Central banks continue co-ordinated Quantitative Tightening as inflation pressures persist

All the major central banks are now engaged in Quantitative Tightening, including at last the Japanese Central Bank.

Japan has been the source of excess liquidity in the world for over thirty years through their Quantitative Easing aka money printing, and they've completely distorted world markets in the process. So it's good that they've finally stopped.

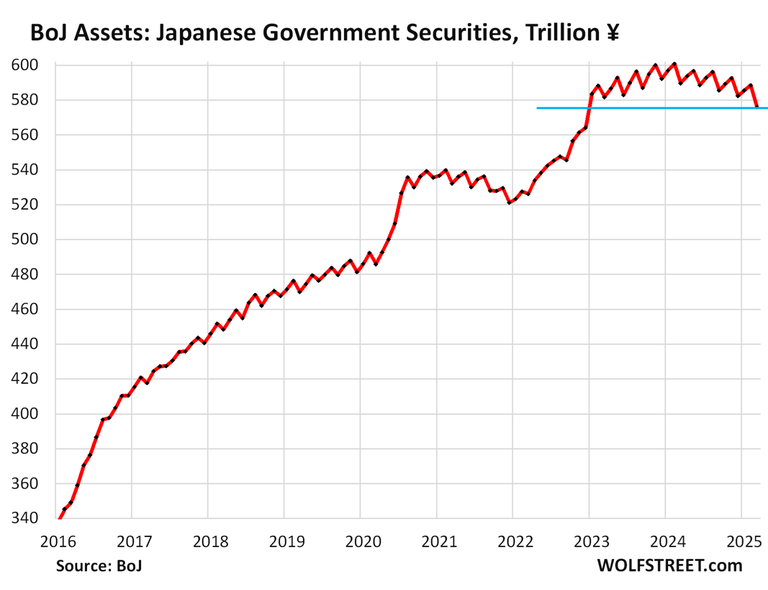

Here is the graph of the Bank of Japan's assets:

They're only back down to 2022 levels, but without the Bank of Japan buying govt bonds, Japanese 30-year bond yields have spiked to 3%. This has put pressure on the Japanese govt to cut spending and run budget surpluses. (Japanese inflation is 3.6% after decades of being close to 0%).

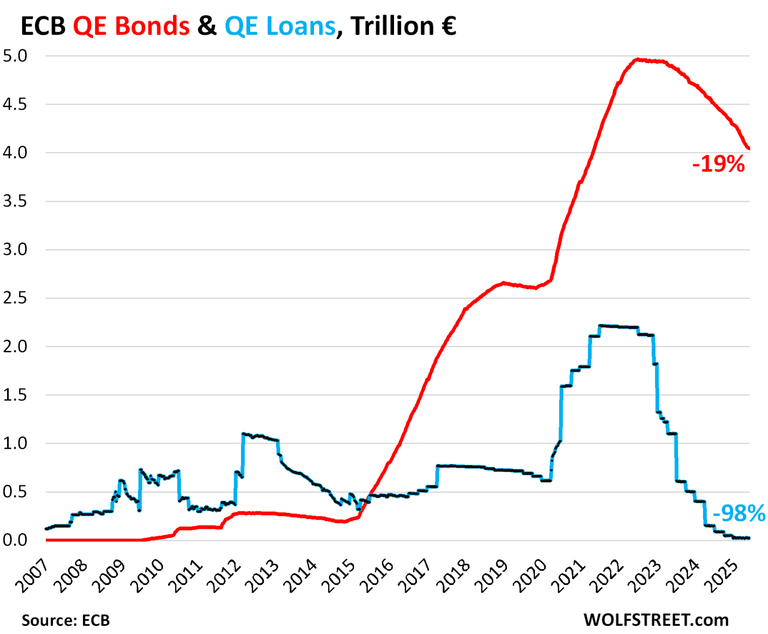

Meanwhile the European Central Bank is also pursuing Quantitative Tightening, even as it cuts interest rates. Here is the graph:

They've managed to get back to 2021 levels and inflation is moderating in the eurozone. (Eurozone CPI is 2.2%).

Finally, the US Federal Reserve has been quietly doing Quantitative Tightening too, despite the drama in the Trump administration. Here is the graph:

The Fed is back to April 2020 levels.

The theory is that when all the central bank balance sheets are back to December 2019 levels, inflation will come back under control and faith in fiat currency will be restored.

https://www.reddit.com/r/economy/comments/1l1m4id/central_banks_continue_coordinated_quantitative/

This post has been shared on Reddit by @rose98734 through the HivePosh initiative.

Hey. We have a rule saying no more than 4 shares over the past 7 days in c/Cryptocurrency. Here: https://peakd.com/hive-197333/@x-rain/re-x-rain-sxnlwa

You have already had 11 over the last 7 days...

Oh, I thought that was a new Contest Rule, as in only a max 4 out of the 5 entries into the contest could be from r/Cryptocurrency. It was in the contest article...

Is this now a general submission rule?

Got it. Yes, that's a general rule just for HivePosh activity. Too much pressure on this sub, we are afraid their mods can become upset with us. HivePosh should slow down in this subreddit.