Which stablecoin should you use? USDT, HBD, USDC or DAI [ENG/PT]

Stablecoin is something we all look to learn more about as we move into the cryptocurrency market, as it is what gives the volatile market some sort of stability.

Let's talk about what is a stablecoin, their different types (centralized, permissionless) and the most popular ones usdt, dai, usdc and our hbd.

Stablecoin é algo que todos nós procuramos aprender mais quando avançamos no mercado de criptomoedas, pois é ela que dá ao mercado volátil algum tipo de estabilidade.

Vamos falar sobre o que é uma stablecoin, seus diferentes tipos (centralizada, permissionless) e as mais conhecidas usdt, dai, usdc e nosso hbd.

What is a Stablecoin?

A Stablecoin is basically a stable representation of purchasing power. And since most people normally think in US Dollars, this parity was chosen.

Uma Stablecoin é basicamente uma representação estável de poder de compra. E como a maioria das pessoas normalmente pensam em Dólares Americanos, foi-se escolhido essa paridade.

Source

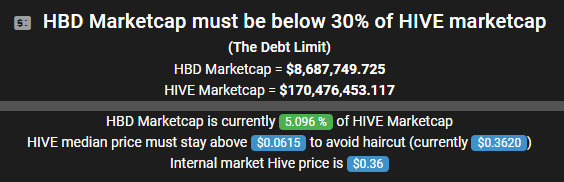

HBD is a good stablecoin as it has two very solid ideas on how to maintain its value. The first is its debit buffer, which in HBD is done through an overcollateration of the marketcap of hive compared to that of HBD in the amount of 30%, giving room for the value to fluctuate without affecting the peg of 1HBD = $1 in Hive. The other great point of this stablecoin is that it has a minimum collateralization to be maintained, which in the case of HBD is at $0.0615 in the price of Hive, this value needs to be maintained above to ensure that at any time the debit of converting $1 of HBD in Hive can be paid off. So if there is a drop the protocol values can be sold to honor the parity.

Some might say that over-collateralization of projects that ask for an extra amount for minting the stablecoin may not be efficient from the point of view of capital utilization, but at least it guarantees security, which in the crypto market is the most important thing.

O HBD é uma boa stablecoin, pois ela traz duas ideias bastante sólidas de como manter seu valor. O primeiro é o seu buffer de débito, que no HBD é feito por meio de uma over collaterização do marketcap da hive comparado com o do HBD no valor de 30%, dando espaço para que o valor oscile sem afetar o peg de 1HBD = $1 em Hive. O outro grande ponto dessa stablecoin é ter um mínimo de colaterização a ser mantido, que no caso do HBD está em $0,0615 no preço da Hive, esse valor precisa ser mantido acima para garantir que a qualquer momento o débito de converter $1 de HBD em Hive possa ser quitado. Assim se houver uma queda os valores do protocolo podem ser vendidos para honrar a paridade.

Alguns podem dizer que over colateralização de projetos que pedem um valor extra para a mintagem da stablecoin pode não ser eficiente do ponto de vista aproveitamento do capital, mas pelo menos garante segurança, que no mercado de crypto é o mais importante.

Centralized X Permissionless

Source

USDC and USDT are centralized stablecoins, as they are issued centrally, where a third party manages its dollar-backed assets that issues the stablecoin. On the other hand, we have DAI and HBD which are permissionless stablecoins, that is, you don't need to ask a central institution to issue the token, anyone anywhere in the world can use the protocol, deposit ETH and receive DAI or deposit Hive and receive HBD. The difference is that while the Dai to be mined needs an over-collateralization of ETH, in the HBD of the Hive network, 1HBD = $1 in Hive.

Centralized stablecoins are the most used, with the highest marketcaps. While Tether is $65.5B and USDC $43.4B, permissionless DAI is only $5.6B. However, even though most prefer centralized stables, it is notable that there is a considerable portion of the market that prefers to stick with decentralized stables.

USDC e USDT são stablecoins centralizadas, pois possuem a sua emissão de forma centralizada, onde um terceiro que faz a gestão dos seu ativos lastreados em dólar que emite a stablecoin. Por outro lado temos DAI e HBD que são stablecoins permissionless, ou seja, você não precisa pedir para uma instituição central para emitir o token, qualquer pessoa em qualquer lugar do mundo pode ir no protocolo, depositar ETH e receber DAI ou depositar Hive e receber HBD. A diferença é que enquanto a Dai para ser mintada precisa de uma over-colaterização de ETH, no HBD da rede Hive, 1HBD = $1 em Hive.

