Guide to Saving HUGE Coinage in the Hive Engine!

As a new person to Hive, I have found it very interesting watching the Hive-Engine marketplace! There are some crazy spreads between coins. I read a post by @badbitch here:

https://www.proofofbrain.blog/hive-167922/@badbitch/understanding-how-to-arbitrage-on-hive-dive-in#@bobthebuilder2/re-felixxx-20211228t12494115z It's about arbitraging to earn some liquid Hive and the article is spot on with great information!

I also like putting in positions, though I do know why @badbitch says that they're riskier...but I wanted to point out a few observations for those who may not have considered the possibilities on the Hive-Engine...

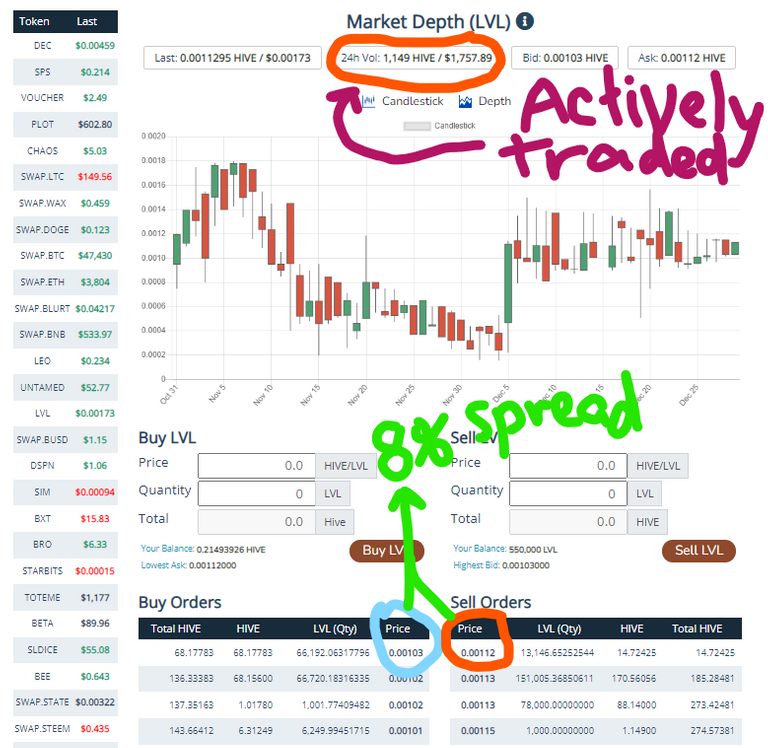

One of my favorite coins right now is LVL because of Psyber-X that is coming out soon. I talk about it more here: https://ecency.com/hive-167922/@haveyaheard/how-to-make-money-playing When you see there's a spread of over 8% on a token between what people are willing to buy it for and willing to sell it for, don't just sell what you're holding blindly...or buy blindly for that matter. If you see that the token is actively traded (which with a price at 0.001 Hive each and over 1,000 in Hive traded in the last 24 hours, it's actively traded!), place your order in the middle and cut the spread. You will likely sell the token you're trying to get rid of for a good percentage more than you would have and it will take only a little while on an actively traded token to have it sold. The same goes for buying. If I were to try to buy LVL, I would either put in a buy order to sit at 0.00104 right now, or if I really wanted it sooner than later, I'd put it in for 0.00108. Instead of buying with an 8% premium, I'm cutting it down to 4%...same on the selling side.

