5 Hive Engine Tokens Making Technical Analysis Moves for 3/16/2022

It is 3/16/2022 and here are the Hive Engine Tokens making waves from Technical Analysis Perspective.

Traders of different trading philosophies would agree that it is important to gain an understanding of a Hive Engine Token's price action. This importance varies among traders, but it still remains important as traders look to buy low and sell high. Every trading day (which is every day in Hive Engine Market) presents new opportunities to examine Hive Engine Tokens and their price movement (technical analysis).

Let’s examine the tokens that have made the most recent technical analysis moves with various indicators. This is a selection of tokens that have made the most significant movements that can have an impact in the short and long term. None of the below is financial advice, you are encouraged to do your research before trading or investing in any securities. Positions carry risk of loss of investment principal.

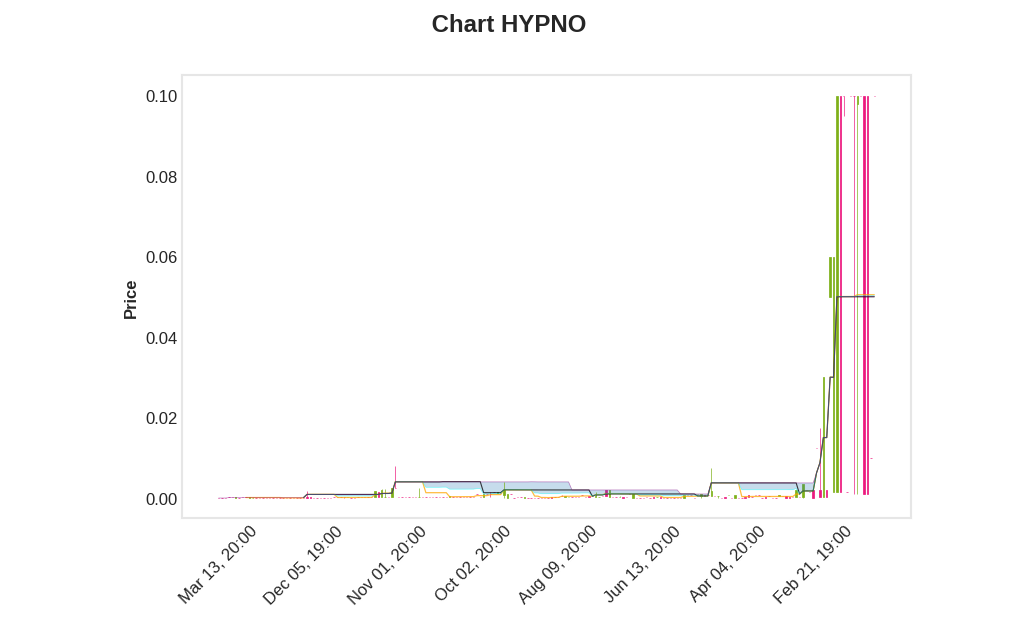

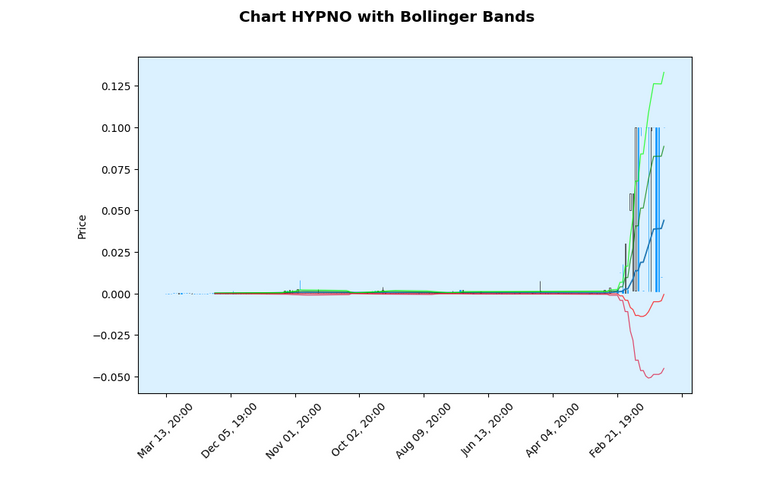

Hive Engine Token #1:HYPNO

The price is above the cloud (kumo), the price is above the Kijun Sen (a measure of the average of the highest high and lowest low over the last 26 periods, which happens to be days on a daily chart), and the Tenkan Sen (a measure of the average of the highest high and lowest low over the last 9 periods, which happens to be days on a daily chart) is above the Kijun Sen. All of this points to a bullish trend.

The daily trend is an upswing and the Bollinger Bands support this case, the price is contained between the first and second Standard Deviation levels above the mean.

