pHBD-USDC Pool VS competitor StableCoins Platforms

A few days ago, PolyCub launched the newest and most anticipated pool on its DEFI platform: pHBD/USDC liquidity Pool:

pHBD-USDC is Now Live! | HBD is About to Get a $5,000,000 Liquidity Pool

So I've been curious about where this pair stands among other well-know StableCoins DEFI Vaults competitors! so let's get right into it!

.png)

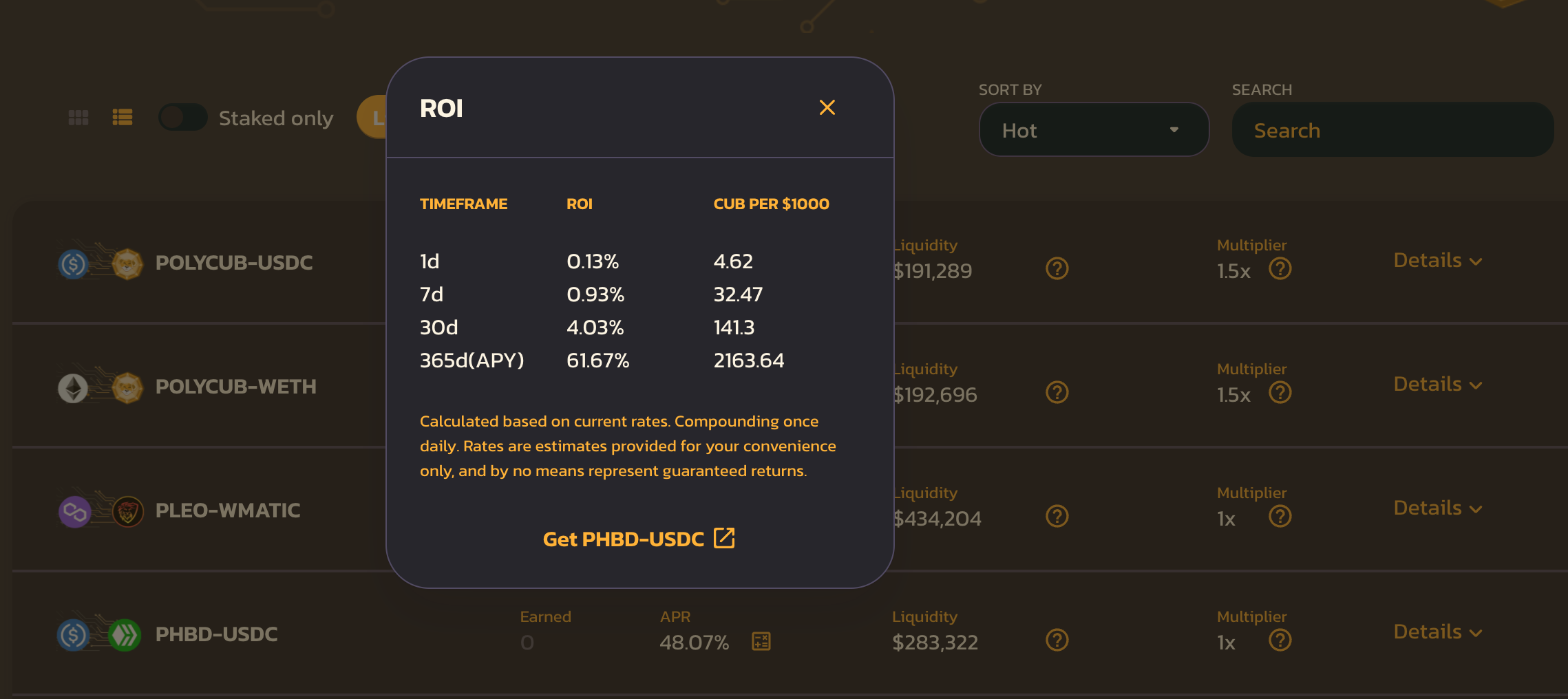

pHBD/UDSC pool

What makes this pool special is the pair composition of 2 Stable coins which leads to little to no impermanent loss in addition to other advantages:

- 48% APR and 60% APY are massive rewards for a stable coin liquidity pair!

