Fed Pivot May Not Be What Bulls Want?

There has been a lot of headlines trying to explain the current stock market bull run of the past week. It maybe a bear rally or that commodities prices are falling such as oil and natural gas which will help the economy operate at a lower energy cost. Or it could be that people having a positive outlook now then a week before and are now willing to invest more. There can be many explanations as to why the markets are up, but one popular opinion is that central banks will be accommodating the stock market if prices fall too far.

Fed Total Assets versus S&P Market Value

Chart above straight from the Federal Reserve shows the last twenty years of assets the FED holds versus the S&P 500 stock market. Notice each time the FED’s asset purchases have risen so has the stock market. Only times when stock market fell were when the FED total assets either shrank or during the 2020 global lock down.

The lock down had the stock markets temporarily drop but the FED asset purchases exploded immediately in order to be more accommodating to the global slow down economically and financially. The result was a swift recovery in asset prices as it only took a few weeks later for the S&P to get back to all time highs and go even higher.

The current market draw down started a little before the FED had stop asset purchases. There is currently a slight drop in total assets held by the FED but it has already created a downward path on stock prices.

Some stock investors are buying now in anticipation that the FED would change their minds and start lowering interest rates and continue asset purchases.

These actions of the FED to continue raising their assets on their balance sheets and lower interest rates to increase consumer lending are considered dovish views in economics. While hawkish view is when FED raises interest rates and stops purchasing assets. The switch from hawkish to dovish view can be abbreviated as the FED pivot.

For most of 2000s since the Great Financial crisis the FED has lean dovish for the most part which has help raise the stock market prices.

History Does Not Repeat But Rhymes

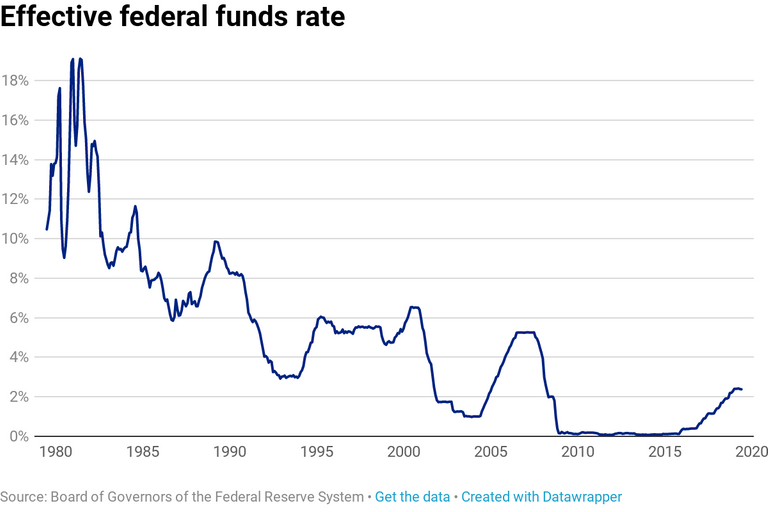

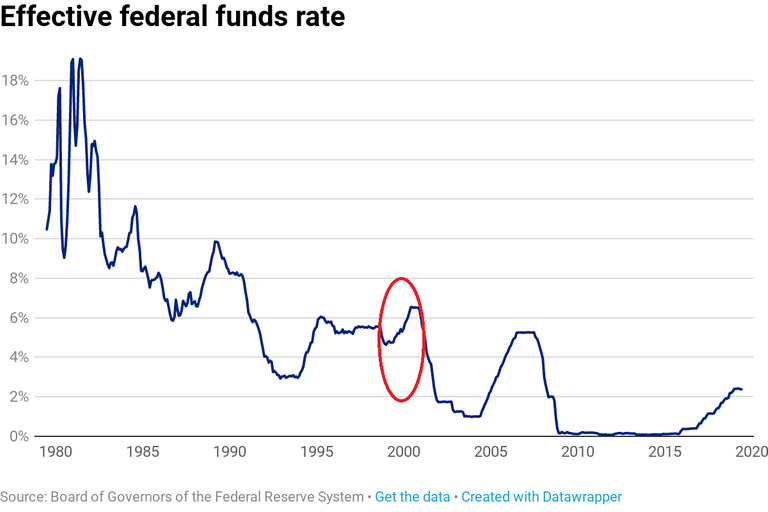

In 2001 during the dot com bubble something similar was happening to what we are seeing today. At the time FED chairman Alan Greenspan decided to lower interest rates early January 2001 when the stock market was falling and it appear the economy was struggling.

Traveling back in time during 2000 the stock market was in a down trend. At the time the FED had been steadily raising interest rates.

Rates were going from low 4% up to 7% before things looked to be bad for both economy and the stock market. Allen Greenspan immediately changed course and dropped interest rates. This you can say is a pivot toward being dovish and with that the FED lower rates close to zero, but the stock market continued to fall. It was only until 2002 did the market find a bottom.

Conclusions

Now over 20 years later the FED interest rate is barely over 2% while the economy already appears to have signs of struggles. In addition the stock market has been fallen from all time highs since March.

There are many parallels between now and 2000 bear market. I do not expect the same results will happen but am making note that there is potential for further pain ahead for bull investors. Be careful out there.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

You maybe right, a lot of investors speculate that when economy slides into recession the Fed will pause the rate hikes or even do another QE. Well nobody knows.

But I am sure that we will have to see more pain before a relief from Fed side is realistic. Inflation is just too high and americans are getting more than annoyed about it.

The Fed can't really do anything but it does help fuel the speculators. I have a large feeling that things are slowly getting out of the Fed's control and it is kind of crazy how bad the speculation is now.

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @mawit07.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more