Where in the world do we have ultra-rich individuals?

There are about 62.5M millionaires worldwide. If you're wondering where in the world you've got to relocate to or should've been born to be among these people, then keep reading to find out!

created using the Bitmoji App

Growing up, regardless of country, you heard a lot about the American dream in the media, right? Do you know at least one or two people from your country who wish to move to America for better opportunities?

Well, it is a common consensus across all 7 continents that the US has consistently demonstrated strong economic and military power. This has helped it gain more influence on other countries. The influence didn't just end on the economic basis (USD) but also on the cultural outlook, with music, fame, and movies making other countries envy the American dream. But is the US the best place where one can easily get rich or get to mingle with wealthy people? Well, looking at the world GDP figures, the figures for the US would say yes. But does this also apply to individual wealth?

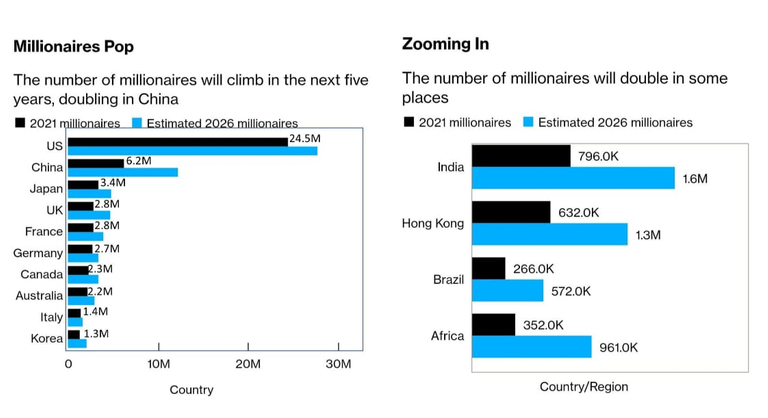

Top countries/territories for ultra rich individuals

Before we even look into the top 10 countries with the richest people and the top ten ultra-rich individuals, let's first define what is considered ultra-wealthy:

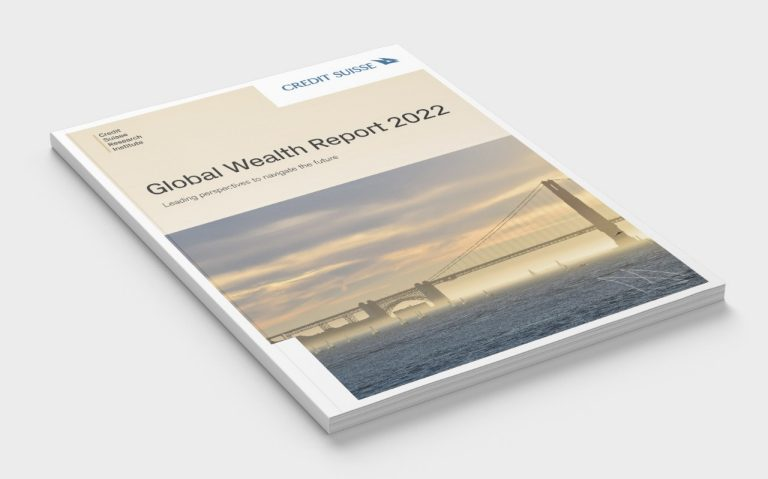

According to the global wealth report, ultra-rich or more affluent people are individuals with more than 30M USD in net worth (Net Worth = Assets minus Liabilities). The technical term is "UHNWI", meaning Ultra-high Net Worth Individuals.

