How to know if a cryptocurrency has good Tokenomics

Hello readers,

If you are reading this blog then you must be involved in the cryptocurrency space and hopefully invest yourself or hold one or multiple Cryptocurrencies, especially during this never-ending ongoing bear season. While the majority of the humans outside this realm know only a little about crypto and mostly know names of the top 3 coins like bitcoin, ethereum or bnb etc, for us who are well aware and old users of this space certainly know that there are hundreds of thousands of small and big coins and tokens being traded right now under different exchanges. Cryptocurrencies are a big wide world and can seem puzzling whether you're a beginner or not. Also, it's needless to mention that the crypto world is always changing and that makes it tough for investors to keep up. As a veteran, I saw the sudden and massive popularity of non fungible token (nft)s but now the trend has changed to AI-related coins and I am pretty sure within the next year something new will come up and change this trend as usual. These ever-changing trends and artificially created FOMO situations often make us burn our hands and lose money even when we get a feeling of what we are doing.

One big thing that all investors in this space worry about is the tokenomics of any crypto when they want to invest their money in it. Now, before you get scared of the term, Tokenomics of crypto is just a simple way of understanding how a certain cryptocurrency works. If a cryptocurrency has good tokenomics, it simply means it is attractive to investors and may get them a good return in the future. On the other hand, If a particular crypto doesn't show any promising tokenomics or something too good to believe, it might not be a good investment. Good investors always focus on the tokenomics of a certain crypto coin or project before investing while others, especially newbies get trapped by not following the same.

But, how can one tell if a cryptocurrency has good tokenomics without doing a ton of research? Well, in this post, I will talk about three simple things that I started looking at whenever I come across a new coin, token or project and it is one of my first parameters to judge whether I should think to get into that coin or not.

How Many Total Tokens Are There?

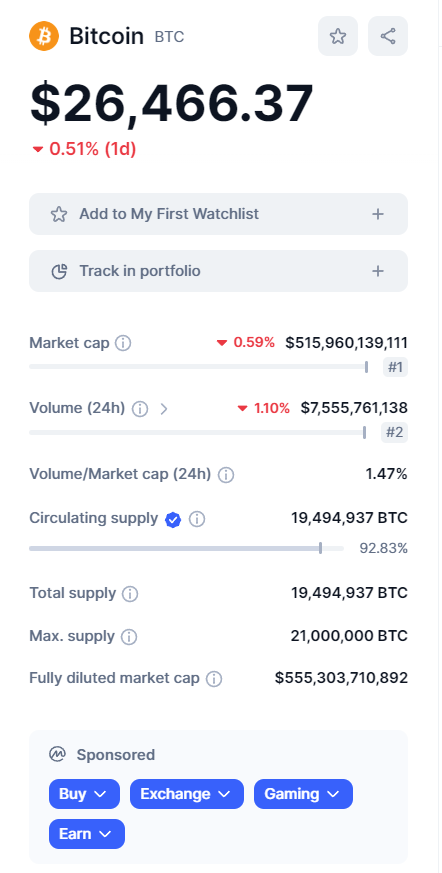

First, we should find out how many tokens a certain cryptocurrency has, including circulating and total possible supply, if all the tokens are distributed at once initially or over time and if the distribution has been done in a decentralized manner or not. Some cryptocurrencies, like bitcoin, ethereum or SPS, have a limited number of total supply tokens. This simply means that there will never be more of them in the future in circulation. And that's a good thing because it can make them more valuable and by nature, if more investors come and invest in them, the price will gradually rise over time. For example, only a total of 21 million bitcoin can ever exist and not a single more Bitcoins can be created in the future and right now, about 19.2 million Bitcoins are in circulation. This scarcity is a very valuable characteristic and makes Bitcoin valuable naturally as more and more people come, buy and hold Bitcoin.

But not all cryptocurrencies work the same. In my years of interaction in this crypto world, I have come across many coins and tokens that can create more tokens whenever they want, but from my experience, I can tell that over time, there’s a high chance that this bad characteristic can make them less valuable over time or even go null. You can easily find out how many tokens can be created max of a cryptocurrency and also the current circulating supply on genuine websites like CoinmarketCap. Also, make sure the numbers that are shown there actually match up with what you find on that particular cryptocurrency's own website or in it’s white paper.