As stablecoins centralizadas são as mais usadas, com os maiores Marketcaps. Enquanto Tether tem $65,5B e USDC $43,4B, a permissionless DAI tem só $5,6B. Entretanto, mesmo que a maior parte prefere as centralizadas, é notável que existe uma parcela considerável de mercado que prefere ficar com as stables descentralizadas.

Problems with Centralized Stablecoins

Source

The continued use of decentralized stablecoins is in part due to the problems of centralized ones. The centralized ones (USDT/USDC) manage to put a wallet that holds these cryptos on blacklists for various reasons, such as deserving. On the other hand, no wallet holding DAI or HBD can end up being blacklisted for holding these tokens.

Thus, it is clear that this is a crypto community that prefers to use decentralized ones to avoid possible censorship of their wallets.

O contínuo uso das stablecoins descentralizadas se dá em parte devidos aos problemas das centralizadas. As centralizadas (USDT/USDC) conseguem colocar uma carteira que holde essas cryptos em blacklists por diversos motivos, como sanções. Por outro lado, nenhuma wallet que holda DAI ou HBD pode acabar sendo blacklistada por holdar esses tokens.

Assim, fica visível, que essa é uma comunidade crypto que prefere usar as descentralizadas para evitar uma possível censura de suas carteiras.

If you enjoyed the post, consider giving an UPVOTE⬆️, it’ll help me a lot, because with more HP I'll be able to create more posts.Thanks! 👍

If you like finance, play2earn, anime, giveaways content, consider FOLLOW, so you'll receive my new posts in your feed.

Thank you for reading! See ya! 👋👋

Some P2E Games that I play and earn with:

|  |

|---|---|

Posted Using LeoFinance Beta

Obrigado por promover a comunidade Hive-BR em suas postagens.

Vamos seguir fortalecendo a Hive

https://twitter.com/1525151105491009539/status/1599966489968144384

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Great post!

Love that you brought up the centralization of certain coins. I think it's easy to assume something is "defi" or exploit-proof, especially to newcomers.

When I dove back into crypto a couple years ago, there was a lot of new stuff. I got a bit overly excited, thinking blockchains had hit a exponentially higher level of efficiency. I honestly thought we finally hit a time where we could have immutable websites, or updates in a game. I thought that DAOs had finally discovered a way to automatically apply voted changed, created scripts using programs or AI. I thought that P2E games were held entirely on chain, and that finally programs could be stored on the blockchain.

Well... I was a bit too optimistic, because none of that is really true. DAOs and Governance Protocols still don't accurately represent majority opinion, nor differentiate between an involved, educated user, and one that's not. Programs don't really exist on chain, we have smart contracts, but they're just a fancier version of a something like a BASH script at the end of the day.

I had actually had a bit of hope for NFTs too, I thought that they finally managed to create a way to store them on chain effectively (the data exists, it was done on ETH in 2016 or 2017, I believe) but alas, they opted to store images on IPFS and call upon them with a single line of text. Not that it really matters, but it's interesting.

Back to stablecoins, it's easy to assume that such an established service, such as USDT, would be decentralized or at least have more restrictions against printing money out of thin air, but it isn't.

I can say though, I'm not particularly fond of tokens tracking the US dollar so hard, what if that itself crashes? Assuming USDT or USDC always stay solvent, would 50K USDC still be worth 50K in 40 years? Will any kind of APR on saving stablecoins actually combat inflation?

It would be nice to see more stablecoins paired against multiple FIATs, such as US DOLLAR, EURO, YUAN, PESO. Or perhaps, see more paired to real world assets, like gold, iron, etc.. used in IT. Really, the sky's the limit on what you can pair a token too, and I'd love to see more.

For HBD, I really like the system of pairing it with HIVE. It makes me feel good about aiming for a 50/50 spread of HBD/HIVE in terms of savings. In addition, fluctuation prevents catastrophic failure in my eyes. For USDT, if it dropped to $0.90 we'd have a bloodbath on our hands, for HBD, seeing it at $0.85 or $1.15 is normal, and you can take advantage of these fluctuations so you desire.

Personally, I see HBD as a better, more realistic approach to algorithmic stablecoin category.

HBD = convenience for me

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444