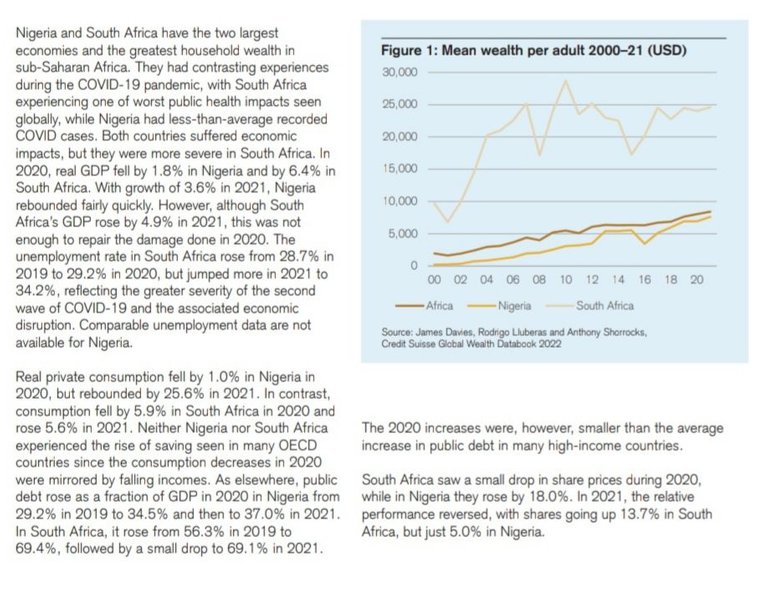

The result of the latest global wealth report, released in 2022, showed that the aggregate global wealth grew by 12.7% in 2021, which is the fastest annual rate ever recorded in the 21st century. This also means that wealth growth proved resilient in 2020 and was not majorly affected by the COVID-19 economic disruption. The ranking method considered the data from 30 countries, namely: Canada, the US, China, India, France, the UK, Austria, Germany, Switzerland, Denmark, Finland, Norway, Sweden, Japan, Korea, Singapore, Taiwan(Chinese Taipei), Australia, New Zealand, Nigeria, South Africa, Brazil, Chile, Mexico, Greece, Italy, Spain, Saudi Arabia, and the United Arab Emirates.

The list of the top 10 countries with the richest people is below.

Source: Credit Suisse Global Wealth Report 2022

From the data, the US was ranked the top country with the most UHNWI. But then, if one zooms into the overall forecast of each country in the future, countries/regions such as India, Africa, Brazil, and Hong Kong have shown huge potential to double the number of millionaires in 2026.

