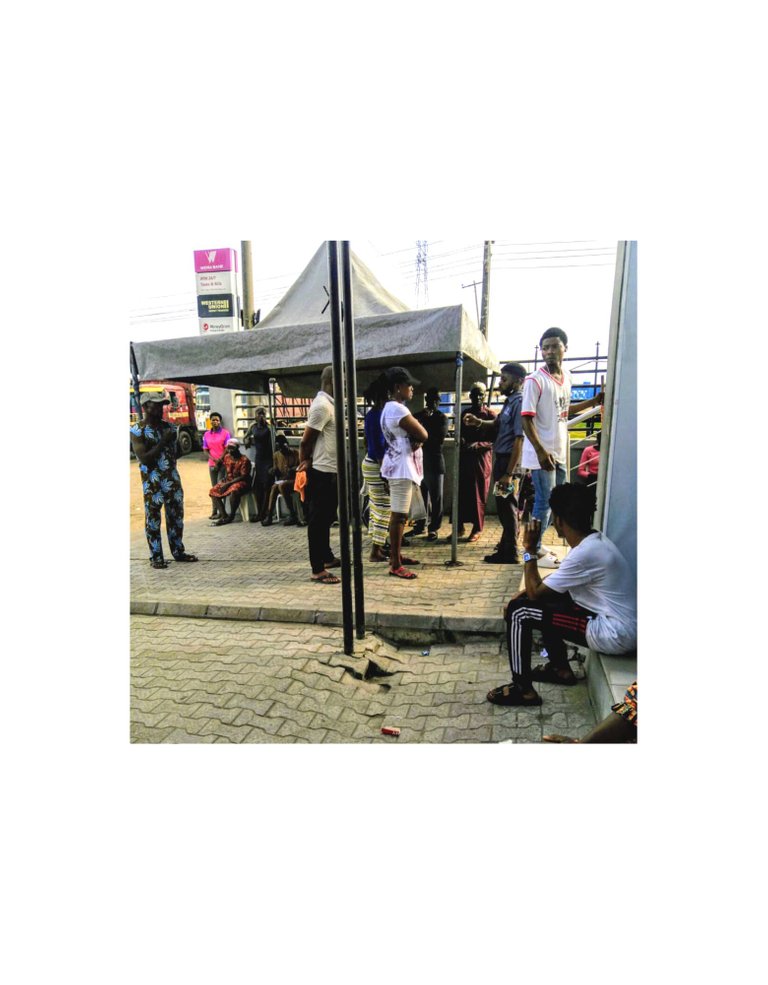

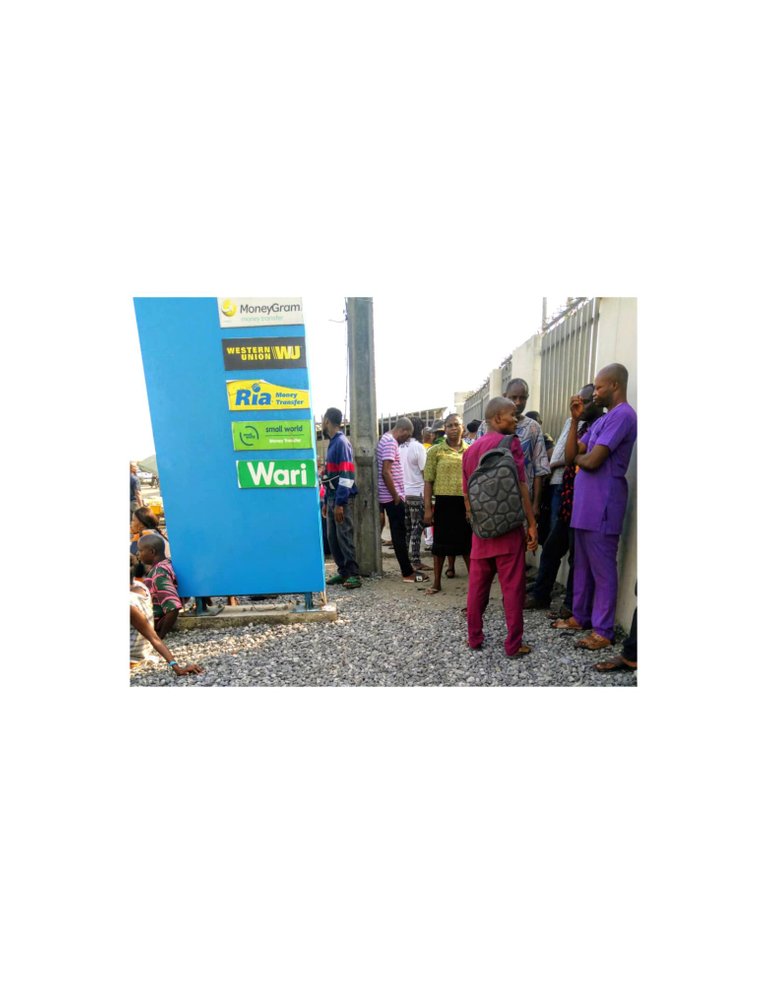

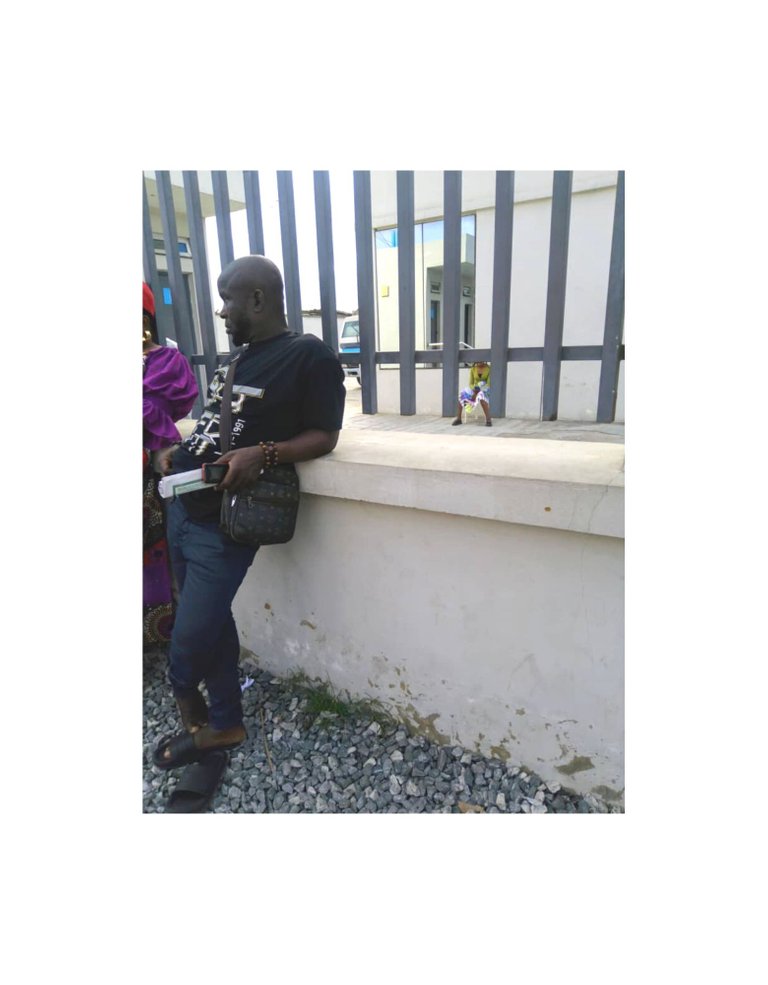

Since February 2023, the general public gradually started becoming cashless. As they visit the bank to withdraw their money, they are denied access to enter the bank as you can see many outside the locked gate.

Transactions now go on money electronic transfers. This has created a very huge problem with many economic challenges. The banks have network issues especially during the day time. The bank is no longer giving cash. They are now on closed doors and people flood the banks with no success to get their cash back for their spending.

Infact the economy is depressed and it has been quite challenging for many. This policy has led to the sell of the naira with naira by the few who were able to get some cash. If you want to withdraw from the so called ‘black market’ and other vendors you pay extra money with high charges. To get N10000 cash you pay N1500 as charges.