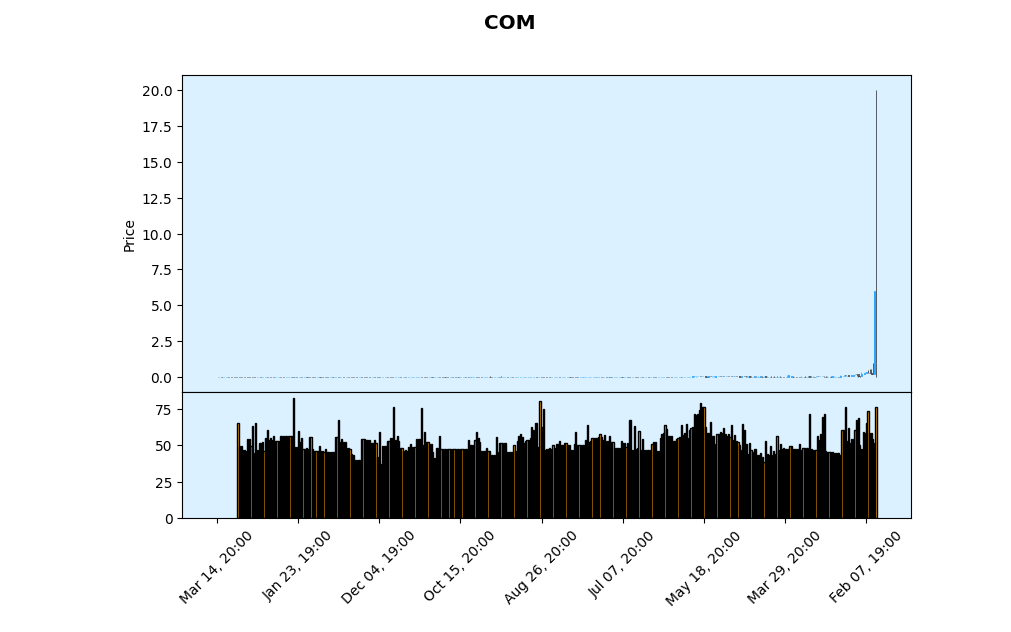

Hive Engine Token #2:COM

The daily chart of COM has the Relative Strength Index (RSI) dropping above 75 in the previous trading day, which indicates that the token is overbought. This is commonly used in conjunction with other indicators to confirm a possible situation where one would go short on this token. or take profits on a long position.

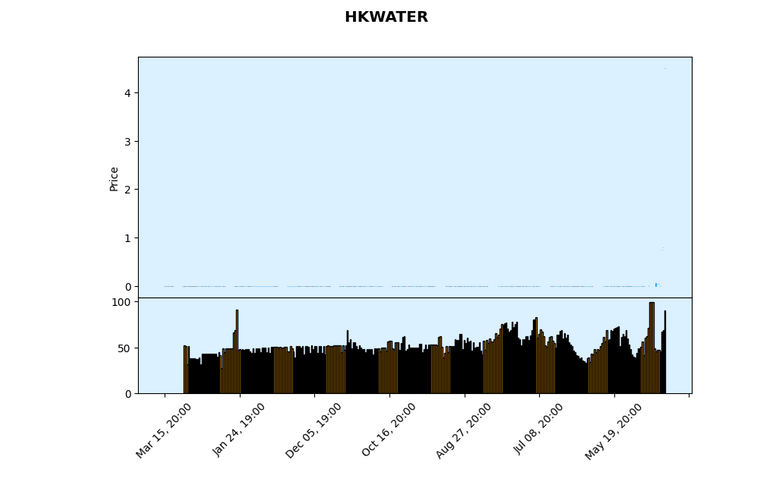

Hive Engine Token #3:HKWATER

In this examination of HKWATER's daily candlestick chart, it has a Relative Strength Index (RSI) that is above 75 in the previous trading day. As far as a 14 day RSI is concerned, it is in overbought condition. When used with other indicators and price action, it could help in providing the conditions where one would take a short position or take profits on a long position.