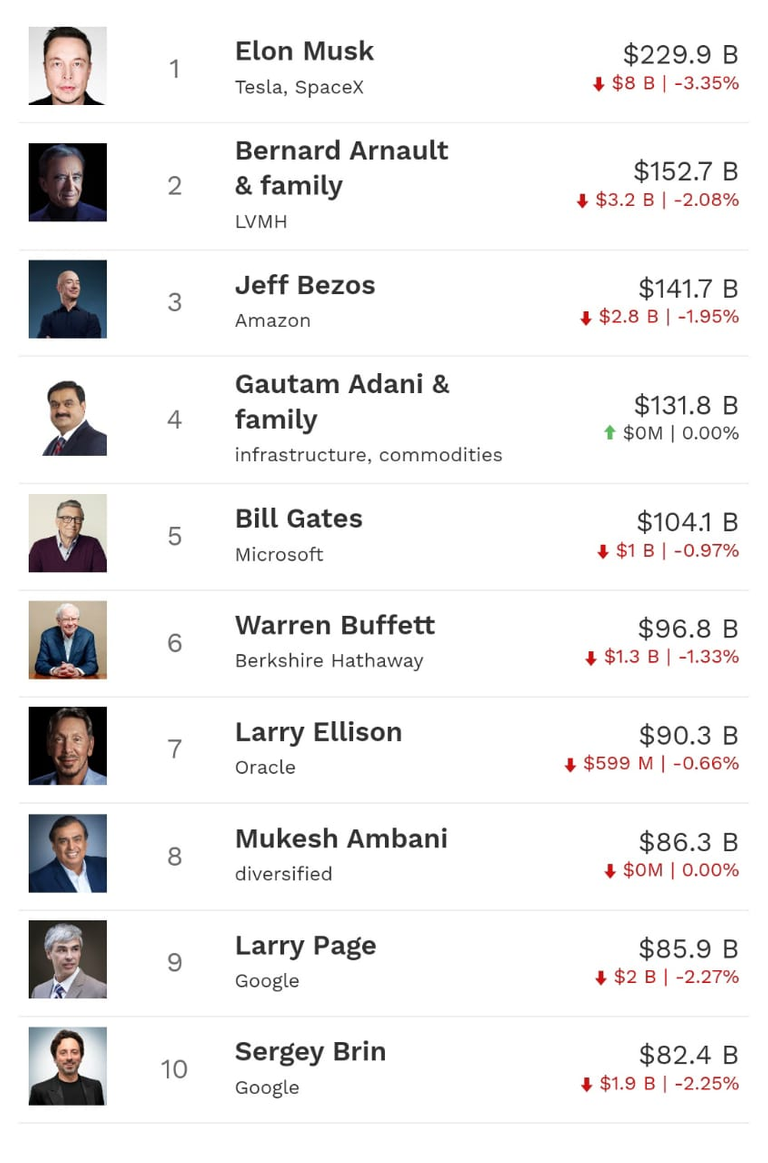

Where can you find the top 10 real-time ultra-rich people?

Real-time (05 Oct 22) data of the top 10 UHNWI

Source: Presented by Macallan

Number 2 resides in France, Number 4 and 8 in India, and the rest (7/10) in the US.

If one zooms into individual or household wealth, Switzerland ranks highest in terms of wealth per adult at 696,600 USD, followed by the US, Hong Kong SAR, and Australia. These facts are often obscured when ranked at the country level (from the Global Wealth 2022 report).

The danger of a single story

Today, as it stands, the envy of the American dream has turned into a nightmare for many countries, and the Millennials are feeling it the most. While back then, the dream, as interpreted across the globe, aimed to have more baby boomers get access to education, the educational institutions also used that as an opportunity to make more money by raising student fees. A lot of graduates walk out of tertiary institutions with student loans, and few are lucky enough to get jobs for the skills they were trained for, and most jobs pay them just enough to keep them from quitting.

The American dream was more endearing for baby boomers as it promised financial freedom, prosperity, success, and the possibility to accumulate wealth through hard work with few barriers. source. For the baby boomers, this meant individuals having a stable job or owning a successful business by the time they started a family. But this could also be interpreted as earning just enough to gain trust from financial institutions to lend you money to afford certain lifestyles, including buying a house.

It is a difficult dream for the millennials and Generation Z to interpret adequately. The younger generation has grown weary and mistrustful of the American dream. Most are shifting focus to navigating cyberspace and the internet economy, which allows accessing the USD buying power anywhere regardless of the location.

Source: image on the right web3.0

Can one navigate cyberspace to live the American Dream regardless of their location?

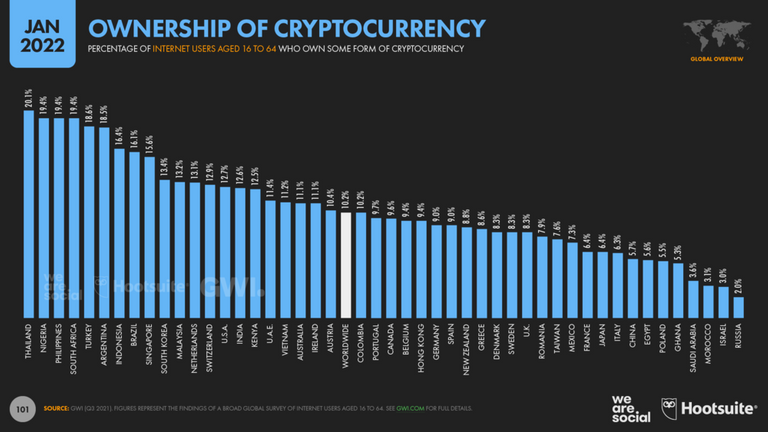

Countries that are ranked low in the spectrum of ultra-rich people are actually becoming more visible when it comes to cryptocurrency investment, and this also coincides with a doubling impact on the future projections for the emerging millionaires. For instance, countries in Africa and Asia have an increased interest in cryptocurrency investment, as reflected on the world MAP above.

Source: See page 58 of the report for Credit Suisse Global Wealth Report 2022.

Within Africa, South Africa and Nigeria are in the lead with interest in cryptocurrency investment, and this also coincides with the two countries' ranking high in household wealth within sub-Saharan Africa.