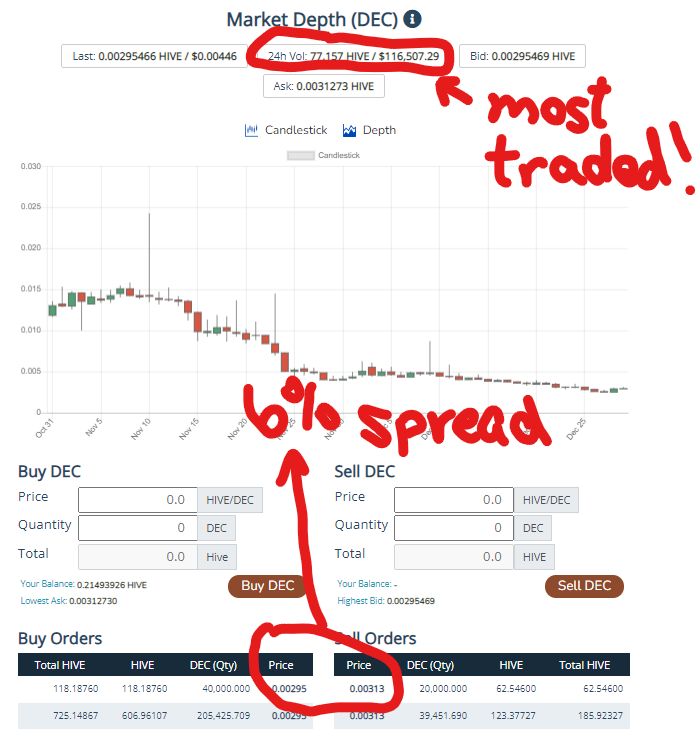

This is the most traded token on the Hive Engine, yet there's still a 6% spread. you could set a position on both sides and potentially grow your holdings by 6% just by buying at 0.00296 and selling at 0.00312... which is probably what the person with 40K to buy and 20K to sell is doing...

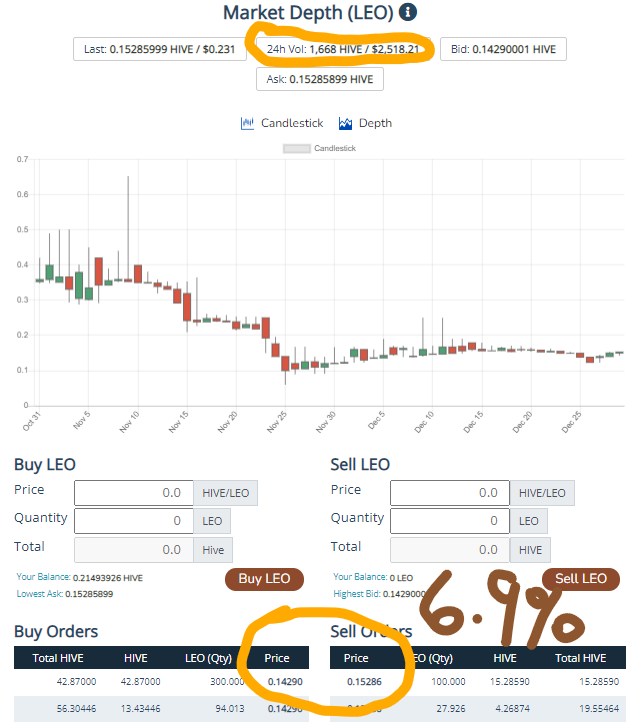

Good ol' Leo even has a 6.9% spread. If you're looking to get rid of some Leo, don't sell it below 0.15, in my opinion...but who am I...I've only been around here for 9 days...I'd lock in a buy at 0.14291 and get all the coinage people are dropping like silly fools...(this is not investment advice...it's humor...do your research and lose all your money to me...what? did I think that out loud?)

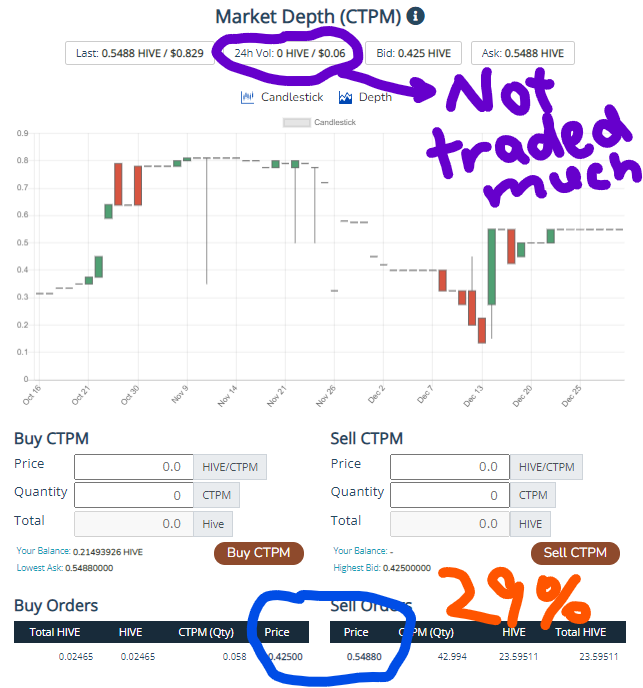

This miner, on the other hand, has only traded 0.06 worth in the last 24 hours...there is a whopping 29% spread...That means if you actually had people wanting to buy this/sell this, you could buy at 0.42501 and sell at 0.54879 and 29% ROI in two transactions, theoretically...