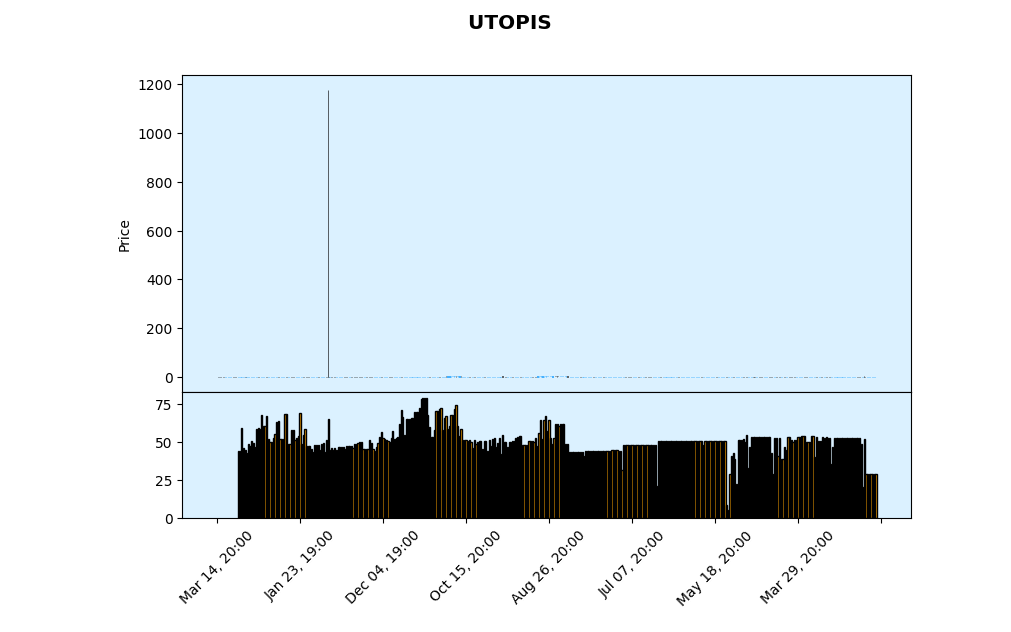

Hive Engine Token #4:UTOPIS

The daily chart of UTOPIS has the Relative Strength Index (RSI) dropping below 25 in the previous trading day, which indicates that the token is oversold. This is commonly used in conjunction with other indicators to confirm a possible situation where one would go long on this token. or take profits on a short position.

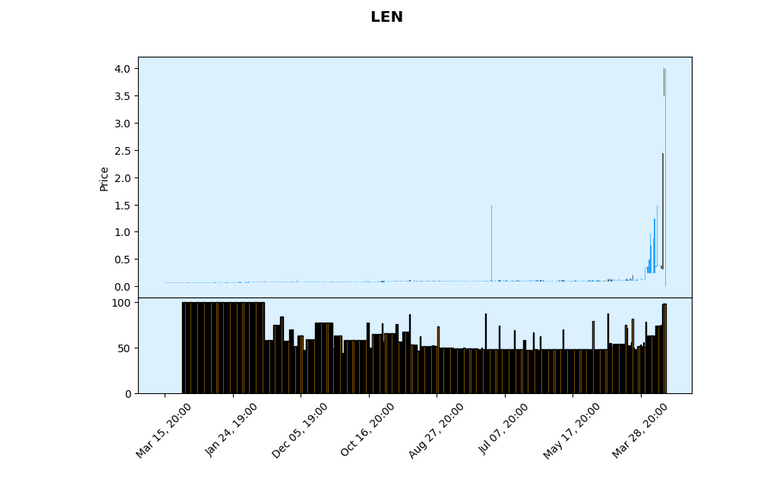

Hive Engine Token #5:LEN

The daily chart of LEN has the Relative Strength Index (RSI) dropping above 75 in the previous trading day, which indicates that the token is overbought. This is commonly used in conjunction with other indicators to confirm a possible situation where one would go short on this token. or take profits on a long position.

0.67882519 BEE

I only familiar with LEO and Waivio token on hive engine before reading your post, thanks for heads up, will pay attention more to them, cheers

Posted Using LeoFinance Beta

Explore the different tokens available. These articles just point out the trends based on technical analysis alone.

If you own a certain amount of UTOPIS (I don't know the minimum amount), you receive daily rewards of HIVE. Not many tokens do that.

Posted Using LeoFinance Beta

thanks for heads up, will pay attention on that token

Posted Using LeoFinance Beta

How does someone short a Hive Engine token (or go long, for that matter)? Is that just selling (or buying), or is there something such as options where we can short/long a token?

Posted Using LeoFinance Beta

You can go short by selling the token to convert it to SWAP.HIVE. I will clarify language in future articles, I have to fix language with future articles because we have already created a few misunderstandings.

Options for Hive Engine tokens... intriguing... don't know if we are necessarily there with volume.

Ah, OK. As for options, I don't think Hive offers that at this time of if there are plans for option instruments.

(If you want to earn more LEO for the technical analysis posts you make, it's best to publish the post using the LeoFinance front-end. Although you still earn LEO when you include the token tag, there's a penalty for using non-LeoFinance front-ends when earning LEO.)

Posted Using LeoFinance Beta

View more

Curious about HYPNO and UTOPIS due to the size of their market cap.

They both have quite small market caps. What are you curious to know? The articles are very focused on Technical Analysis and where the most recent movements/changes with various indicators are.

$1.9M market cap for HYPNO and $159.6k for UTOPIS are not really small as layer 2 tokens. There are many on Hive, which market caps are far smaller than them. Just curious because I am wondering why these tokens are not given much attention despite the bigger size of their market cap compared to other layer-two projects on Hive.

View more