EMERGENCY ALERT: NEVER USE DSWAP FOR LARGE TRADES

Did you catch the dip?

Whatever you think of the LVL @psyberx project, I think you can agree that @baconface is a happy camper having scooped 2.1 Million LVL tokens for about 2 cents of SWAP.HIVE

How could something like this be possible?

It all has to do with orderbooks, and the dangerously programmed @dswap. Don't use it folks.

I mean, it works. As long as the market book liquidity holds up. But not with big purchases or dumps.

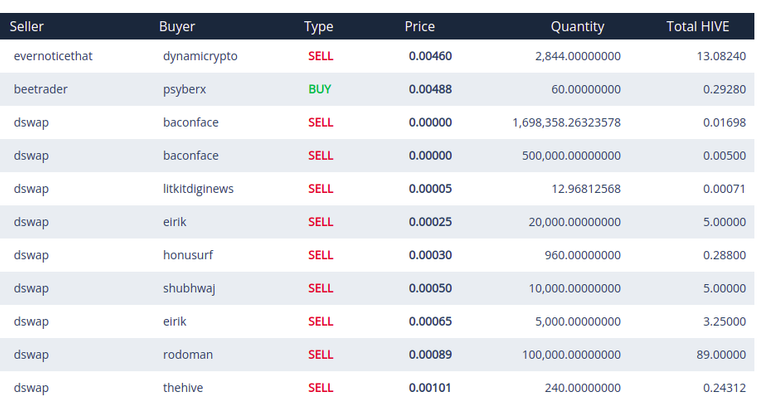

With a little investigation, I found this:

I am sure even @tbnfl4sun wishes he would have just listed a sell order on the market place now. His huge dump swept the orders for about 500k LVL, then the last 2.1M tokens went to @baconface.

@baconface might just be a bot that lists low orders like these for this exact occurance. The 'fat finger' trade when you send too much liquidity at the order books, something that @dswap makes much to easy to do, in my humble opinion.

How much liquidity do the order books hold?

That depends on the market, but the truth is, not much. You should only expect a couple hundred dollars in liquidity in most populated markets on hive-engine. Many projects don't have $50 dollars of 'dump' liquidity on the books; this is the reason that liquidity pools and linear liquidity projects have become so popular.

There is an opportunity cost to locking up liquidity in order books.

Market 'order books' are a tool, and its worth learning a bit about it if you want to learn to use tokens.

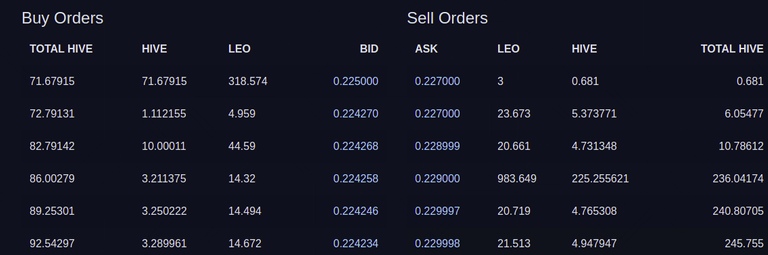

Markets are two books, the Buy Order book and the Sell Order book. The highest buy order (the 'bid') and the lowest sell order (the 'ask'), make up the market spread.

On developed markets like LEO, robots magically work the spread, tightening it against each other and making it moderately useful for people buying and selling moderate amounts of tokens.

But at any moment if someone wanted to sell say, $10,000 dollars worth of LEO, the buys could not stand up.

Its worse on almost every other market.

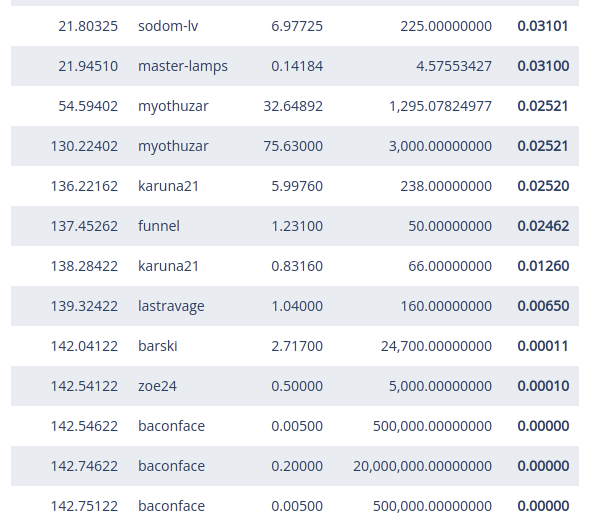

Here is the bottom of the barrel buy orders for popular token ONEUP:

As you can see there is about 20 HIVE within the 0.03 range, then there is some good liquidity, about 110 HIVE at about a 20% discount, then another 10 HIVE of mixed bag ladders, and there is @baconface, ready to buy any amount of these tokens for very little risk, just 0.25 swap.hive in play.

The risk reward for super low buy orders is really good, but not so much for moderate 50% off liquidity. This creates a situation where dumping tokens all at once hits extreme diminishing marginal returns. Sellers must be patient.

Buyers have to be patient too, the same phenomenon happens on the buy side, especially with dividend paying tokens, where if you list the tokens on the market, you miss out on the dividends.

This, again, is one of the reason liquidity pairs in pools is a superior concept. But the same lesson remains:

TRADE IN CHUNKS PEOPLE!

Thank you, this emergency broadcast has ended.

View or trade

BEER.Hey @ecoinstant, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Thanks for sharing such information

wow...wish I had placed an order for 1M LVL at 0.25...

Tell me about it!!

This is a good message to get out, be very careful when you hit the buttons! Always stop for a few seconds and review what you are about to do. A few seconds will not change your life in any way.

All I can say is Ouch.

This almost has me speechless. Thanks for the heads up and I feel for him in this scenario. !PIZZA !hivebits

PIZZA Holders sent $PIZZA tips in this post's comments:

@onewolfe(1/15) tipped @ecoinstant (x1)

You can now send $PIZZA tips in Discord via tip.cc!

It's always important to check liquidity and I wouldn't want to be that person making that swap. I have never used Dswap as I prefer the order books and diesel pools.

Posted Using LeoFinance Beta

Manual trades are superior in many ways, sometime bots just automate silly mistakes.

Really smart advice here and thank you very much for your post!

Me and puppy dog really appreciate your knowledge.

Worth ruminating about

I don't know how anyone accumulates millions of tokens on hive and doesn't understand this. Hive has one of the most illiquid ecosystems I've ever seen.

I wanted to buy 500 !LOLZ a few days ago which is only about $30 but I couldn't have done it without sending the price up 100x. It's dangerous out there.

lolztoken.com

He uses their algrrrythm

Credit: reddit

@ecoinstant, I sent you an $LOLZ on behalf of @imno

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (10/10)

Thank you very much for that valuable info!!!

One question... - How did you get that Buyer/Seller list? Where we could see it? (I can't find it!)

I use this open source tool built by @jjb777

https://jjb777.github.io/hive-engine-classic/?p=market&t=LVL

you can replace LVL with any token in the URL to see this view.

WOW! Thank you so much!

!LUV

Sorry, but still one more question. - How do you get the transaction history as on the first image in your post?

@ana-maria(1/1) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

Given the current emission rate of LUV pushing 500/day, increases to required LUV levels will likely be forthcoming.

OMG! I'm so sorry! Please, disregard my additional question above. I really didn't see that the history is right below.

Sorry for bothering you for nothing, and thank you very much again!

Thank you for confirming!

Wow, that is painful. Thank you for bringing this to my attention.

Buyer or seller beware!