When will the supply shock hit American shelves?

First, a timeline of when the tariffs came into force:

On April 2nd, "Liberation Day", a range of tariffs were announced, from 10% on the UK and Australia, 20% on the EU to 50% on tiny Lesotho. But additional tariffs announced on China took their total to 84%.

On April 9th, Trump rolled back all the tariffs to 10% for 90 days, apart from China, whose tariffs were increased to 145% in retaliation for their retaliation.

On April 10th, China retaliated again, banning the export of rare earths to the US. All trade between the US and China came to a halt.

On April 14th, after being lobbied by Apple's Tim Cook, Trump exempted electronics including smartphones and laptops from tariffs.

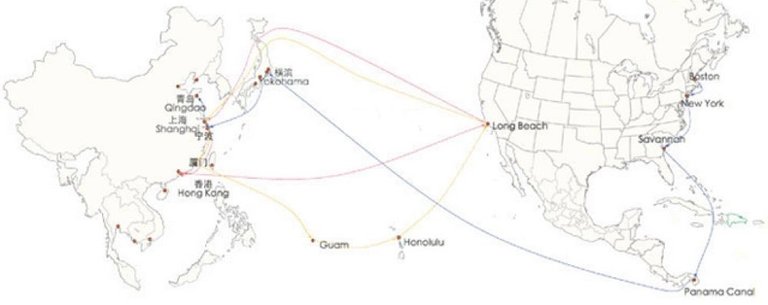

Here are the shipping routes from China to the USA:

It takes 25 to 30 days for goods from China to arrive at the port of Los Angeles. It's 45 days to Chicago in total (sea plus train or truck journey from LA to Chicago. It takes 55 days to New York from China via the Panama Canal.

The goods arriving in Los Angeles this week are the ones that sailed between April 2nd and April 10th. The volumes were down because of the 84% tariff.

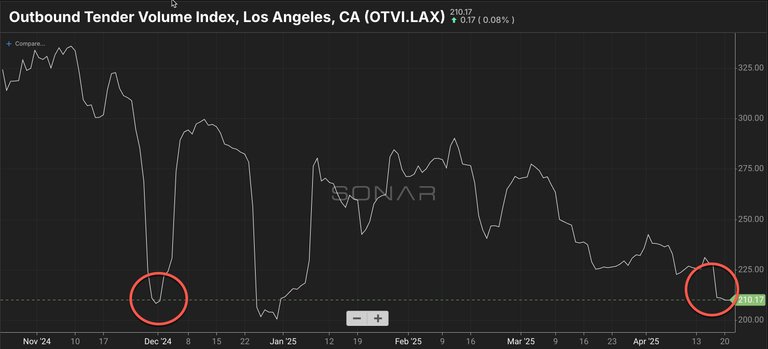

As you can see from the following graph, this is already affecting trucking, as they have fewer goods to distribute:

They're down to Thanksgiving and Christmas levels when everyone is on holiday.

Next week Los Angeles will experience the impact of the near zero trade with China (apart from electronics). The port employees and truckers will experience lay-offs.

New York will experience it two weeks later.

Businesses tried to protect themselves with massive orders in February and March to fill their warehouses. How long that inventory lasts is anyone's guess.

Small businesses would not have had the capital or loans to build up a lot of inventory. Large businesses will have built up several months worth.

There is no sign that China is talking to the Trump administration to resolve this.

So the American consumer will see the impact in stores in the second half of May.

The Federal Reserve will next meet on May 6th and 7th. They might have data from the western part of the US by then, and will have an idea of how it is impacting prices.

Exciting! I don't have enough expertise to predict anything (aside from a drop in supply and rising prices for some goods — but which ones? poorly informed about the details of the China–US canceled trade)... So... just eating popcorn and watching things unfold from Southeast Asia.

The goods impacted are things like kitchen utensils, anything plastic, also the tools and other stuff you find at Home Depot.

So, it looks nothing too critical for the general audience but some businesses will be negatively affected, no doubt.

https://www.reddit.com/r/economy/comments/1k6wqr3/when_will_the_supply_shock_hit_american_shelves/

The rewards earned on this comment will go directly to the people( @rose98734 ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Congratulations @rose98734! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPhttps://bsky.app/profile/did:plc:tv2gtpdvq6k2i6le2srikthg/post/3lnlgdbuzqc2t

https://bsky.app/profile/did:plc:tv2gtpdvq6k2i6le2srikthg/post/3lnlgdbuzqc2t

https://bsky.app/profile/did:plc:cuu4cpvbaimi4o7dpizsenb3/post/3lnsvglvq7c2m

https://bsky.app/profile/did:plc:cuu4cpvbaimi4o7dpizsenb3/post/3lnsvglvq7c2m

https://bsky.app/profile/did:plc:cuu4cpvbaimi4o7dpizsenb3/post/3lntebbh2zk2w

https://bsky.app/profile/did:plc:cuu4cpvbaimi4o7dpizsenb3/post/3lntebbh2zk2w

https://bsky.app/profile/did:plc:dozrbbuzuojdwr2psqkapfxo/post/3logyxwbk722c

https://bsky.app/profile/did:plc:dozrbbuzuojdwr2psqkapfxo/post/3logyxwbk722c

The rewards earned on this comment will go to the author of the blog post.