An interesting income source on Hive – Providing Liquidity

Hive is probably not the most recognised blockchain when it comes to Defi and it's true that we don't have all the lend/borrow, short/long or multiply functions that other platforms provide. However, we have liquidity pools and they are pretty great because they allow you to swap a wide array of tokens.

These liquidity pools on hive-engine are however also an interesting income source for liquidity providers. When you go to tribaldex or beeswap, you can see all the diesel pools in existence. That's how liquidity pools are called on the second layer of hive.

Reward pools linked to diesel pools

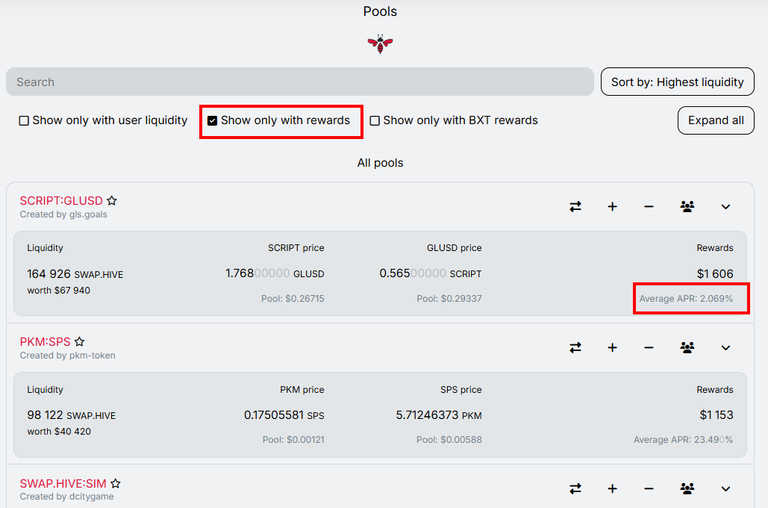

One income source for people providing liquidity are the reward pools that are linked to some of the diesel pools. It's easy to go to beeswap and simply filter the pools so that only pools with rewards are shown. Like that you can see which pools are rewarding the best. You have several options to filter the list.

source: Beeswap

What you have to know about these rewards is that they are provided most of the time by the creators of the pools. It's an incentive to provide liquidity. However there is another income source linked to these diesel pools...

Income from Fees

It's pretty unfortunate that neither platform gives us a precise return from fees. Each swap in the diesel pools costs 0.25% transaction fee that goes to the liquidity providers. The more swaps, the more fees and the more income for liquidity providers. Contrary to the rewards that we spoke about above, the fees are not paid on a daily basis. The fees are added in the form of tokens to your existing liquidity. This means that the fees make your position grow.

How much can you earn from fees?

I was wondering what kind of return could be achieved through fees. On Tribaldex, it's possible to see the accumulated fees expressed in USD during the last 30 days. I made the following calculation to get a return from these fees:

(Fees of last 30 days) X (12 months) / total liquidity in the pool

There are probably more precise ways of calculating the APR. There are many variables that need to be taken into account like the fluctuation of the fees from month to month, the impermanent loss, the quantity of liquidity in the pool. Needless to say that the numbers I have calculated here should be taken with some precautions.

| Pool | Total liquidity | Fees 30 days | Apr in % |

|---|---|---|---|

| swap.hive:sps | 576408 | 4169 | 8.67 |

| swap.hive:swap.btc | 287941 | 3971 | 16.54 |

| swap.hive:dec | 212431 | 3826 | 21.61 |

| swap.hive:swap.ltc | 86767 | 1782 | 24.64 |

| swap.hive:swap.usdt | 52565 | 1059 | 24.17 |

| swap.hive:swap.sol | 29235 | 565 | 23.19 |

What I found interesting from this calculation is that the fees that one could earn for providing liquidity in some of these pools is above 20% APR, which is higher than what you would get from staking HBD...

For some pools you have reward pools and fees that are cumulating their effect and providing a very nice return for liquidity providers.

Are you providing liquidity in diesel pools?

With @ph1102, I'm running the @liotes project.

Please consider supporting our Witness nodes:

It is certainly one of the best ways to invest in Hive and it also provides liquidity to the token, which is essential. As you say, it is a shame that it is not shown anywhere. I think that would make more people invest in those pools.

