The Risks of Liquidity Pools....

Today's post is illustrating some of my failed investments to date. Failed in the part that I am holding the investments at a loss but have yet to sold but not sure if they will break even. I am not holding my breath.

Osmosis Draw Down

My original $20k investment in Osmosis has now dwindled to less than 50%. What is worse is since OSMO, native token of Osmosis, has fallen in price my pools participation has accumulated a lot more OSMO. Close to 50% of my portfolio is now in OSMO even though I started out at zero when I had $20k investment.

Recent days OSMO has drop to a new low and continues to fall on a daily basis. The token is used as a reward for people providing Cosmos IBC tokens to the platform for trade. The tragic part of this is the value of OSMO has drop since I first purchased and while investing in the liquid pools it has only lowered my overall principal.

What was the risks that I did not forsee. First every pool I invested in had 50% of in OSMO which made it all the more pain when OSMO dropped in value. I now learned the lesson of not to put all eggs in one basket and in this case not partake in so many pools with OSMO.

Osmosis has pools with no OSMOs which would have help reduced my losses as OSMO has dropped more than 60% from all time highs just a few months ago. The daily rewards yielding OSMO was adding to the losses as the drop in value in OSMO lead to drop in daily rewards.

Each day now I am earning more OSMO but the value continues to fall hence the more OSMO. All in all its a disappointment as I lost more than $10k in just less than three months. Truly a bad timing to have started investing in Osmosis.

Stable Coin Pools

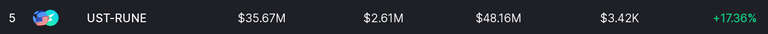

Many of my followers would know that I also love investing in stable coin pools. One of those that has cause some negative earnings at this time is my UST : RUNE pool. This is the front page image of this post where I am currently down more than 21% from my original principal.

The cause for a lose in yield? RUNE token drop in value and swift causing the value of the pool to drop in proportion. The price of RUNE is the major cause in drop both in assets in the pool and the yield in the pool.

At a yield under 18% APY this pool is technically worse than what Anchor is providing!

Conclusions

I want to be transparent here and be clear to followers / readers and remind myself that I too am getting hit in the current cryptocurrency draw down. In addition I am posting this to spot out the draw backs of participating in liquidity pools.

Lessons I take from this is that liquidity pools are not always safe even if there is stable coins involved. It is likely if all assets in the pool are stable coins the principal would hold up better but % yield earned would not be as much as holding riskier assets.

The OSMO holding has taught me that holding too much of one token relative to the rest of the assets in my portfolio will lead to a make or break situation. OSMO is falling hard and I am feeling the price pain by holding majority of my portfolio in OSMO. I should be getting away from the asset and balance my portfolio better.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

What's up friend? I think it's a very good post, I do cryptocurrency analysis almost every day and this seemed great to me, I will investigate the OSMO currency today to see if we are at a good time to invest, do you agree?

Posted Using LeoFinance Beta

I am a believer in osmosis. They were first on the scene with cosmos dex therefore likely had a fomo from investors. Now there are more competition. Also the lock up periods in assets is a major drawback. Can’t switch or take out assets so easily. Yet the developers are transparent and progress is made on the platform over the months. Above all as a daily hive user I have been hooked to no fees transactions. Osmosis currently has no cost in transactions. The transactions runs smoothly. Take a test run with small amount first like $1 to see for yourself.

Crypto drawdowns are frustrating but also opportunistic.

I've been putting a lot into the pHBD-USDC pool. Haven't had any impermanent loss in there ;)

Posted Using LeoFinance Beta

Me too, I just put some capital in the pHBD-USDC pool and let it work when I sleep each night :)

Posted Using LeoFinance Beta

Make money when you sleep - that’s how you reach true abundance!

Posted using LeoFinance Mobile

Yea, I've been doing the same. Not as much, for sure, but slowly building up there

Posted Using LeoFinance Beta

Osmosis is really hurting. Getting painful waking up each day and seeing it and seemingly everything else on it down another few percent.

I am hoping that once the EVMOS fomo dies off, OSMO will recover.

Posted using LeoFinance Mobile

You and me both. Been though sledding but I believe in the project. To me one of the best dex out there. If it can do cross chain transactions as easy as IBC then skies the limit.

I'm not involved with Osmosis but I know how you feel since I'm with many projects on Fantom and taking some serious blows.

You might have heard about Fantom and that one whale in danger of getting liquidated with some big bag..