Now, read @badbitch 's post linked above...you can lose playing the spread, but you can also win big. I have a mentor who showed me that he was selling LVL at 0.00138 and buying at 0.00095 when the spread was amazing...people would win LVL, not know anything about it and sell it immediately, paying no attention to the spread, and the people who found out about psyber-x would get all gitty and buy at the top of the spread, also paying no attention to it...my buddy made mad gains... (not all results are the same...do your research and lose all your money to me...ooops, I did it again...)

Follow me for more stuff...cuz that's what I write...stuff. I like finances, so that will likely be my aim. Good luck, and don't forget to tip your waitress...she has several kids...

tip for you...use beeswap to move Hive to Swap.Hive...it'll save you 0.75% in transfer fees...it moves it into your Hive-Engine wallet just the same as using Hive-Engine for 1/4th the cost...you're welcome. 🤑(I also just learned from @dalz that there's a LeoDex ( https://ecency.com/hive-167922/@dalz/a-look-at-hive-s-l2-hive-engine-or-data-on-hive-deposits-and-withdrawals ) ... I'm learning folks...

My post was specifically about arbitrage, which should be an instant trade shit, that's why creating positions was discouraged, however, this is something I pretty much do, well, I did often in the past. Sometimes you don't really have to place it on the markets, some coin spreads make it profitable to sell off on diesel pools, so once you're able to buy low, immediately, you can trade that for a profit in one swap, did that in the past, so, great stuff!

Dec market is very dangerous, lots of rich bots running in them, wouldn't recommend it for anyone

Your post inspired me...when I get enough coinage, I hope to play around with the numbers. I'm very much into analyzing figures.

Nice

You can look at hive engine as a backend database and the interfaces as skins.

Here are the options

That's great! Thank you for putting these in one place for me!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I just learned how to delegate 2nd layer tokens via leodex! How much Leo should I hold and how much should I delegate? Any tips? and Thank you for curating my post!!!

Hi @haveyaheard! I`m here to help :) If you want to delegate, please make a comment (for example replay to this one) like this:

I want to delegate X sp to @user

Where X is the amount of SP and @user is the steem user you want to delegate to. For example:

I want to delegate 100 sp to @india-leo

@tipU will answer with a delegation link. Hope this helps!:)

View more

Congratulations @haveyaheard! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 100 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Thanks for publishing this post. I'm new to trading at the Hive DEXs, so setting limit order positions based on the spread for quick turnaround is new to me. It's great knowledge to have and top use.

Would you know (or point me in the right direction for) how I can use candlesticks to determine at what position I should place a limit order to buy or sell? My wallet is modest, so I was thinking in terms of catching flash spikes for limit order sells, but I don't know where to locate the optimum price.

Please forgive me for my tardiness in saying this, but welcome to Hive and LeoFinance!

Posted Using LeoFinance Beta

There are a lot of people who use candlesticks for predicting where a commodity is going next. I'm not one of those people. I know people use Fibonacci numbers to determine if a commodity/stock/token is going to bounce up or down. There are many different patterns that have semi-predictable outcomes, but I don't really go by those. I try to find something that seems popular, see if there's a spread, and if it's something I want to own, I'll place my buy orders above the top buy order so that I'm the most likely person to receive the next sell order that matches. Then, I'll either hold it, because I wanted it anyway, or I'll post a limit order on directly under the bottom sell order so that my order gets the very next buy order coming in. As an example with LVL, if there's a 30% spread, I could buy 100,000 tokens at 0.001 (100 Hive) and sell at 0.00130 (130 Hive), then I just got a 30% gain...or 30 more Hive than I had before. That in turn allows me to put in another buy order at 0.001 for 130,000 tokens. Do this a few times and you'll find you've doubled your holdings in just a few transactions...but I don't necessarily put in orders for flash spikes...if you have something that you're totally cool selling at a higher price and you know what that price is, you can put in a limit order that stands forever, and when the price hits, your limit gets called in...that's probably where the Fibonacci numbers come into play...

For my sell limit order placed to catch a flash spike, I chose a price which had been reached several times in the last 60 days. That's the only analysis I did for the token. It's not the highest price it could reach, but it's not "just enough"; it's a decent gain if the order is fulfilled.

Regarding the analysis you used to take advantage of the spread and order histories, I had to print hardcopy so I could refer to it the next time I bring in money to make buys for trading purposes. Thanks for taking time to reply!

Posted Using LeoFinance Beta