Rich dad, Poor dad || Book review

This is the 21st Century, a time when we have the internet, so much knowledge and information available to us at our fingertips. In this world where information is so vast and readily available, knowing where to focus is what is most important.

One the great privileges we have available to us is knowledge from people who have walked the path that we want to walk, they pass this knowledge to us through books, videos, courses and social media.

One of these great books is the “Rich Dad Poor Dad” by Robert Kiyosaki.

This book is a standout is so many ways, each chapter holds so much that can be applied practically into day to day life, written in very simple and understandable English.

One major point that Robert Kiyosaki makes in his book, is the fact that to become financially free, the most important thing you need is financial literacy.

“Money comes and goes, but if you have the education about how money works, you gain power over it and can begin building wealth.”

Financial literacy is the education about how money works.

The rich dad poor dad story is about two dads of the author Robert Kiyosaki, he describes how learning from both of them shaped his ideologies about money.

His poor dad was his own father, he was educated, had a PhD and was a teacher, on the other hand, his rich dad was the dad of his best friend whom didn’t even go to college but later became a wealthy man.

To become financially literate, the author wants you to understand some basic things.

Cash flow, assets and liabilities.

Assets are simply the things that put money in your pocket while liabilities are the things that take money away from your pocket. Meanwhile, cash flow is the flow of cash from your assets to your liabilities and vice versa.

“Cash flow tells the story of how a person handles money.”

Popular to general knowledge, assets are things you own, they could be a house, a car, jewelry or something of great value. In this book, Robert Kiyosaki opens our eyes to realize that as long as these things are not earning you money, they are liabilities.

“There is a difference between being poor and being broke. Broke is temporary. Poor is eternal.”

You may not have the kind of money you desire, but that doesn’t mean you’re poor. Poverty is a mindset, the purpose of writing this book was the authors way of helping to change that mindset. When you’re financially literate, the next step is to think, plan and work towards your financial goals. You may be broke now but with the right education, plan and execution, it won’t be long before you become financially free.

“Rich dad believed that the words ‘I can’t afford it’ shut down your brain. ‘How can I afford it?’ opens up possibilities, excitement, and dreams.”

Robert Kiyosaki places a lot of emphasis on the need to change your mindset, when you look at the things you can’t afford at the moment you need to ask yourself how you can afford them. You need to think deeply about how you can move from one point to the other. When you say to yourself that you can’t afford it, your brain shuts down and you’re likely to wallow in your misery and lack.

Robert wants you to learn these basic things: Accounting, Investing, Understanding markets and The law.

These are the game changers, most people don’t bother to learn these things, if you’re going to change your money game, it important to invest is learning these.

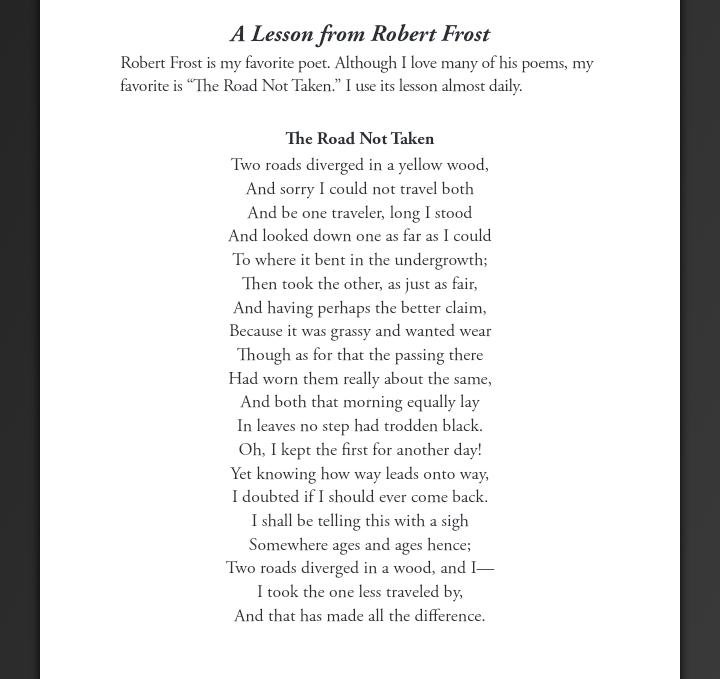

On the long run, your education is more valuable than the money you have.

Going to school should be the beginning of your learning process, gone are the days that you learn a 4, 5, 6 year course and it gets you a job that pays you for life. You have to constantly learn, unlearn and relearn throughout your lifetime.

It Is also important to know that your job is a short term solution to a long term problem, what if something happened to you and you stopped working?

Your job Is a means to an end, while working a job, grow your assets column to the point where you don’t have to work to earn money.

The main management skills needed for success are; managing your cash flow, managing systems and managing people. As you grow, you’ll have to groom these skills, take trainings if necessary so you can continuously grow your assets column.

This is only a tip of the iceberg to the great knowledge the book Rich Dad Poor Dad by Robert Kiyosaki holds

This book will change your money game, have a good read.

People that chop book, my hands are up for you guys 🙌🙌

Haha, whining everywhere. Thanks for stopping by dear kingleyy

No be whining.

I envy people that read books...

View more

https://leofinance.io/threads/seunruth/re-seunruth-5zkndmyh

The rewards earned on this comment will go directly to the people ( seunruth ) sharing the post on LeoThreads,LikeTu,dBuzz.

Yay! 🤗

Your content has been boosted with Ecency Points, by @stevenson7.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Dearie @stevenson7

Thanks so much for all the support. I really can thank you enough,never expected $1 mark. Love you ❤️❤️

💙🤗

But what are you doing up by this time? 😅

View more