French bond yields converge with Italy's across the board - is a new eurozone crisis brewing?

French political turmoil has reared it's head again; it looks like Prime Minister François Bayrou won't be able to pass a budget through the French Assembly. There will be a confidence vote on Sept 8th, and if he loses there may be elections called to elect a new assembly.

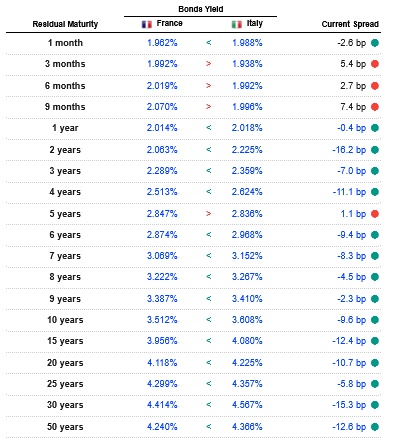

French bond yields rose across the board, and are now converging with Italy. Here is the table:

In Sept 2023, the Italian 10 year yield was 200 basis points higher than the French 10 year yield; now there is a difference of 9.6 basis points. If Bayrou loses his confidence vote, French yields will spike much higher.

Analysts have long been puzzled why the markets gave France a pass, as their fundamentals are worse than Italy's.

It is true that Italy has debt to gdp of 135% compared to France at 113%. But Italy's debt is a legacy of the 1980's; it is current running a primary surplus, which means it's debt isn't increasing. France on the other hand runs a budget deficit of over 6%, so it's debt is growing. In absolute terms, the French national debt is the largest in Europe, and if it can't address this with sensible budgets, their debt as a percentage of GDP will continue to rise.

What happens if there are new elections, but French voters refuse to elect a govt that will cut spending? The bond markets will melt down.

People keep talking about the IMF being brought in. But the IMF doesn't have the funds to bail out an economy as large as France's.

More likely, the European Central Bank will have to intervene, buying French bonds in the secondary markets with printed money - i.e. another dose of QE. But that will reignite inflation across the eurozone. Other eurozone countries will likely place harsh conditions on France in return for ECB help.

There is another factor to be considered; the second largest holder of French government bonds are Japanese investors. In 2017, in the lead up to the French Presidential election when it was feared Le Pen would win, Japanese investors sold €27 billion of French bonds. In 2025, the Japanese are already liquidating bond holdings around the world as yields in the domestic JGB market rise, making them attractive for those who want to minimise currency risk. Combine that with perceived political risk in France, and sales of French bonds by the Japanese are likely to accelerate.

https://www.reddit.com/r/economy/comments/1n0rwhv/french_bond_yields_converge_with_italys_across/

This post has been shared on Reddit by @rose98734 through the HivePosh initiative.