- Rewards are in PolyCub, PCub price after is stabilising at 30 cents range and most likely will go up in the future => even higher APR

- Zero Deposit Fees on this pair

- APR can be adjusted through PolyCub Governance

Source

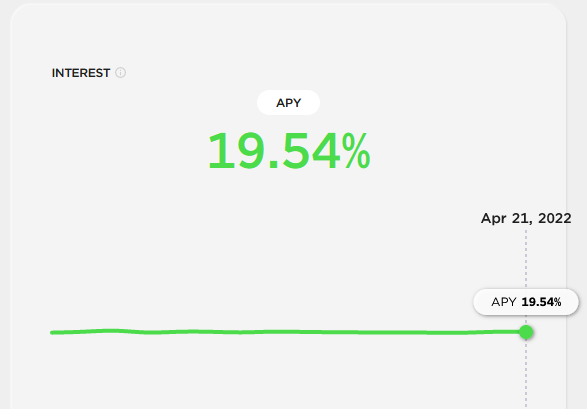

Anchor Protocol

Anchor protocol is a DEFI lending platform based on Terra blockchain and allowing investors to Stake UST for 19.54% APY. The deposited UST is used for collateralized loans and generate profits from the borrow APR.

This protocol was one of the reasons for the increasing demand on the governance Token and current TVL is at a whopping $19,18 Billion! Let's hope the same will happen for HBD/HIVE/POLYCUB.

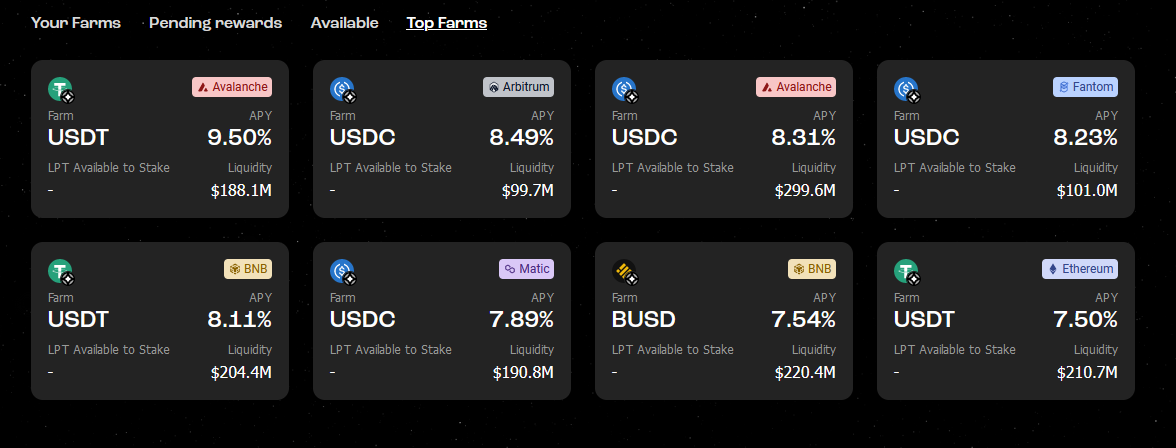

Stargate Finance

A platform that allows a cross-chain bridge for stable coins in a couple of clicks on an eye-catching UI with a $2 Billion in TVL. its popularity came from the 20% APY offer for staking USDT/USDC/BUSD from different chains including Polygon, Ethereum, BSC and Fantom.

For the time being, APY for farming are currently at 10%-8% paid in STG Token.

