When you should power up HIVE

Direct from the desk of Dane Williams.

A look at the various scenarios around if and when you should power up HIVE.

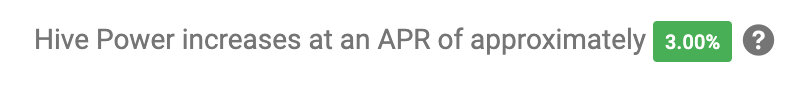

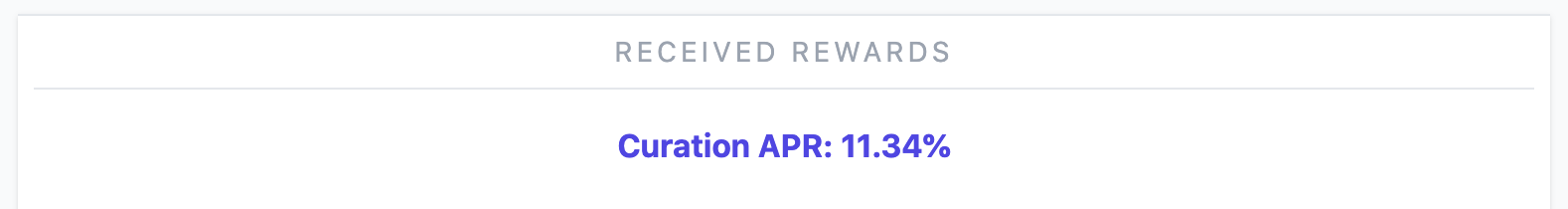

Powering up (staking) your HIVE, allows you to earn 10% from curation rewards and 3% from simple inflation.

An extremely attractive return, alongside all the security and governance benefits that come along with taking a stake in the network.

But with the ability to earn a higher return on your HIVE elsewhere, I keep seeing people asking if and when they should power up HIVE.

In this post, I take a look at the various scenarios you need to run through in your mind before deciding when is the right time for you.

Scenarios for when you should power up HIVE

Deciding when you should power up HIVE, revolves around the following two main factors:

- Your desired HIVE holding period.

- Where you view the price of HIVE moving.

Remember, by powering up your HIVE, you’re essentially locking your tokens away for 13 weeks.

Powering down takes 13 weeks to complete and while it’s running, you’re only given back access to 1/13th of your tokens each week.

That means that your first consideration around powering up your tokens must be the time you’re willing to forfeit access to them in their liquid state.

You have to be comfortable with not having access to your HIVE for 13 weeks and have the foresight to plan your eventual power down, essentially 3 months in advance.

Only power up your tokens if you’re comfortable holding for this period of time.

If the 13 week power down period is okay for you, it’s then time to then consider price.

If you think the price of HIVE is going to go up

Are you bullish on the price of HIVE?

If you think price is going to rise, then now is the time you should power up your HIVE.

By powering up, you will not only earn the 13% APR on your single asset stake, but you will also be able to take full advantage of HIVE’s rise in price.

In this era of DeFi popularity where degens chase unsustainable returns on assets that are obviously going to zero, powering up HIVE is extremely underrated.

HIVE Power was DeFi before DeFi was a thing:

If you think the price of HIVE is going to go down

But what if you’re bearish on the price of HIVE?

If you think price is going to fall more than the 13% APR you will earn by powering up, then you shouldn’t power up your HIVE.

In this scenario, you want to gain some protection from any downward price movement and be paid a higher APR for doing so.

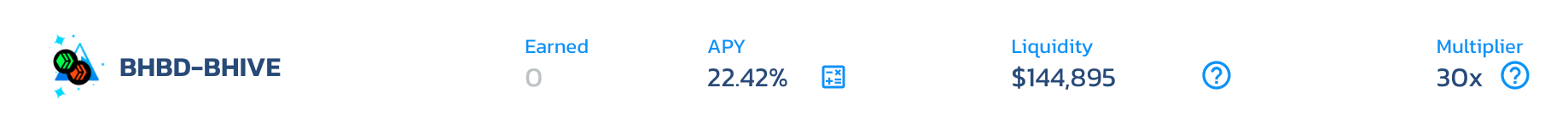

This is where wrapping your HIVE into bHIVE on BSC and then placing it into the bHIVE:bHBD LP on Cub Finance becomes your ideal move.

