Correlation Analysis between BITCOIN and HIVE

In the last days of 2022, it is essential to measure the performance of HIVE against BITCOIN as this article will present an analysis of correlation between both assets under the following subheadings.

Result of analysis between BITCOIN and HIVE

The result of analysis is shown below.

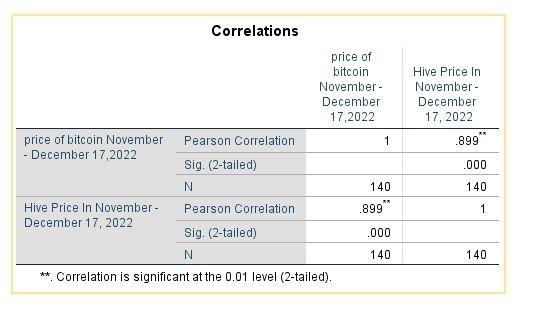

The point of intersection between price of BITCOIN and the column of HIVE shows a figure 0.899. This figure summarizes the coefficient of correlation according to its theory.

When the coefficient is between 0 to +1, the closer the coefficient to the positive one axis, the stronger the relationship positively.

A relationship is said to have a positive correlation when the price of one can influence the price of another. In order words to predict when the price of HIVE will be bullish, we have to depend on the price of BITCOIN because they are somewhat linked together.

The second row shows a significance value for the test of correlation.

The test of correlation has its null hypothesis that there is no relationship between both assets. It compares the calculated significance value with standard 0.05 when the calculated significance is less than 0.5 the rule is to reject the null hypothesis which states no relationship and accept there is a relationship between both assets.

My calculated significance value is lesser than 0.05 in a nutshell there is a relationship between the price of HIVE and BITCOIN.

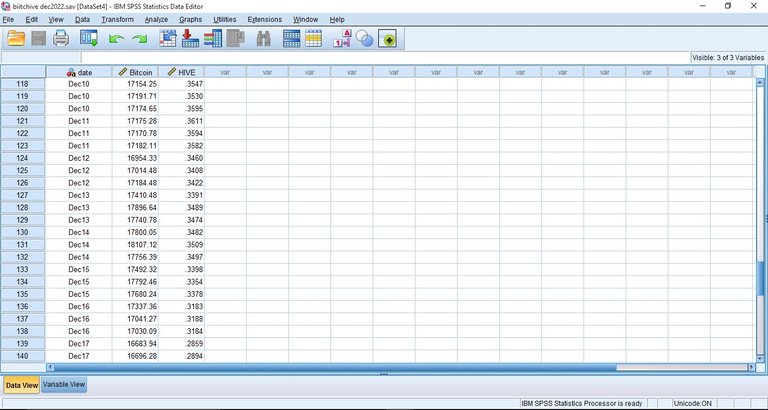

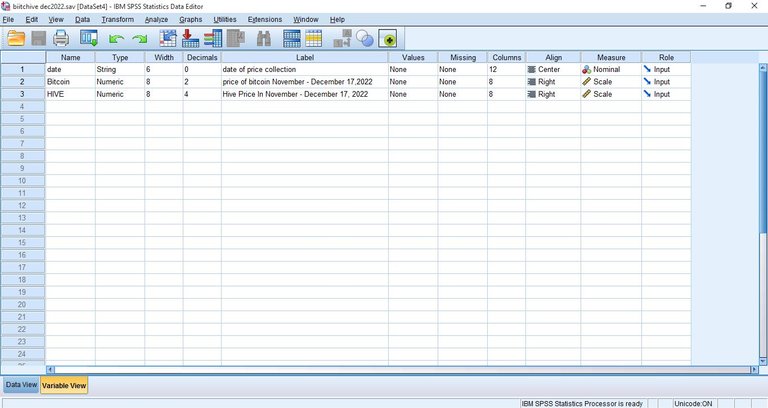

The last row denoted by letter N shows a value of 140 because I collected 140 prices of BITCOIN and HIVE for the month of November to December 17, 2022.