A lot of millennials and generation Z seem to be getting it right and are not falling into the trap of measuring wealth by tangible assets or capital. Millennials and Generation Z are reportedly investing more in cryptocurrency. These statistics were reported by the Global Weakness Index (GWI),which is a real-time indicator of how weak the global economy is.

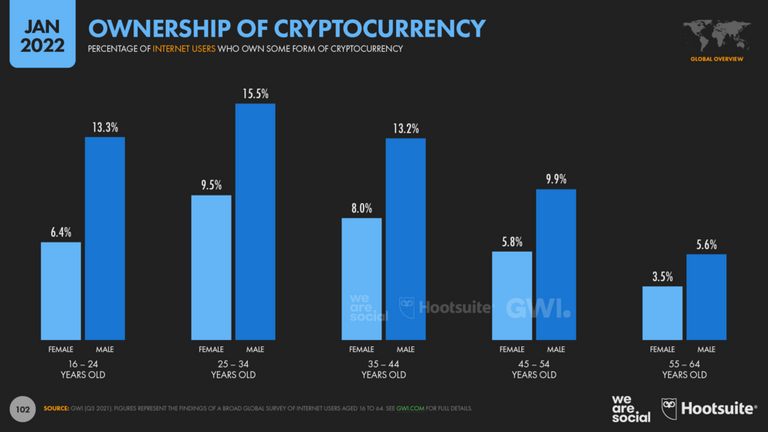

The age group that is investing more in cryptocurrency is between 16-44. Males are nearly twice as many as females. An important observation is that countries that are showing a high potential of doubling their wealth in 2026 also correspond to an increase in the number of cryptocurrency owners.

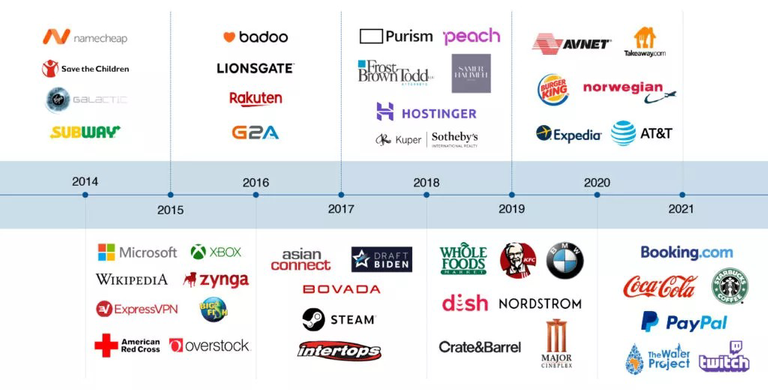

Whether they want to buy into it or not, investors, businesses, and brands can't ignore the rising tide of cryptocurrency for long. The biggest brands in the world are also adopting the internet economy and accepting crypto payments.

What is your perspective?

Looking at the current status of technological advancement in cyberspace (artificial intelligence, blockchain, and the internet of things), do you think the American wealth idea still holds in the lives of most millennials and Generation Z? Is one guaranteed to get better opportunities in America than where they are now in the future? For current Americans, is the American dream still alive and measurable to you?

Thank You for Passing by!

©Humbe 2022

Posted Using LeoFinance Beta

I long developed a different perspective of the American dream, it used to be the country I wish to relocate to while growing up but over the years that idea or dream faded away.

Countries like Australia, New Zealand, and Canada are the ones of interest to me.

For Africa to produce millionaires in the future I think cryptocurrency will play a part as people tap into the opportunities the blockchain space offers.

Nigeria and South Africa are now doubted economic powerhouse of the continent, sadly though Nigeria happens to be a joke.

!PIZZA

Posted Using LeoFinance Beta

@Joetunex, those are also great countries and Australia seems to also have a high household wealth. America can be a better choice if one is also after the entertainment vibe.

Not entirely, perhaps the big gap between the poor and rich could be the one that's making the economy unstable. Also, corruption cut across almost all countries with rusty leadership. But then blockchain will help to reduce this dilemma.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@joetunex(4/10) tipped @humbe (x1)

Please vote for pizza.witness!

Congratulations @humbe! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 800 upvotes.

Your next target is to reach 200 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!