Still some decent returns to be had in Hive-Engine Pools

I've been in a lot of Hive-Engine pools over the years, and they've been good to me for the most part, but as with most liquidity pools, many of them have had their day and so I've sold up and come out of a fair few.

But I've kept the faith with a few because they still offer some decent returns on a broadly stable-asset prices, and here are the ones I'm currently still in:

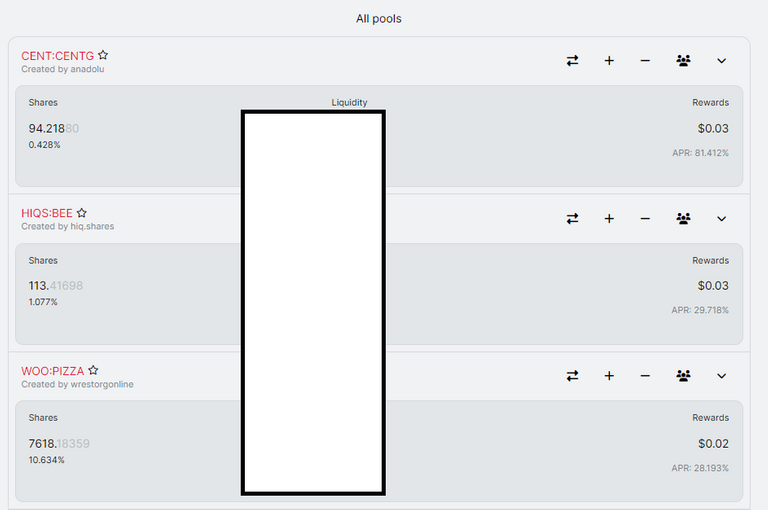

CENT: CENTG - 81% APR

I don't have very much in dollar terms in this pool but it's a nice one for the return. As far as I'm aware CENT is designed to be a stable coin pegged at a cent and centG is the governance token for the project, not that I have any idea how you can use that.

I just get dropped centG so I stake it with the CENT I earn from posting (you can use the CENT tag on your posts, for finance content!).

HIQS:BEE - 29% APR

HIQS is the token of the Hive magazine, which I was impressed with at HiveFest in Amsterdam, so I bought some and if you stake it with BEE (the Hive-Engine token you need to mint new tokens) then you get a decent return.

I'm less a fan of BEE, but I'll hold onto some for this return!

WOO:PIZZA - 28%

Again, not much in dollar terms for me but I control 10% of this pool, which is enough, WOO is a wrestling game I know nothing about and am not invested in, and I've got a soft spot for the PIZZA project, and a decent return!

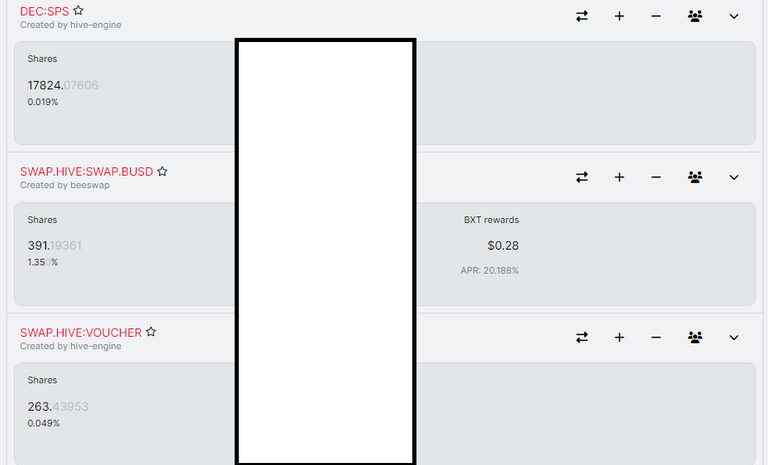

HIVE-BXT - 23% APR

I've got slightly more in dollar terms here - BXT is the BEE-SWAP token, and you can stake it to earn Hive but you getter return in the pool, and the price has been pretty stable, so I'm happy to Vest half my BXT back in!

HIVE-BUSD - 20% APR

This is the hidden gem of Hive-Engine - double the staking return for Hive, same return as for HBD, and a sort of hedge for both, big fan of this one and really my only significant dollar investment!

And the SL pools

I'm also in the HIVE-VOUCHER and SPS-DEC pools, although with the former I've started just holding VOUCHER now it's worth so little (sell some next pump, it does that!) and I hold mainly loose DEC, I've got < 10% in with SPS, the returns are 40 and 20% respectively.

Final thoughts - watch that impermanent loss!

With most of these pools, the asset prices against Hive or each other have been pretty stable recently, but there's always a risk of Impermanent Loss, which is a pain to track on HE, hence why I've pared back my Vest, but it's good to keep something in as sometimes there's new projects on HE to buy into and it's good to have some easily liquifiable funds!

None of this is meant as financial advice, NEVER!

@tipu curate

It seems a lot to keep track of but it looks like you're doing a good job of keeping on top of it.

I haven't really paid it much attention over the last year of so TBH, just checking in now really!

Im mostly just in the Hive:SPS pool , but have some in the LEN:LENM which brings 14% currently.

Never heard of LEN - I must check it out!

Ahh! But BEE is very consistent in price at least for the last 6 months.

Actually, BEE is my first choice in all tribe tokens now.

IT IS HOLDING UP, THAT'S FOR SURE!

My first five HIVE Engine tokens that I stake for curation rewards are LEO, WAIV, CENT, POB and CTP.

Obvs leo out of those for me!

I went to revisit the pools recently but didn't find much I thought had a good return in terms of profit margin . These have a good APR though. I guess there is no hard fast rule here. Just depends how much risk you keen to take!

I think anything on Engine is pretty high risk, so I don't put too much in!

I am in and out of the Hive:scrap pool for the Terracore game.

Cine:Hive is also good, it gives lgn and bro.

You can access those pools from TribalDEX?

I use BEESWAP, but you can on tribaldex too I believe!

Just checked seems an interesting project but the interface is not quite exciting. You can swap, provide liquidity, and mine their token with a supply of 10 million.

When you provide liquidity, do you just get rewarded with their token?

I think the rewards are paid out in various different tokens!

It is quite confusing! Because you cannot know the reward before providing liquidity. I don't know if this DeFi project might be good to join...

I think BEESWAP shows the rewards.

About the Bee, is the interest 29% monthly or how?

[@quekery] Always yearly. But you get daily payouts for Diesel Pool.

[@quekery] We had our reasons to choose BEE as pair. But after Hive Engine disabled the DAO fund for BEE we struggled. Our Liquidity Providers helped us with the hard times so we decided to support the pool also in the future. Now we have 3 pools (HIQS:BEE, HIQS:INK and SWAP.HIVE:INK). 😅

!hiqvote

!PIZZA

Hey cheers, I may look at some of those other pools!

@hiq.redaktion, the HiQ Smart Bot has recognized your request (2/2) and will start the voting trail.

In addition, @revisesociology gets !WEED from @hiq.redaktion.

For further questions, check out https://hiq-hive.com or join our Discord. And don't forget to vote HiQs fucking Witness! 😻

$PIZZA slices delivered:

@hiq.redaktion(2/5) tipped @revisesociology

I have a little in some SL pools, so I make something from that. I'll take that.

You are absolutely right if we invest here we can get very good returns and its price in upcoming bull market can also be very high this is very good and trusted platform.