Investment 101 - Technical Analysis vs. Fundamental Analysis

Hello Readers,

During or after spending their teenage life, most young souls understand and feel about the importance of money and finance in life, the tool that measures how much successful you are in this world. Most of them either focus on getting a good job depending on our educational qualities and skills or goes into business. But after a certain time, many of us realize that not only earning is important, but saving and investing a portion of your income to generate more wealth is also as important to service and live a better life. For anyone who is just starting to invest in any financial market can feel like being on sail in an uncharted sea. The winds of uncertainty now and then and the sudden waves of volatility can make it challenging to make informed and precise decisions. This is where two distinct approaches come into play as our tool to sail well - technical analysis(TA) and fundamental analysis. Both of these methods aim to guide investors through the high waters by providing a possible range of insights into the future performance of stocks and other assets. In this article, let us dive into the world of investment analysis where I will be comparing the technical and fundamental approaches to help you set a course toward successful investing.

Technical Analysis

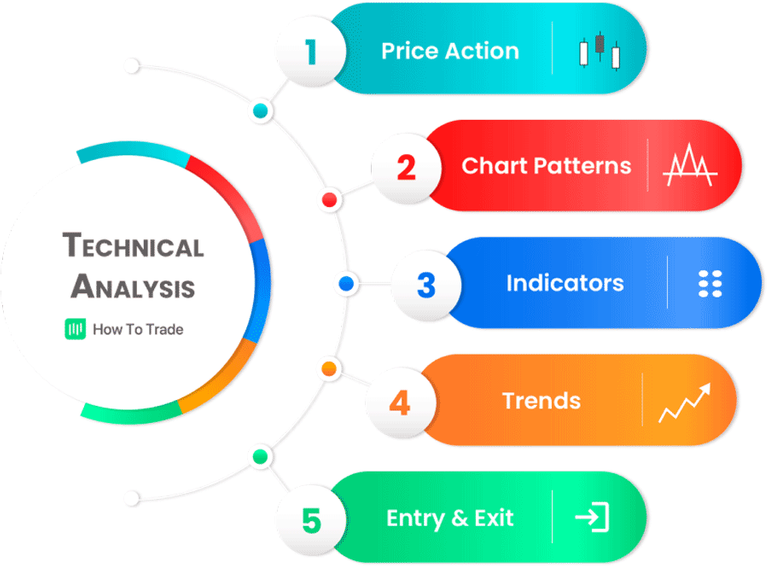

To make it a simple start, just imagine you are a sailor, who is studying the patterns of the ocean's currents and the direction of the winds before setting sail. The study will help you to sail using these forces to make your journey faster or smoother and also to avoid any unnecessary move against your course. Similarly, the technical analysis examines historical market data - such as price and volume, etc. to predict the future price movements of that particular stock, coin, or asset. By identifying trends, chart patterns, and indicators of a certain asset, we as technical analysts can identify or calculate the probability of the future performance of any asset and try to uncover potential trading opportunities.

source

Charts are the primary tool to calculate technical analysis of any asset and play a key role in this aspect. They display or trade price movements over time make certain moves and reveal patterns like "head and shoulders," "double tops" and "flags" etc which are then examined by technical analysts, and these types of patterns are believed to indicate possible reversals or continuations in price trends. Though nothing is guaranteed in the world of investing and every calculation or analysis is just a mere educated guess here, these types of patterns in technical analysis often benefit analysts to catch a good trade and earn money if rightfully invested.

Source

technical analysis also employs various indicators such as moving averages, relative strength index (RSI), and stochastic oscillators which are the tools of a technical analyst to predict the asset’s future price actions. These indicators aim to measure the current and probable future market sentiment, momentum, and overbought or oversold conditions of that asset. By closely analyzing these signals, the investors hope to make well-timed trades and get benefited from their analyses.