By pooling your bHIVE with the stable bHBD, you’re protected against downward fluctuations.

What ends up happening when the price of HIVE falls, is that impermanent loss causes you to essentially just continue DCAing into a bigger HIVE position.

All while keeping your exposure under check thanks to the HBD stablecoin side of the LP.

Not only are you protecting yourself from downside price fluctuations, but you’re also earning a higher APY than if you were simply powered up:

Final thoughts on powering up HIVE

As long as you know your desired holding period and can make a call on where you view price moving, then you have the answer to whether you should power up HIVE.

In my personal opinion, HIVE is a good investment and is set to break out to the upside in 2023.

When you dig a little deeper into other cryptocurrencies, you quickly discover that NOTHING is like HIVE.

As I’m happy to hold long term and believe that price has more upside potential, I’m putting my money where my mouth is and keeping the majority of my HIVE stack powered up.

What do you think?

Jump in the comments and let me know whether you’re powering up your HIVE or are continuing to protect yourself against further bearish price action in the bHIVE:bHBD LP.

Best of probabilities to you.

Posted Using LeoFinance Beta

https://twitter.com/3979726700/status/1601078397282955264

https://twitter.com/1415155663131402240/status/1601243056937742337

The rewards earned on this comment will go directly to the people( @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I don't mind powering up Hive. At least it's constantly developing and new things are coming out all the time. Let it earn here and I tend to prefer the HBD savings over liquidity pools to earn a return on the Hive.

Posted Using LeoFinance Beta

As long as you're happy to not have access to your HIVE for 13 weeks and are bullish about price, then powering up your HIVE is a no brainer.

Posted Using LeoFinance Beta

Interesting! This all boils down to what we think our decision is when it comes to powering up your Hive. The two factors you have listed are sure important things to look into before deciding whether to power up or not and in the end, we feel we are making the right decision. But what if we aren't sure? Well, it depends on every individual.

As for me, I don't mind powering up my Hive tokens because it gives me power in the ecosystem and aside that, I get to earn juicy returns when I put in my effort to engage and the rest. Since this week, I have been powering up as little Hive I get. I got some Hive giveaways on Discord few days ago and I powered them up.

Posted Using LeoFinance Beta

If you aren't sure, then you need do the research required to make a call.

Nobody should be investing in things they don't understand.

I'm happy to see that you've done the research and understand why you've powered up :)

Posted Using LeoFinance Beta

True, but I don't think of powering up or down for now 🤔. I just make my HP to delegations to get other tokens and re-invest it while my post stays for 100% HP rewards to increase my HP every day 🤗.

The reason behind that is obviously this one below too. As I think of my HIVE account as an urgent money helper. 😅

I still don't have a mind to power up 🤣. I ever think to increase my HBD Savings rather than powering up smh. "More ways to increase the capital is better than one way to increase the capital", That's what I think. It's good to see that you think of a way for someone who thinks bullish and bearish at the same time 👍 Nice info.

!PGM

!LOL

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

lolztoken.com

An oughtter.

Credit: reddit

@forexbrokr, I sent you an $LOLZ on behalf of @cursephantom

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(2/4)

I like your strategy of powering up HIVE because it will give you an income generating asset.

If the price of HIVE goes up, then you can essentially pay yourself a wage from the rewards/yield that you earn from it.

That way, you never have to touch your base stack, but can still sell your liquid rewards to make money.

Posted Using LeoFinance Beta

I'm doing something similar to you, but pooling my HIVE inside the diesel pool instead doing cubdefi... The result is more-less the same...

Also, we can't forget the "side-effects" of powering up HIVE... Having more HivePower is having more influence on the platform, and very often, more recognition... Which leads to appreciation, better upvotes, and finally, more income...

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

Which Diesel Pools are you in?

Do you still choose ones with a SWAP.HIVE side?

How do you manage your impermanent loss in the more risky ones that pay the higher yields?

Yep, this is a great point!

The harsh reality of Hive is that those with stake, earn more author rewards.

Why would curators (who have stake themselves) choose to upvote people that are just endless dumpers?