I would say that the whole liquidity pool side of hive-engine is not well presented at all. It's such a great tool but it's pretty difficult to find it. Also it's completely absent from hive-engine.

I see that you're using BeeSwap as an example. I couldn't locate the filter for "Show Only With Rewards" on Tribaldex.

Thanks for sharing this information.

When it comes to diesel pools, I prefer the BeeSwap front end. It carries more information and is easier to use in my opinion.

Thanks for your explanation. I appreciate it.

Beeswap is my favorite hive-engine token wallet/pool. !BBH

I agree, it's much easier to transact on BeeSwap and there are more information available.

It's interesting to see that some of the pools have such high APR. It seems like it's mostly tokens that people use a lot. Either to get in or out of the ecosystem or for Splinterlands. I do provide some liquidity but I haven't checked up on mine very often.

That's a very good observation and it's totally true. The more a token is useful, the more people swap it in pools. That generates volume and fees and provides nice return.

I used to do that in my early days on HIVE, and then decided that most pools aren't worth it because of the random spikes in HIVE prices during those "korean pumps".

It's never good to have too much fluctuation in a pool...

Very interesting topic! But does anyone know why HIVE droped from almost 3$ to the actual price?

There are many reasons for that but the most obvious is the fact that the demand for the token is very different from when it was 3$ :-)

Yeah, 🤘😎

!INDEED

!PIZZA

Nice never took a look in swap hive and swap usdt which sounds amazing! However, if swap.hbd market already suffers is the lack of liquidity!! I get some swap.hbd and it is tough to sell it for swap hive, and just saw thay swap.usdt suffers from the same so if you buy 1swap.usdt it doesnt mean that you are buying exactly 1 usdt! Right now to buy 1 swap.usdt the price is around 41 cents per hive while the internal market is almost 1 cent bellow for hbd!

The price of these different swaps is definitely not always close to peg. The reason is mainly that not many people know about these pools and it always takes some time before arbitrage happens and the prices rebalance.

Yes, you need to be patient so as not to overpay the token!

This is a really interesting topic for me, thanks for writing about it, man, and I don't really understand it. I've only contributed to the liquidity pool for zingtoken once and I don't know if I made a profit from it because the price of Zing has dropped a lot recently. I don't know how much people remember, but there was a time when 1 Zing was worth 0.50 Hive, and now a Zing is worth 0.0029 Hive, so that's about 340 Zings for 1 Hive. Anyway, I guess one learns things by trying things lol.

Providing liquidity comes with a certain risk because of the thing called impermanent loss. It's quite tricky to explain this. In a nutshell, if you have two tokens in a liquidity pool, you will always own 50% of value in token A and 50% of value in token B. If in your case Zing goes down in price, you will own much more Zing tokens and less hive tokens. In my opinion, it's always important to chose a pool with tokens that evolve in a similar manner or that you don't care ending up with either or. For example if you provide liquidity in the pool hive:btc, you probably don't mind ending up with more hive or more btc. I would only provide liquidity for such pools.

That makes a lot of sense man, that's the way I'm going to go from now on. Like you said, having more Hive or BTC is not a problem.

Those are something interesting APRs. Maybe I should move some of my liquid Hive on HE to LP, since it seems we slowed down on the pumps.

The pumps got rarer lately. I wonder whether we will see more of them...

I'm pretty sure we will.

Thanks for the curation!

I didn't know this method before after reading your post my knowledge has increased a lot. When people get such opportunities people will definitely start using this platform.

I'm happy you learned something :-)

Thanks alot for sharing.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Thanks for the curation!

I hesitated for a long time before trying out, but after a few months, I was actually not sure if I was gaining the APR overall because the price of the coins can be very volatile, and my coins holdings also fluctuated accordingly. Decided to withdraw in the end.

I have a rule that I set for myself. I provide only liquidity in pools where I don't mind ending up with one of the tokens or the other. Take a pool like LEN:LENM; both are pretty stable in price and you will get more or less the same ratio over time. If you take another pair where one token is very volatile and tends to lose value, you will end up with much more of this token than of the other.

Yeah I read about that but the prices are sometimes a bit unpredictable. I was pairing another token with SWAP.HIVE and Hive went up quite a bit, and I think that also led to some selling in the other token.

$PIZZA slices delivered:

@ladyaryastark(4/10) tipped @achim03