FTX Exchange finally painted the crypto market Red yesterday!!

Yesterday, I was obviously shocked to find BTC’s price decline suddenly below 20,000$ . Along with BTC, ALT coins also experienced a decline of reasonable magnitude. I wondered why? .

Is it because of some Macro economic reason? . Soon, I found out no, it was a reason specific to only the crypto industry because the S&P 500, DJI and Nasdaq had no declines of noticeable magnitude.

So, I checked out crypto news and the reason for the crypto market to suddenly get so red was FTX Exchange…

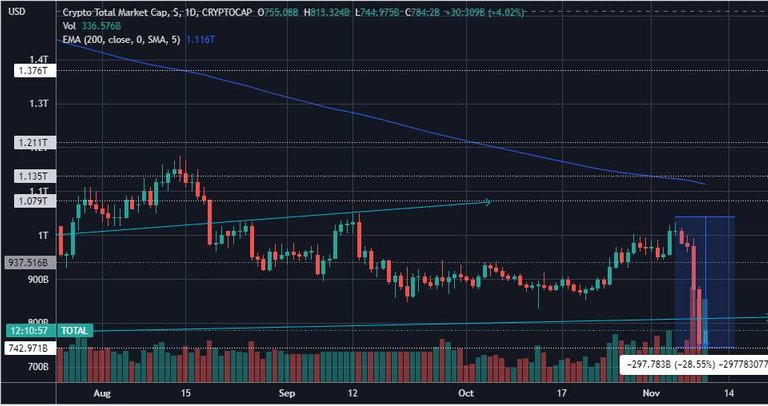

From Tradingview Crypto Market Cap has been falling from Nov 6 to Nov 9th all due to FTX Exchange dramas.

FTX continues the saga of crypto businesses collapsing due to liquidity crunch issues

Oh my God, so another Black Swan event in crypto as if we had not had enough chaos a few months back with collapse of Luna-UST, then liquidity crunch in Celcius with the platform not allowing its customers to withdraw funds!!

Ofcourse, similar events got replicated with Voyager, Block Fi etc, they all suddenly were not able to process Customer Withdrawals.

FTX Exchange, faced similar issues as all these known and trusted entities in the crypto space.

(Ouch - this is really hard to digest, really is!!)

FTX acquisition deal with rival Binance because it’s collapsed!!

FTX Exchange is founded by Sam Bankman-Fried, who also founded Alameda Research. Solana Blockchain is in turn founded by Alameda Research.

Usually, Solana Blockchain is always in news about its Blockchain facing downtime and outrage issues due to congestion, but for the past few days FTX Exchange was in news due to concerns about its liquidity standing.

Ofcourse, by now everyone knows, FTX did not have enough funds to honour withdrawal of their customers' deposits as it got confirmed yesterday with the FTX’s agreement to get acquired by Binance!!

Well, yes Binance’s CZ too was part of causing the end of FTX Exchange and I will narrate that story now.

Story started with Alameda’s leaked financial report

FTX Exchange’s troubles started somewhere last week, with crypto journal Coindesk’s report that leaked financials of Alameda Research.

Alamada Research’s June Financials had the entity’s assets at $14.6 billion and liabilities at $8 billion. The problem was Alamada’s assets of $14.6 billion were on ill-liquid assets like FTT(native coin of FTX exchange) and other SOL based project tokens like SRM, MAPS, OXY.

Obviously, this could mean that Alameda Research may not be able to retrieve 14.6$ billion if it sold those assets, so its stable financial standing was questionable. This means that it’s possible the firm does not have assets to pay back its creditors if they suddenly ask Alameda to pay up.

Just to emphasise the extent of Alamada’s holdings on FTT, consider, it had $5.82 billion worth of FTT holdings when the total marketcap of FTT was only $3.32 billion.

Now, obviously this means, there is not enough liquidity for FTT tokens for Alameda to retrieve back close to 5.82$ billion value if it needed to sell the FTT tokens.

This also meant, if Alameda dumbs FTT tokens, FTT’s price will fall down heavily and all this is not in the interest of other FTT holders.

CZ dumps FTT tokens causing the value of tokens to collapse

This report started all the dramas with our CZ, that’s Binance CEO, Changpeng Zhao dumping 23 million FTT tokens worth $584 million.

Alameda’s CEO, Caroline, was offering to purchase all those FTT tokens from Binance at 22$ but I am not sure CZ accepted her offer. However, CZ dumped those tokens and FTT’s price collapse began.

Ouch - yes, read in news it fell to 5$ and below, imagine all the FTT token’s Alameda held in liabilities, their value just gone!!! This is all CZ’s doing!!

From Tradingview. FTT token falls from 26$ on Nov 5th to below 2$ Nov 9th!!

FTX not able to process withdrawal requests of its depositors

Meanwhile, FTX users were worried about the declining value of FTT tokens, and they too must have sold them off. However, it looks like with Alameda connected to FTX, they suspected that their deposits in the exchange may be in danger. So, there followed a bank run, where masses of users withdrew their BTC, ETH and other cryptos from their FTX accounts.

This was too much for FTX to bear, as it became obvious the exchange did not have enough deposits to honour all their depositor’s crypto withdrawal requests. So, soon FTX’s Sam Bank Friedman accepted defeat and was willing to sell off FTX to Binance.

Customers’ deposits were not stored in an honest manner in FTX exchange!!

I am frankly not able to understand how the finances of Alameda should lead to this situation of FTX. Agreed FTT tokens were losing value definitely causing financial turmoil to Alameda but why were user’s deposited crypto in FTX not there in the exchange for them to withdraw???

This could only mean that FTX had not kept users funds in user accounts, they utilised users funds for their trading purposes and ruined their own otherwise robust crypto exchange business.

There can be no doubt FTX did not have the right to touch and use customer’s funds for their trading pursuits, as FTX was just supposed to keep their users’ funds safe somewhere in cold storage.

This should aghast any one, hell, FTX was my favourite exchange, I used to use this exchange transitioning from Binance. Shrugs…

Youtuber Nicholus Mertin explains FTX's laxity in safe keeping of customer deposits better

This story does not end hear, there’s more side effects to follow suit

This is no end of story…because, I wonder what would be the impact of Solana’s SOL and other projects in Solana. There are stupid whales mostly holding most of these tokens of a Blockchain that’s facing outrage problems frequently.

Plus, what impact will Alameda’s, FTX and maybe Solana Ecosystems collapse have on wider crypto ecosystem? … Await the Contagion effect which maybe coming soon further crippling the crypto market

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Very informative and a good analysis. Thanks for sharing it. 😊 This should not happen in exchange or with the exchange. The user's fund should be safe.

Thanks for reading and appreciating my post!!