Posted Using LeoFinance Beta

I'm mostly in SWAP.HIVE:SWAP.BUSD... I know that it's not HBD, but at this moment, I'm comfortable with exposure to BUSD... Besides the APR that you get in BXT, you also earn fees from exchanges, which can be nice when people panic... 😃

I don't understand what you mean. Don't find that pool risky as I like both assets... If HIVE goes down, I'm ok with it, and vice-versa... If you were thinking about OTHER pools, I do avoid most pooling shitcoins... Eventually, if I pool 2 shit coins together... lol... A perfect example of my bad investment in the past was pooling HIVE with Polycub... 😃

Personally, I'm not thinking that black and white, as what is the point if everyone is just compounding, accumulating... It's OK to take profits, but on the other side, you should build your stake, too... So, I do agree with your statement partially... Take some profits, but also grow... And on HIVE you grow, your friends grow, and the whole ecosystem grows if you stake something... Which is a good long-term plan, if you ask me... :)

Cheers!

Oh yea!

I've been powering up slowly and steadily and also participating in HPUD whenever I remember. No regrets baby

Posted Using LeoFinance Beta

Just keep grinding that HIVE stack higher!

Posted Using LeoFinance Beta

I power up daily when I can as I like the compounding effect. As a long-time Hivean, I'm not going anywhere and am in this for the long haul. Now is a great time to be buying HIVE and continuing to build your stake.

Posted Using LeoFinance Beta

I don’t do much of daily ups because I like powering up PUDs since they have some extra benefits like chances to win HIVE(which you can add to your stake again) or win Hive Power prizes(also more stake) or even HP delegations. Recently though, I try to power up small amounts as often as I can on regular days.

Keep grinding that stack higher.

Your future self will thank you!

Posted Using LeoFinance Beta

I’m bullish on Hive as well and I agree that there’s nothing like Hive out there. HIVE went over $3 in the last bull market and since then, there’s been a lot of developments, upgrades and new things on the blockchain. It can only go Higher in the next bull!

My thinking is the same as yours.

As such, any price movement up and down between 0 and $1 means nothing to me.

Just keep stacking!

Posted Using LeoFinance Beta

Exactly. Everything between 30 cents and $1 is just noise.

There is of course the option to swap HIVE to HBD and keep it in savings or in an even more liquid form in a stable diesel pool or LP on CubFinance while the trend is downward and switch back to HIVE whenever you estimate the bottom is close.

A useful guide for newbies!

Yep, pool your HIVE with HBD until you think the bottom is in.

Then convert all the remaining HBD to HIVE and hold.

That way you take full advantage of the price rise back up.

But obviously this is riskier than just keeping it in the bHIVE:bHBD LP because you no longer have any downside protection and aren't earning any yield.

You're now just relying entirely on price rising.

Posted Using LeoFinance Beta

I never thought of about any such factors while powering up. I just powered up because I want to reach a level where my vote would make some meaning at least. Perhaps, this is also because I do not have many financial intentions but to keep on learning via writing .

Smart! :)

Posted Using LeoFinance Beta

😀

Hadn't really understood the meaning of impermanent loss until you explained it that way, thanks for that! I like that strategy a lot, but messing with cubdefi makes me wary, I am more likely to do something similar using just hive engine LPs on TribalDex at this time, but maybe learning my way around cubdefi would be worth it? Idk, I'm not "crypto-smart" and don't have much time to invest in learning/research, let alone doing any blogging/writing at this point, so I'm typically slow to act in any way that isn't familiar to me.

Good post! And, just for the record, I'm bullish on Hive. I think an upswing is coming soon! 🤞

When I started to think of impermanent loss as just a way to use one asset to DCA into the other, it was a lightbulb moment for me ;)

If you don't have the time to learn about how to use BSC, then definitely start with the LPs on Hive.

Check out this BeeSwap BXT distribution page.

The SWAP.HIVE:SWAP.BUSD LP is currently paying out 35% in BXT tokens.

So that pool is essentially exactly the same as the bHIVE:bHBD LP on Cub Finance and pays a higher yield!

Posted Using LeoFinance Beta

I will just keep participating in #HIVEPUD and in case I have a bigger fund, then I will stake more HIVE. As for HBD, I will test my self-discipline this 2023 if I can manage to accumulate at least 500.

Posted Using LeoFinance Beta

Just keep stacking mate! :)

Posted Using LeoFinance Beta

Yeah, that's the way to go. 😊

Powering up… always powering up! Now even every day, I want Hivebuzz’s pum-badge!