My other projects are doing better, some Terra protocols for example have recovered pretty well compared to Fantom. Also Goblins on SmartBCH doing ok

Posted Using LeoFinance Beta

I have a small amount in BeethovenX so am quite familiar with Fantom blockchain. I am down even more in that investment than osmos but ftm I think is more of a one time occurrence. Like you mentioned the ftm whale selling out. It’s definitely worth a post in itself to talk about ftm dip but I think it will recover. The osmos is painful as pretty much every week since I started investing in late January it continue to go down. A risk that I personally overlooked is the fact that I invested lump sum into the protocol instead of DCA. Pools are just like buying tokens, don’t need to go all in at once.

That is an excellent point. I don't know why I go all in at once even though with tokens I DCA my way in.. it must be a mental thing 😅

Same here... I got interested in Fantom when I learned about the underlying tech but unfortunately getting hit a lot these days. Hopefully it will recover when the markets are better

Posted Using LeoFinance Beta

Yeah i't a shame cos Fantom has some very good projects going on. Too bad that there's always something happening behind the scene. Hoping for the best

The impermanent loss is always here, in every LP, even paired with a stable coin.

But at least, the impermanent loss has a positive effect in the downtrend period.

The LP has more value than holding a single coin

We only have a very minor impermanent loss by a pair with 2 stable coins like pHBD-USDC at the moment.

Posted Using LeoFinance Beta

Yes pair of stable coins is one of the safest pools to partake in a down trend but very difficult to time when markets crash.

Man you've learnt some tough lessons in crypto right there and I must say, they fucking suck. At least you can share the story for all of us to learn from.

I'm particularly interested in the UST/RUNE farming operation. Is it still going on? Do you still hold the LP tokens or have you cut your losses?

Posted using LeoFinance Mobile

Thorswap still operating and plenty of pools to partake. Note all pools have 50% rune in them so no way to avoid if a draw down in rune does occur. What I didn’t know was since rune price drops so will the yield rewards. Major reason I put close to $3k in it was the initial yield was 40% apr. since then rune price drop and yields are 17%.

That's kind of like the situation on Cubfinance

Posted using LeoFinance Mobile

Good correlation. The big thing with thorchain is that it’s a dex for multiple chains so if one was to swap between tokens not rune they are dealing native assets.

Entertainment purpose statement weighs more than the whole article 😂

Posted using LeoFinance Mobile

Disclaimer lol. I want to be transparent though and illustrate investing in crypto is not all that rosy. Many years of saving and scraping by to have that amount of $ in crypto and see it decay is painful. Got to see the light in this and know it’s apart of the volatility I signed up for, definitely entertaining...

People tend to invest in crypto looking at high yields, and miss the volatility part. Forex is also a risky business but people still like to trade lots.

Posted using LeoFinance Mobile

That's a bad hit indeed. The risk is always there in investments and I think we do need to learn when to get out before things turn really bad. Hoping for better days.

Posted using LeoFinance Mobile

Amen. Stay positive and keep learning as all we can do. Focusing on the things we can control and let the rest play out.

Yes, that's the best we can do, keep an open mind and learn.

Posted using LeoFinance Mobile

The bearish trend is affecting almost all the coin in the market. That's what we are seeing in the market since weeks now.

Posted Using LeoFinance Beta

I am optimistic at the moment and believe crypto still bullish. If btc losses $30k I will have a change of heart.

Ok

Posted Using LeoFinance Beta

And why don't you try trading? with $20K you would have generated a good return in 3 months of almost 60% or even more.

Posted Using LeoFinance Beta

Because I was greedy and lazy. The osmos pool were yielding 80% apr or higher and collecting daily external incentives tokens. All without having to keep track of asset prices. Now I have learned.

You have indeed spoken out of experience and I must say that in as much this is not a financial advice but I have as well learnt so much from it.

Indeed the entire cryptocurrency market is bleeding and there's no safety even for liquidity providers.

In as much as it is all blood currently, the best time to get involved is still now.

Posted Using LeoFinance Beta

Drawdown = Opportunity , stay strong!

Posted Using LeoFinance Beta

But there are still chances of recouping right? I mean, if Osmo recovers, then you’ll make your money back yeah? I want to believe so. Sorry about it, any amount of loss one makes hurt. I should feel hurt about my splinterlands asset because it went in this way too, but I believe it’ll recover at some point. This is why I like to be full on convicted about what I’m putting my money into.

I’m very much interested in only pure stables pairing farms. Not stable plus volatile. Only stable.

Moreover, the only volatile pools I’m participating in is Rune+BTC and Polycub+usdc. Because I believe in their long term value.

Posted Using LeoFinance Beta

I don’t know much about osmo but I think the crypto drawdowns have caused a lot of trouble than solving any, it won’t be long before you smiled to your wallet again

Posted using LeoFinance Mobile