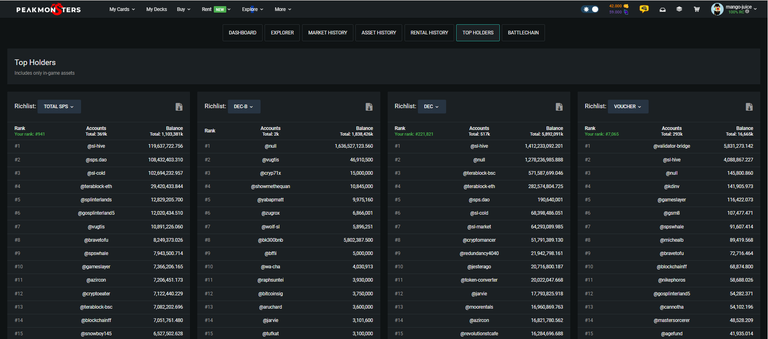

Who Has the Tokens?

As for the next characteristics, let us now see who has possession of the tokens of that particular crypto. This part is also very important before investing because it tells us if the tokens are spread out in a decentralized manner among many people or if just a few people have the most amount of the crypto. Let us take bitcoin as an example again. Bitcoin has a total max circulating supply of 21 million but it didn't get distributed all the tokens initially. Instead, Newly minted Bitcoins are given to people who are miners and help run the Bitcoin network. This makes sure that lots of different people have some of the bitcoin instead of a few people possess most of them and that’s what brings a good economy over time in Bitcoin.

But some cryptocurrencies may give most of their tokens to just a few people, and that can be a problem for the future and the pump and dump schemes mostly run in these types of cryptos. When only a small group has a lot of tokens, they can also have too much control and make it centralized and that can hurt the value of the tokens as time passes.

What Can You Do with the Tokens?

Last but not least, let us think about what we can actually do with that particular token. Some cryptocurrencies, like ethereum, are used to pay for things on their network. For example, we need Ethereum to buy non fungible token (nft)s in many gaming apps on the Ethereum network. This gives Ethereum value because people who want to enter and play that game will buy ETH anyway. Another good example would be SPS which needs to be staked while playing splinterlands non fungible token (nft) games to earn more rewards. However, not all cryptocurrencies give a clear picture of what we can do with their tokens at present or in the future. Well, Some might say they have big plans for the future, but there's no clear plan or roadmap yet. These can be very risky because it's hard to know if people will want them in the future and also a risk for them to go rug-pull overnight.

So in conclusion, understanding tokenomics of any particular cryptocurrency doesn't have to be complicated and some simple steps which I stated above can give us a basic view about them. We just have to look at the stats like how many tokens there are, who has them and what we can do with them. Though this is not enough to judge any cryptocurrency or the project behind but at least this will help you make smarter decisions in the world of cryptocurrencies.

Also, Please note that I am not a financial advisor so please do your own research before investing in any cryptocurrency. I hope you liked reading my post. Please let me know in which cryptocurrency did you invest most recently in the comments below and I will be seeing you all in my next post.

Posted Using LeoFinance Alpha

https://leofinance.io/threads/mango-juice/re-mango-juice-t5pkkqsg

The rewards earned on this comment will go directly to the people ( mango-juice ) sharing the post on LeoThreads,LikeTu,dBuzz.

Congratulations @mango-juice! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1700 posts.

Your next target is to reach 400000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Being 7 years actively in crypto, I saw a lot of different projects/tokens that were coming and vanishing, some of them stayed... Can't say that I have seen it all, but I saw a lot... In any case, these tips are one of the important ones that everyone should pay attention to... By checking the stuff that you mentioned, you can save some money and not be rug pulled...

In crypto, there is no such thing as being over-cautious... It's a must!

Thanks for the tips!

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

Yes indeed, being over cautious is a must in this wild world! Thanks for the support snd choosing my post! ❤️

great text!

!luv

@mango-juice, @crazyphantombr(2/10) sent LUV. | connect | community | HiveWiki | NFT | <>< daily

! help(no space) to get help on Hive. InfoThanks for visiting and the awesome surprise !pimp

You must be killin' it out here!

@mango-juice just slapped you with 1.000 PIMP, @crazyphantombr.

You earned 1.000 PIMP for the strong hand.

They're getting a workout and slapped 1/1 possible people today.

Read about some PIMP Shit or Look for the PIMP District