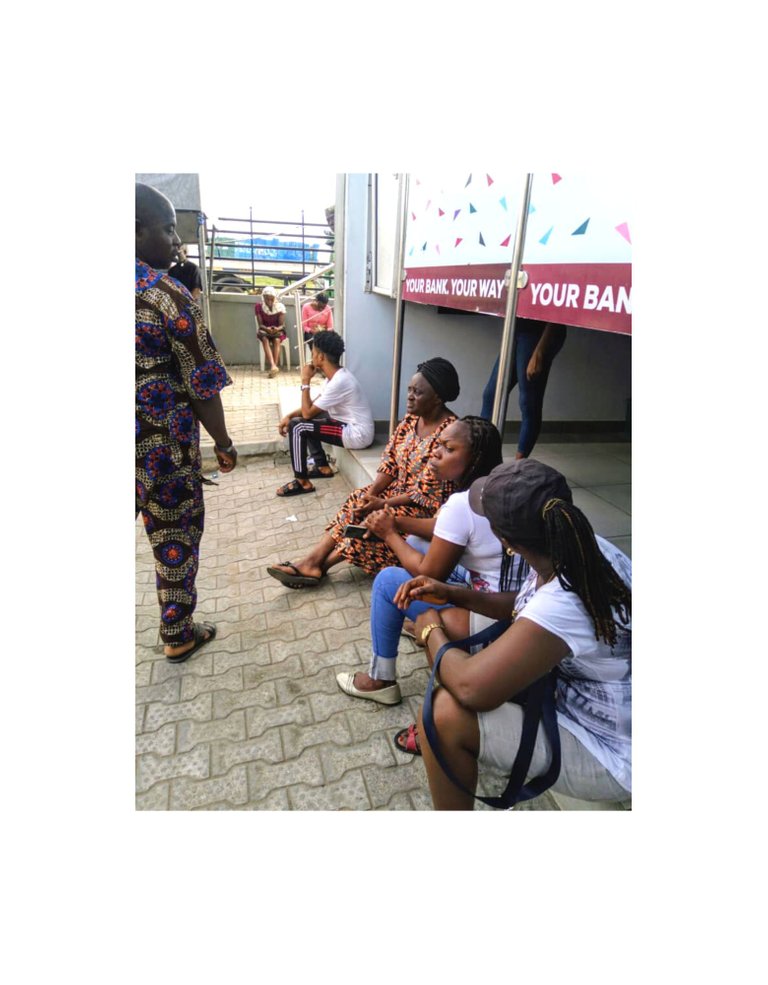

Those who cannot afford that still go and que in the bank hoping to get a little money but end up wasting their precious time and efforts. I also experienced this ugly situation as I went to 3 different banks - Union Bank, United Bank for Africa, First City Monument Bank, all to no avail. I regretted my life that faithful day as I came back empty handed without a naira on hand.

People got tired standing under the hot sun without shelter. Some just spread their handkerchief on the floor and sat down. It's really terrible.

People came to the bank's ATM points waiting to see if the bank will load these machines with money so as to withdraw any amount available as the bank may wish to pay customers.

Many argue that if the government wanted to implement a cashless policy, it should not have been in one full swung. It supposed to be done gradually over a period of time.

This could allow the general public and businessmen to adapt to the new system and the government should have provided an opportunity to address any challenges that may arise out of it.

The need for education and sensitization of the general public could have led to success of this policy to change to a new naira note. The benefits of this has almost been defeated. Many families are finding it very difficult to put food on the table, not that they are lazy or poor but their cash is with the bank. Those that managed to transfer money, the network is not delivering the money on time and some money transferred are hanging. Its been quite difficult for many even to buy medicine and pay for hospital treatment. Someone fainted in one of the banks out of frustration.

The government could have provided incentives to people so as to gradually adapt to the new policy but nothing like that in view. Now, after creating the problem for the masses, the CBN have just issued an order for the old naira note to continue in circulation till December 31st 2023, it is quite absurd.

Yet money has not been released in circulation. No smiling faces from the citizens. Many are saying it is due to the political change in government over the general election for a new President and their cabinets.

Many new challenges has now been created for some traders as hoodlums ceased the political opportunity and burnt down some shops in one business location in Lagos Nigeria. Goods and properties lost to the inferno, a huge problem now face those affected in this incident.

Indeed it is going to be a new era for us in Nigeria as we enter the next week after the governorship election. I hope normalcy will be restored and everyone continues in their daily affairs.

I thank you for reading to the end. Watch out for my next article.

Congratulations @essygold1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 200 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

It’s very sad to read about all these cashless stories going on in Nigeria. It’s completely unnecessary and the sad result of meddling bureaucrats who didn’t need to do something but seemed to want to inflict pain on people. My prayers for you in Nigeria to get things better soon!