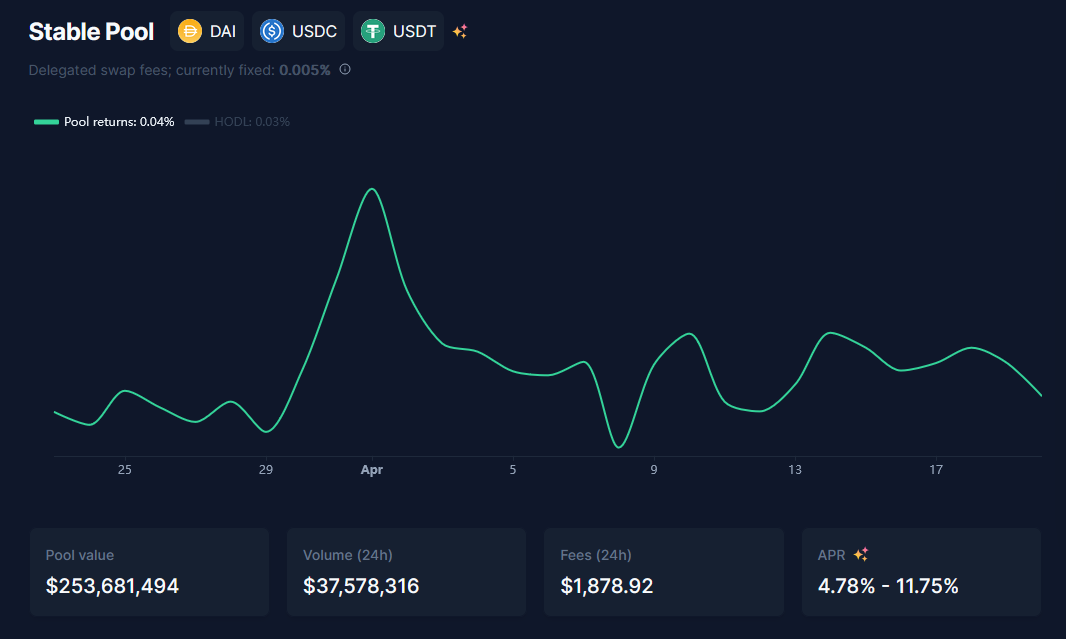

Balancer

One of the top AMM DEFI on the ethereum blockchain with $3.45 billion in TVL. You can provide liquidity not only for stable coins but in many other assets too.

Speaking of the stable pool, the APR is at 4.8%-11.78% paid in BAL Token

Keep in mind that you won't need to provide all these assets to provide liquidity on this pool, depositing only a single asset is enough to earn APR from the pool.

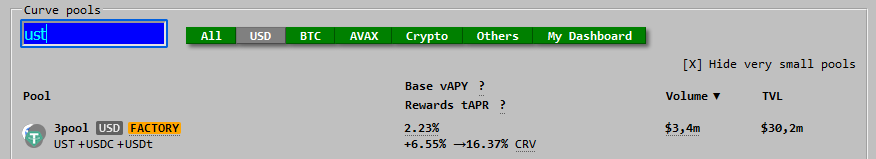

Curve

You can't speak of stable coins without mentionning Curve. It's the first AMM that provides swapping between stable coins for extremely low fees and slippage and keeps expanding to multiple blockchains from Ethereum to Harmony, Fantom and Optimism.. holding a TVL at $20.4 Billion.

However the APR is not that attractive compared to the vaults mentionned eralier.

The most lucrative stable coins pool can be found on Avalanche: 3pool UST/USDC/USDT paying at to 16% APR in CRV token

Conclusion

| Vault | APR | APY |

|---|---|---|

| PolyCub pHBD/USDC | 48% | 60% |

| Anhor Protocol | - | 19.54% |

| Stargate USDT | - | 9.5% |

| Balancer Stable Pair | 11.78% | - |

| Curve Avalanche 3Pool | 16% | - |

As you can see, the pHBD/USDC pool APR is by far higher than it's well-known competitor and 3x more than the closest platform in term of APY.

Keep in mind the the APR can vary depending on the total liquidity deposited and the price of PolyCub in addition to its emission rate.

PS: Don't miss the chance to win 100 HBD by participating in the writing contest

Posted Using LeoFinance Beta

https://twitter.com/FinanceLeo/status/1517357989639954432

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The pHBD-USDC pool has massive potential. HBD native has massive potential as well.

To unlock that potential, we need liquidity to enter the pHBD-USDC pool. Whales need both on-ramp and off-ramp liquidity and pHBD is the perfect balance to achieve that.

Through POLYCUB governance, I expect a lot of yield to get directed to this pHBD-USDC pool. One day soon, Hive whales will catch on that the best way they can build Hive is by adding liquidity to this pool

Posted Using LeoFinance Beta

That's for sure, more liquidity needs to be provided! As I was checking there is still a significant slippage when trying to swap $1000 which the whales doesn't want.

Hopefully liquidity will pick up after additional yield will be allocated for the Stable Pair!

And a great pleasure finding my post shared on the official LeoFinance Twitter account!

Congratulations @cantfoldaces! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 8000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!

I'd honestly prefer the Balancer, due to the fact that I won't need to provide all assets in order to provide liquidity to the pool, and depositing just a single asset in order to earn APR from the pool, is fabulous.

Posted Using LeoFinance Beta

Agree that's pretty cool to be able to earn rewards for providing a single asset thus no impermanent loss for you! But then I generally avoid Ethereum network because of the Tx fees.