Correlation Between Binance (BNB) and HIVE

Correlation between digital assets has been one of the area of interest investors tends to pay much attention in terms of diversifying investments. It is not different from the correlation in statistics as this test for an analysis of relationship between two or more assets. This article will determine the correlation coefficient between HIVE and BNB.

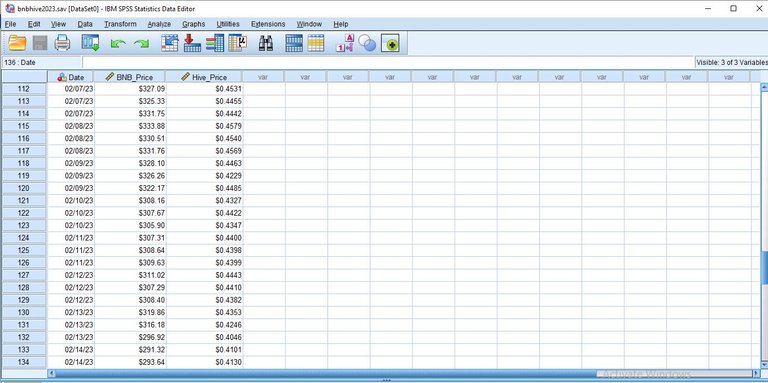

The data collected for the analysis was gotten from coin gecko. It covers the period between Januarys to February of 2023.

The following are very essential as regards the subject of correlation.

Correlation coefficient

Coefficient of correlation determines the level of relationship between two or more assets in consideration which in our case is that of BNB and HIVE.

The coefficient of correlation is either indicating a positive, negative or zero correlation.

When the correlation is positive, it is however interpreted that an increase in the price of the higher crypto asset which is BNB in this study will lead to an increase in the price of HIVE.

When the correlation is said to be negative, it indicates that an increase in the price of BNB will lead to a decrease in the price of HIVE.

When there is a zero indication of correlation, there is said to be no relationship between both assets in the crypto market.

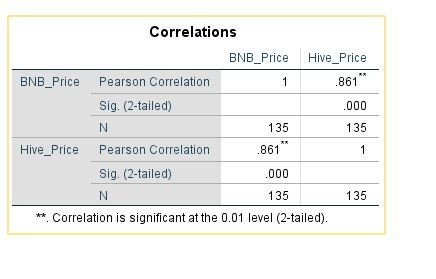

The coefficient of correlation for BNB and HIVE in January to February, 2023 is as shown below.

With a coefficient of 0.861 shows an indication of a strong positive correlation between both assets. In order words, it can be understood that as the price of BNB experiences an increase, there will also be an increase in the price of HIVE as well.

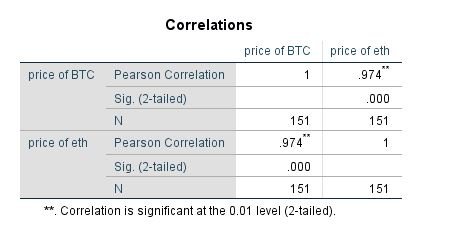

Comparing this result to the previous analysis, carried out between BNB and HIVE for the month of December 2022 – January 2023 shows a coefficient below of 0.974 at its highest peak of positive correlation.

But currently from January to February of 2023 shows a reduction in the coefficient of correlation by 0.113. However the interpretation remains the correlation is still strong and positive.

Other relevant aspect to consider are:

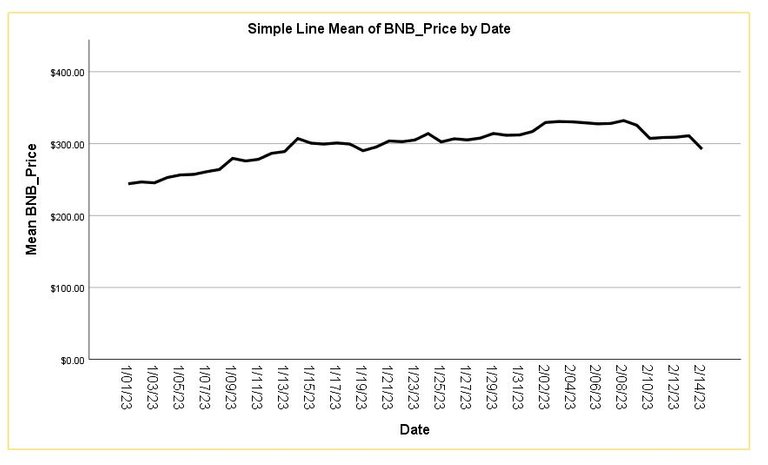

Line graph for BNB

The line chart for BNB is seen below.

It is visible that the price of BNB has been finding its way above $300 but recently dropping below the price. It is expected that in the next Bull Run, it may climb to the $400 target. This will definitely be a plus for BNB investors.

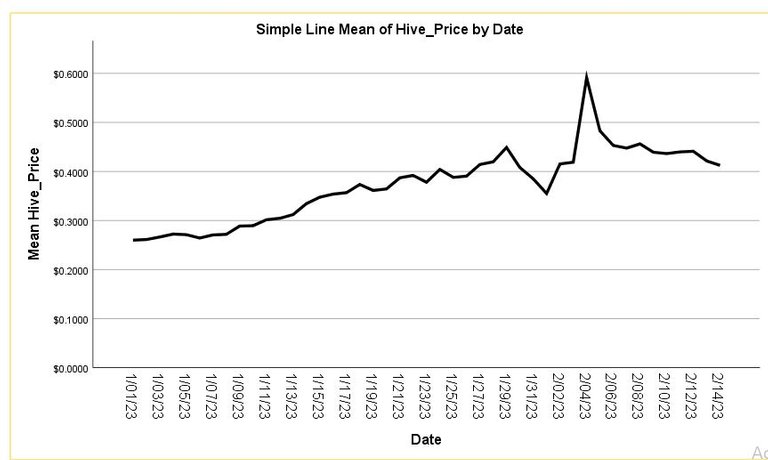

Line graph for HIVE

The line graph for HIVE is seen below.

It is visible that as the price of HIVE estimates half of a cent, there was also a spike above it. To me this is an indication that HIVE may achieve the estimated $1 = 1HIVE this year if everything remains same.

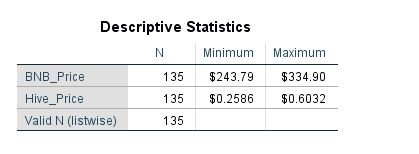

Highest and lowest prices of both assets for the duration

The highest and lowest price of BNB and HIVE are shown in the table below. This gives a valid description of the line graph above.

The maximum price of BNB for the duration is $334.90

The maximum price for HIVE for the duration is $0.603.

Conclusively

The correlation between BNB and HIVE is strong and positive, however, there was a deviation in terms of decrease in the coefficient as compared to the December, 2022 – January 2023 analysis.

Proof of work

Posted Using LeoFinance Beta

https://twitter.com/1455313948425732098/status/1626000349919150082

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

.86 is a really strong positive correlation. Good to see someone digging into SPSS!

!LUV

@iniobong3emm, @crrdlx(1/4) sent you LUV. | tools | discord | community | HiveWiki | NFT | <>< daily

NFT | <>< daily

Thanks brother.

!ALIVE | !BBH | !PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

@iniobong3emm! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @vocup. (3/20)

Thanks for reading friend.

@iniobong3emm! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @vocup. (8/20)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.