Fundamental Analysis

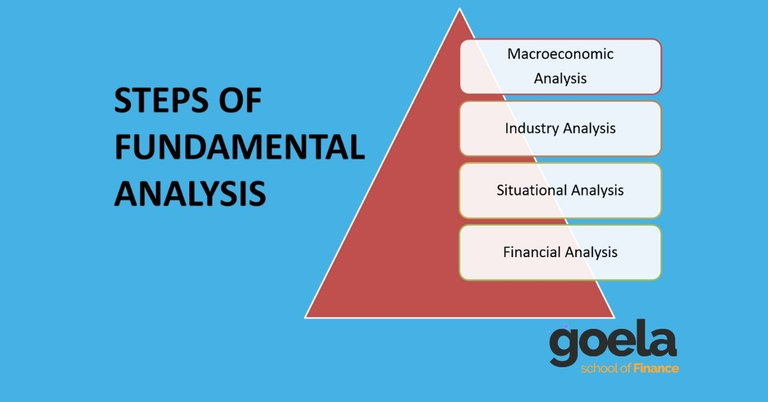

On the other hand, fundamental analysis takes a completely different approach and takes a look into the essence of a company's true value. Just imagine that you are inspecting the required materials used to construct a ship before deciding to invest in it. The fundamental analysis examines a company or asset’s financial statements, earnings reports, industry trends, and overall economic conditions to assess its intrinsic value. By doing fundamental analysis, we can predict the long-term future of a company or asset whereas with technical analysis, we can predict the short-term outcome of any asset.

Source

When analyzing the fundamentals of any company or assets, the key financial ratios like price-to-earnings (P/E) ratio, earnings per share (EPS), debt-to-equity ratio, and all the major previous decisions made by the company heads that affected its future are generally used to evaluate a company's true financial health. In addition to that, macroeconomic factors such as interest rates, inflation, and political stability like factors are also taken into account to analyze the broader market environment of that entity.

Source

Fundamental analysts believe in the fact that by understanding these underlying factors that drive a company's performance over time, they can identify certain stocks that are either undervalued or overvalued and this helps to decide whether to buy or sell those assets. This scientific approach is often used and believed by most long-term investors who seek to construct their portfolios with companies that are here for sustainable growth.

Which way to go

Though they are different approaches and distinct from each other, both technical and fundamental analysis have their own set of merits and usefulness for valuing an asset and many investors choose to blend aspects of both approaches to determine the true value of an asset. The main key here is to understand your investing style and risk tolerance.

Technical analysis is used widely for catching short-term market trends or waves and thus offering the potential for quick profits. However, it requires constant monitoring and can be influenced suddenly by market sentiment hence more risky and needs more attention.

On the other hand, Fundamental analysis is well known for navigating a steady course for a long period while neglecting short-term market movements. It is about long-term potential and understanding a company's true worth. But please note that it might not be as effective for short-term trading decisions.

Source

Conclusion

In this modern world of tons of investment options and areas to choose from, technical analysis and fundamental analysis stand as guiding stars for us to help us invest wisely. Just like the captain of a ship, you have the choice to rely on patterns, indicators, and charts or to assess the true worth of companies before making your investment decisions, or to mix both of those to constrict your custom strategy. But we have to keep in mind that the winds and waves of the market are ever-changing and neither approach can guarantee certainty. By combining our understanding of both of these two methods and staying informed about past and current market developments, we can think educated with a clearer vision toward successful investing.

Just like no sailor can predict every twist of the ocean but as their experience grows they become more accurate and experienced, in here also no analysis can perfectly foresee every market movement but with practice over time they get polished and take better decisions and their experience grows with time. However, with the right knowledge and a dose of calculated risk, we can begin and continue investing with greater confidence.

Posted Using LeoFinance Alpha

https://leofinance.io/threads/mango-juice/re-mango-juice-2n7zycp9j

The rewards earned on this comment will go directly to the people ( mango-juice ) sharing the post on LeoThreads,LikeTu,dBuzz.

!PGM

!PIZZA

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Thanks for the amazing support torran!

Thanks for all the quality content!

!BEER

View or trade

BEER.Hey @mango-juice, here is a little bit of

BEERfrom @torran for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.$PIZZA slices delivered:

@torran(2/10) tipped @mango-juice

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.