Are You Investing? Or Are You Gambling?

What do investing and gambling have in common?

Money? Life saving? Fun? Thrill?

Where do you draw the line? At "make or break" situation, "over-extended", "all in", or somewhere earlier?

Can you still afford a ramen?

We probably all have a friend, or two, or three, who boasted how much money they made on Tesla, Bitcoin, Dogecoin, Luna, Solana, or some other shitcoin, you name it. What they are not telling you is how much they have lost, when their bets did not pay off, when they almost lost everything.

Without knowing the full reality and often only getting the biased success story, it may be very tempting to try to one up their success - by taking excessive risks and uncontrolled gambling to get rich (go broke) quickly. Emotion is powerful and detrimental to financial success, FOMO is most dangerous when your mind tries to trick you into chasing that "potential profit" you "could have gotten".

Could have, would have, should have, hindsight is 20/20.

How many people have the ability (without insider trading) to consistently buy at the bottom and sell at the top? If you have the perfect crystal ball, you wouldn't be here, you wouldn't be reading this, you would own the entire world already.

Imagine you just pulled off a 100x... what's next?

When you are young, you have the time to start over and recover from lessons and experience, you probably don't have a lot of assets to lose (unless you are born with a silver spoon), you may have already made your 100x that amount to... not much, because you could only put in $100.

Now with $10,000 banked, you want to continue to grow the wealth and attempt to pull off another 100x, you aim high and you believe you will be a millionaire next bull market, and billionaire will be within reach after two more cycle. After all, you only have to do 100x 2 more times followed by only a 10x to be a billionaire, but if you do 100x the third time... you can by 1/4 of Twitter, maybe Elon will let you buy 1/5 of Twitter for a cool $10 billion. But will you? Do you have the crystal ball (or luck) to consistently do back to back 100x?

Here is the reality as we go through life

Risk is a necessity, how you manage risk is both an art and science.

If you take no market risk, inflation will eat away the purchasing power and in no time you will feel very broke.

If you continue to HODL a single asset like when you did in the teens or early 20s, one Kodak moment you will be starting over from zero. Kodak was cool, Xerox was cool, Blockbuster was cool, AOL was cool, Myspace was cool, Blackberry was cool, Palm was cool, until they are not. Even Facebook is for "old" people now.

Is BTC going to be cool for the next 100 years, or for the rest of your life? Maybe, maybe not. Do you want to gamble or hedge your risk? It all depends on individual circumstances, you decide for yourself.

It is important to keep the money after you have made the money

While bear market is the best time to pick up additional assets that are on sale, now is also the best time to be real about your priorities, without FOMO hysteria that clouds your better judgement.

You really don't want to be "forced" to HODL for yet another cycle just to "make back your potential profit” again - especially if this is the money you are counting on for goals that are important to you.

Posted Using LeoFinance Beta

Congratulations @slhp! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 500 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

You don't know whether bull market is returning or not. but there is a hope and you should hold some good coins like i'm doing. I made a huge lose past 12 month, HOpefully all the lose shall be recovered in the most awaited next bull market.

In this year i am investing my life saving in one project and the project coins will down almost 99'/' but i can't sale single because i believe in mu luck and also in crypto bull cycle is coming soon and recover my all investments soon.

Many people are lured into these high-return "Investment schemes" but the rule of the thumb is, if the higher the (possible) returns, the higher the risk.

For me, it it offers to "double" my money, it's either gambling or a scam.

The problem is, as you stated in your example, most people will get ahead early in the game. Once they earn a lot of money, they thought they could sustain it and they forget about the risk involved.

If you can’t figure out who pays the high yield, it’s a ponzi

I would rather say investing. Both in time and in money too. I am trying to build my Hive Dollar (HBD) savings, and my other investments in long term. My first goal is to get out of poverty, and then to financially be able to buy and maintain/repair a sailboat. I would like to buy a sailboat to live on it.

So far I'm more of a gambler.

Although I may have found a safe harbor on the Hive

HIVE is more interactive 😁

I'm not a happy man.

I want to believe that this place will give me perspective

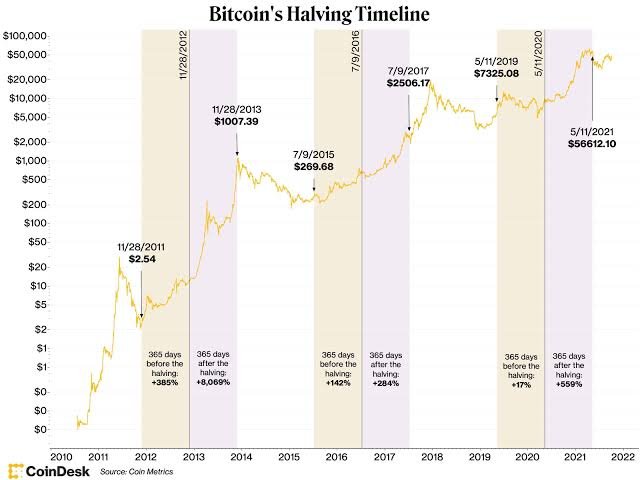

I like what Max Keiser said in a recent interview. Either you are willing to follow up a strategy for more than 4 years or don't call yourself a trader, you are a gambler. Minute 37

Ha. After mathematically lost 80% purchasing power in a year 😂😉

Exactly, this is not a get rich quick scheme. You need to measure it in 4 years lapses. Not 1

It's called accumulation period because it's expected to not make money but accumulate. Those that think you should be making money everyday have a skewed vision of what is investment.

Yes. Back in the old days even 4 years is not long enough. Long term is at least 5 or even 10 years. And long term is what we called investments.

He is going by the Bitcoin halvings. How convenient.

Well, the 4 year is parallel to the pumps that Bitcoin has done. And unless you can identify an altcoins that has truly decoupled from the Bitcoin cycle I'll listen to you. But most altcoins have a formation more similar like a pump and dump than otherwise. Check the first gen ones like litecoin, dogecoin, second generation like dash nem or waves, third generation like eos, cardano, fourth generation like uniswap, yffi, algorand, fifth generation like apecoin, axie, polygon

The longer cycle - referring to stocks 😓

Usually market cycles are like 2-10 years according to fidelity documentation. So 4 isn't that different. https://www.fidelity.com/viewpoints/investing-ideas/the-market-cycle-and-investors#:~:text=Economic%20cycles%20range%20from%2028,the%20recurring%20ebb%20and%20flow.

The problem is often not knowing when to stop. When it's enough. Most people allow the euphoria of winning their first 100X blind them into thinking they can always do it again. They haven't learned when to draw the line and this often leads to burn.

Good take and we'll said. We have to take the good times and bad, make sure to sock a little money away for when times are tough or you go through that spurt of bad trades.