Web3 Investment Simulation in Moonkarts: The ROI I Didn't Expect

Good afternoon, everyone. I hope this weekend you've done all the things you were able to do during the week, whether for work or other reasons. This weekend I took advantage of the opportunity to go fishing with a childhood friend, and we were really lucky because he caught a Sargo, it is a very common fish on the Mediterranean coast, and more specifically on the Spanish coast, and it weighed almost 2 kg, in other words, a marvel.

fuente

And this morning after eating this nice fish, I kept thinking about the Moon Karts game and what would happen if I invested a decent amount in the game. But I also know that it's a volatile environment, but also one with opportunities if played well—in every sense. To avoid getting my fingers burned and making a bad investment, I ran a simulation, and these are the results I got.

We will simulate the "Competitive" profile ($500 USD)

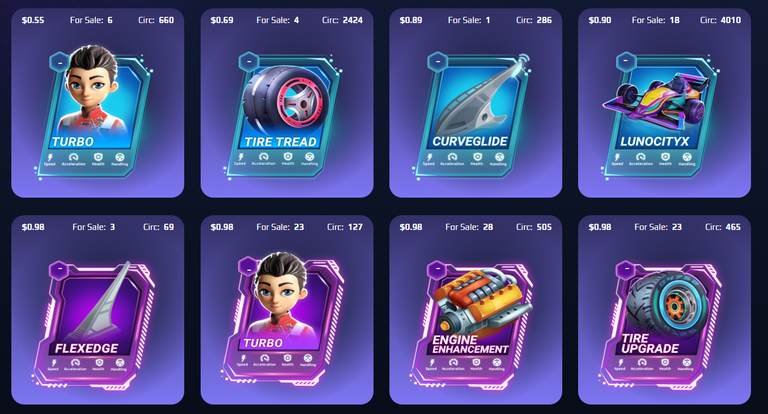

To start, I would have to buy everything on the market: the car, driver, accessories, fins, wheels, engine—well, everything you need to be competitive in the game. The first thing I did was buy a medium-high rarity NFT kart, which was essential for serious competition. Then I acquired an NFT driver, also of medium rarity.

Well, so far, so good. Now it was also very important to have cash to participate in events, pay registration fees, or even stake if the opportunity arose. With all this, I had already spent my budget, and to figure out the estimated income, I made some assumptions that included:

- You play 3-4 races per day

- You participate in 1 weekly tournament

- $MOON price = $0.05 (fluctuates)

With all this, I could get an idea of the estimated monthly income source.

| source of income | Monthly Estimate | Details |

|---|---|---|

| Daily races (rewards) | $60 | Rewards in $MOON and NFT drops |

| Tournaments | $40–80 | If you achieve top 25% |

| NFT Rentals | $20 | If you don't use all your assets |

| Estimated Total | ~$120–160 | ROI monthly: 24%–32% |

As you can see, from playing I earned rewards, tournament prizes, and a small amount of rental income from my NFTs. Of course, I only earned this when I played the game, and sometimes when I wasn't. My surprise was that with an investment of about $500, and doing a lot of math, I earned between $120 and $160 a month. Some months were better than others, especially when the token went up to seven cents. Others were weaker, like when it dropped to four. But all of this was possible if the market didn't move too much and was stable, but as we know, this is a roller coaster. And I'll explain this better with a 6-month data table.

| Month | Token value | Estimated Earnings | NFTs value (market) | Comment |

|---|---|---|---|---|

| 1 | $0.05 | $140 | $500 | Investment recovered at 28% |

| 2 | $0.06 ↑ | $160 | $550 ↑ | More tournaments played |

| 3 | $0.04 ↓ | $110 | $480 ↓ | Token deactivation |

| 4 | $0.05 | $130 | $500 | Stable |

| 5 | $0.07 ↑ | $180 | $600 ↑ | Bull market |

| 6 | $0.05 | $140 | $520 | Consistent |

Conclusion

The truth is that I was very surprised by this simulation. I think this game is very well done, and it's clear that there are people behind it with very clear ideas, which are:

- Decent ROI if you play regularly

- NFT ecosystem with potential for appreciation

- Possibility of staking and renting

But as with any game, there are also risks that must be assumed, which are:

- High dependence on the price of the $MOON token

- Less liquidity if the game's interest drops

- Changes to the game's rules/tokenomics

And with all this, I can say that this is a great game to invest in NOW because I don't know what might happen tomorrow, as they might release new updates and it might stop being profitable.

!LOLZ

!PIZZA

gracias

Feels like I've seen this scenario countless times before, high ROI means it's never sustainable, otherwise everyone would be profiting. The name of the game is to get your money back as quickly as possible before it all collapses. If everything would go up due to a demand spike because the high returns, sell all your assets, take the profit and run for the hills :)

You are absolutely right, but what I didn't put in the post is that they do this to attract users to the game and once they see a good amount, they will start making changes, because as you say, this way the system will go down a lot and the first thing that goes down are the prices of the tokens since almost all of them sell.

https://x.com/wizloge/status/1944477191481221493