Federal Reserve Fooling Investors or Fooling Themselves?

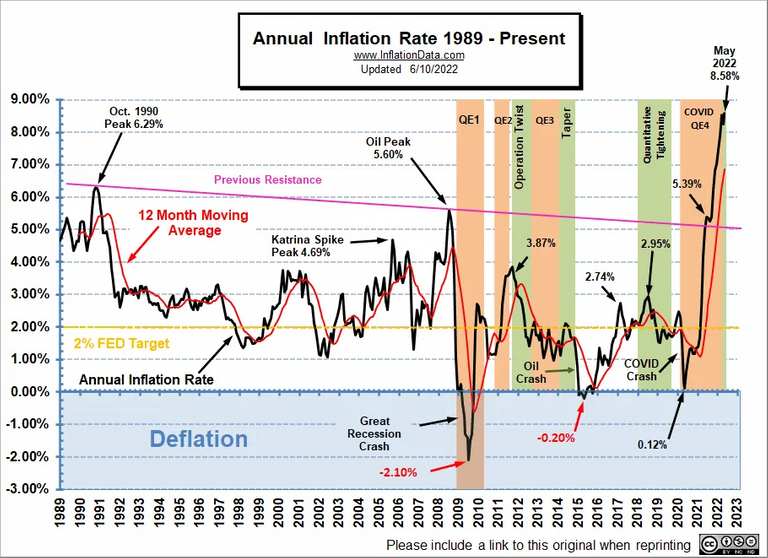

Chart courtesy of inflationdata.com shows how dramatic inflation has become in the United States and accelerating as we speak. Yet there were people who spend their whole lives studying and dealing with economics. These people are considered the most powerful people on the planet because they control the money supply of the largest reserve currency. The Federal Reserve is the title of this entity and the Federal Open Market Committee (FOMC) that consists of 12 members including some of the state federal banking presidents. One of FOMC jobs is to provide guidance on the future of of the US financial system.

Recently with the rise in inflation effecting people there has been greater scrutiny on FOMC's guidance regarding inflation. In this post I will chronologically identify why the recent FOMC's guidance on inflation is not only wrong but wrong consecutively yet no one is held responsible. Instead their mistakes have amplified the inflation which in turn is effecting every American's livelihood.

FOMC in November of 2021 Sees Inflation to top 1.9% in 2022

PCE price inflation was therefore expected to step down to 2 percent in 2022 and to 1.9 percent in 2023 before edging back up to 2 percent in 2024.

FOMC in December of 2021 Sees Inflation to top 2.1% in 2022

PCE price inflation was therefore expected to step down to 2.1 percent in 2022 and to remain there in 2023 and 2024.

FOMC in Janurary Sees Inflation to top 2.6% in 2022

Even so, an improvement in supply conditions and a decline in consumer energy prices were expected to slow PCE price inflation to 2.6 percent in 2022

FOMC in March Sees Inflation to top 4.3% in 2022

All told, total PCE price inflation was projected to be 4 percent in 2022

FOMC in May Sees Inflation to top 5.2% in 2022

All but the most recent May projections of inflation came from FOMC official transcripts, link here. Each consecutive meeting for over the past six meetings the FOMC had to adjust their inflation prediction to the upside. This is because every month they have been behind the eight ball with what was happening in 2022.

Inflation was happening and at rapid rate causing any aggressive predictions from the Federal Reserve is underestimating the actual

outcome. With this in mind what do you think any and all other predictions from the FOMC holds validity. It does not.

For over a year the FOMC did not accurately predict the inflation that is currently spreading through out America. This can be compared to as simple as a weatherman that predicted sunshine ahead but everyday it rained.

FOMC are experts in their fields but somehow the are off with their predictions. This has me concern and many others who follow the FOMC meeting minutes as there are signs that the central bank may not know what they are up against and appear to be winging their projections. If that is true what is to say their current course of actions will help subdue the inflation? It will not.

The FED has the power to control the supply of money with two main twos. First tool is to adjust borrowing rates of the dollar and second tool is controlling how much dollar is in the open markets. Ignore the details of how they exactly control the supply of money for a moment. Instead realize for over the past year they have not been able to accurately predict the inflation that is currently happen in the US economy. How do you feel to know people who have power to control the value of the dollar is actually not good at forecasting the future. These people are considered highly respected economists that come from full range of financial experiences from corporate world experience to higher education. Yet they could not foretell the current inflation yet have been trying to take action on subduing the inflation.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I have a feeling it has a lot more to do with the falling value of the USD and less resources all around. Many factors none of which raising rates is going to fix any time soon.

Posted Using LeoFinance Beta

You summed it well. Basically the FED can only control supply of money but they can not control the supply of goods and resources.

What I am trying to emphasize is that these people who are the FED have thousands of hours studying economics and yet they are unable to maintain normal growth. Unfortunately most Americans and people who do business with USA will suffer the most for what the FED does.

The Fed only speeds speculation and it affects the interest rates by doing so. However, they are powerless if people don't believe in them. They can't really do much and we saw that by how much they asked for Congress to give fiscal aid and I think the biggest reasons for the rising rates is the supply chain issues.

Posted Using LeoFinance Beta

Supply chains definitely a cause to the inflation but I think Feds actions for over the past decade has manifested to this inflation. The supply chain problems were concealed in the back of money printing but now is surfacing because the money printing is no longer working effectively. The end result the next decade we may likely seem some form of stagflation. Where prices go up but wages and jobs shrink. I won’t me surprise stock market go to all time highs meanwhile millions are homeless.