Is it Possible to Predict HIVE price Using BITCOIN?

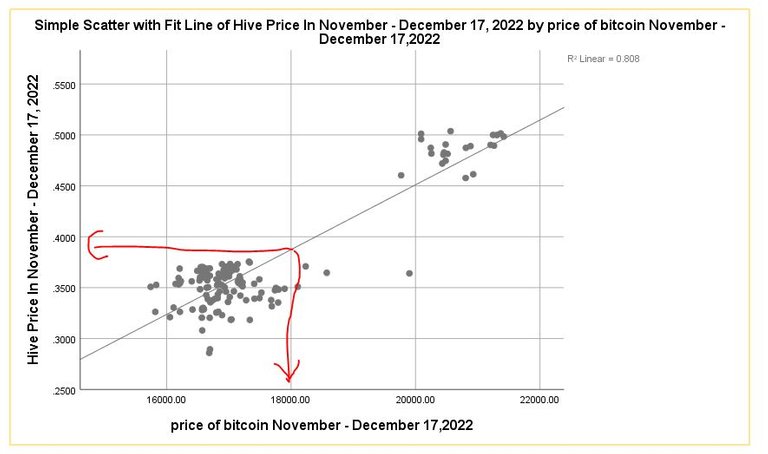

To answer this question, let’s take a look at the scatter dot diagram below.

Having considered the diagonal line, it can be concluded that the price of BITCOIN can be useful in predicting the price of HIVE.

Performance of BITCOIN

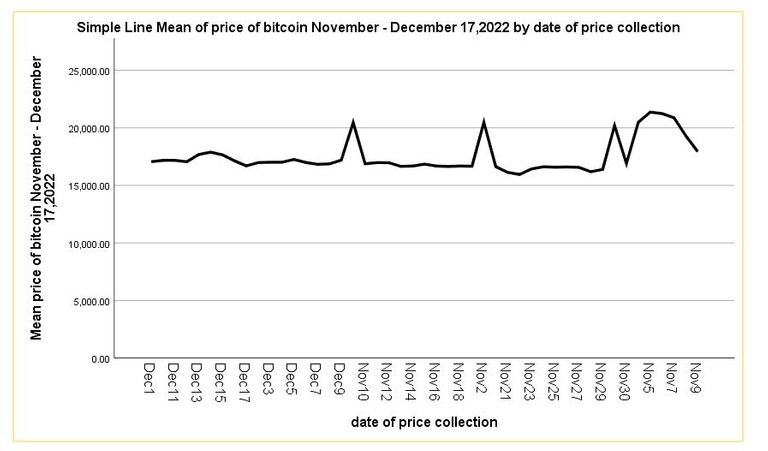

The chart below shows the price performance of BITCOIN for the month of November to December, 2022.

From the line graph it can be seen that in early November the price of BTC was $20,000 and above and during the second week of November the price of BITCOIN attempted a dip to $15,000 and currently it’s on the way to $20,000 again probably after this bearish moment it might plot above $20,000 in 2023.

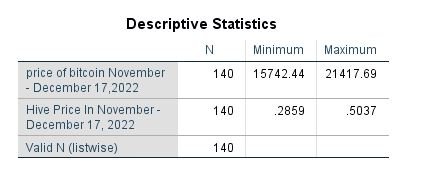

Maximum and minimum price of BITCOIN and HIVE.

The maximum and minimum price of BITCOIN for the month of November 1 to December 17 are $21,417.69 and $15742.44.

The maximum and minimum price of HIVE for the stated duration is $0.5037 and $0.2859.

Other images are data and variable view.

Conclusively

This article has aimed to summarize the performance of BITCOIN price using line graph. It also analyzed the correlation between BITCOIN and HIVE which was found to be positive. This simply implies it’s possible to predict the next bull run for HIVE price when there is a bull in BITCOIN price.

Other analysis calculated for were null hypothesis for correlation, including maximum and minimum price of both assets.

Posted Using LeoFinance Beta