Financial Investment Plans and Analysis

One of the means through which we grow wealth is through investment. Money doesn’t remain at a particular level, it operates on the principle of growing or reduction in amount.

In this analysis, I used the dataset of a financial plan from kaggle.com showing different investment avenues and other factors considered by respondents in their investment.

The data presented in this investment plan was a fun project during the covid- 19 lockdown as regards investments. The data set was downloaded via the link on kaggle.com

https://www.kaggle.com/datasets/nitindatta/finance-data

Variables such as gender, age, investment avenues, objectives of investment, investment monitoring and returns rate on investment were considered in the form and would be analyzed for information it carries.

About the data

The spreadsheet contains 40 respondents’ investment plans and objectives.

The link to the data set is provided above.

Tool used

The tool used for analysis of this data is Microsoft excel.

Criteria met

Before the data was considered in order to derive information from it, it was cleaned: duplicates were removed, improper spellings were corrected as well as error from missing values also eliminated.

However the following questions are relevant as regards the data provided.

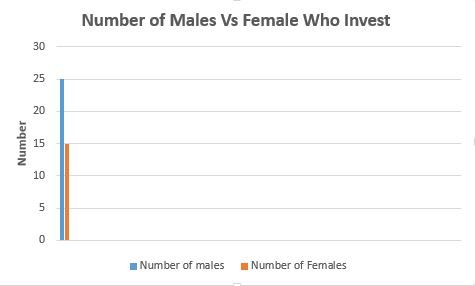

Considering the male and female gender, which gender buys the idea of investment the most?

Using COUNTIF statement in excel resulted a value for the number of males which are 25 and that of females are 15. This means from the data set majority of respondents involved in the investment were males which summarizes 62.5% and that of women 37.5%.

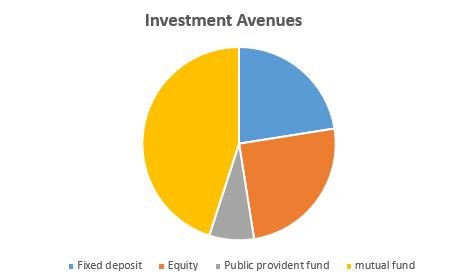

Which investment avenues does respondents patronize the most?

To answer this question, there were provided avenues of investment and the number of investment each respondent have.

They are namely:

- Mutual fund

- Public provident fund (PPF)

- Equity market

- Debentures

- Government bonds

- Fix deposit and

- Gold

Mutual funding had 102 investments of respondents.

Public provident fund had 81 investments

Equity market had 139 investments.

Debentures had 230 investments.

Government bonds investment were 180.

Fixed deposit were 143 and

Gold was 239.

To answer the question the avenues of investment most respondent chooses out of the listed are:

Mutual fund = 18

Fixed deposit = 9

Equity = 10

Public provident fund =3

Respondent can have more than one investment in all avenues.

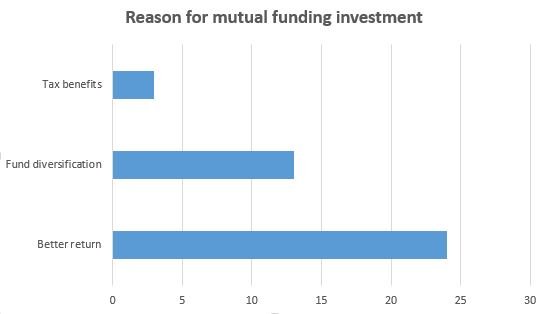

Why respondent chooses mutual investment avenue?

To answer this question, analysis of reason for mutual investment avenue will be carried out. There were three reasons which stated why mutual fund was better type of investment, they are;

- Better return

- Tax Benefit and

- Fund diversification

From the chart above, it is visible that people choose mutual funding because of better return opportunities present in it.

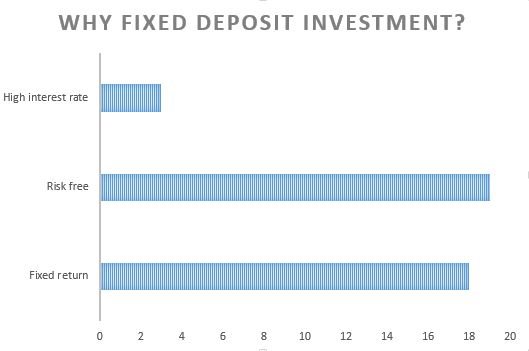

Why respondent chooses fixed deposit Investment Avenue?

To answer this question there were different reasons provided to why fixed deposit should be chosen, they are: high interest rate, risk free and fixed returns.

However from the chart a lot of respondent chooses fixed deposit as an investment avenue due to the fact it is risk free and it has fixed return.

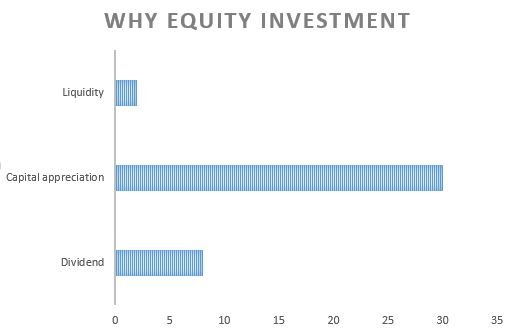

Why respondent chooses equity Investment Avenue?

To respond to this question, people chooses equity investment avenue because of liquidity, capital appreciation and dividend.

From the chat, the main reason for the choice is for capital appreciation.

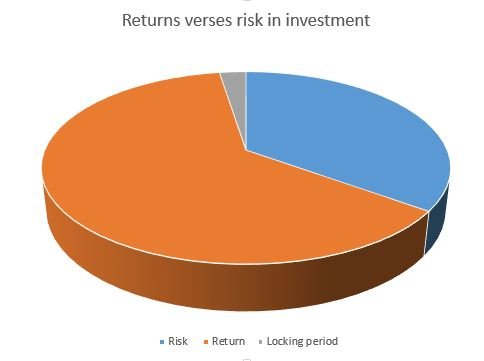

Considering each forms of investment, what were the outcomes?

Obviously investment is a risk, the likelihood of an investment experiencing a lost is known as risk, when there is likelihood of experiencing a gain or profit it is referred as return. However to view the outcome, I will first calculate the number of risk, locking period and returns then create a pie chart to visualize them.

Below is a pie chart showing the risk and return of investments. Most respondent experienced return upon their investment, a percentage was locked up. Whilst minority indicated the likelihood of experiencing risk.

Investment is a major factor for wealth creation, however if not properly planned could be frustrating and may eventually lead to loss, However from the analysis above a lot of respondent chooses mutual fund and fixed deposit and equity for their investments as it offers better return opportunities, capital appreciation and risk free.

Link to excel data:https://drive.google.com/file/d/1KXVJcfF0WKQXpv0BlHz8MvU2ZMqwyPkV/view?usp=drivesdk

Posted Using LeoFinance Beta