Staying DEBT-FREE after December

If there is one month where budgeting could be tricky then it’s the month of December. I think this is the major reason why people start the new year without any money at all. Most people say January is one month where you have no money, this is solely because we tend to spend without making a budget in December. December is a month with so many activities which require money, so we spend without looking back.

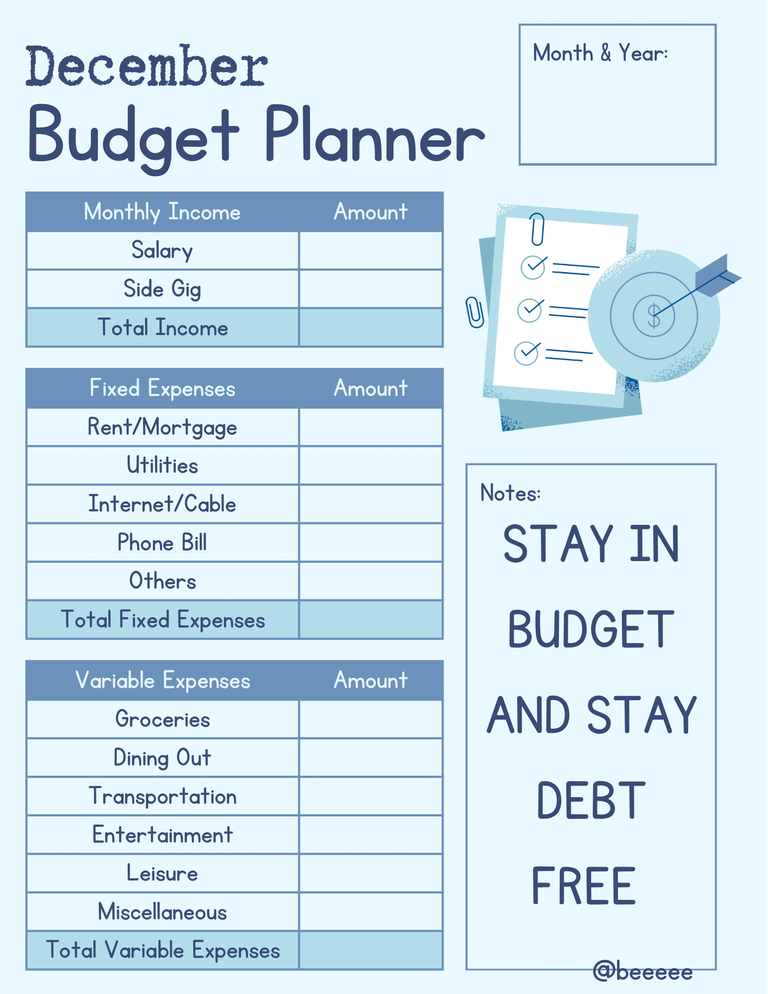

Budgeting involves planning and managing your money. If there is one thing budgeting helps with is making sure we are spending within our means to avoid financial debt. It helps us manage our finances and save for future purposes.

It might be difficult to avoid certain things that would require you to spend a lot since it’s the Christmas season, but having financial self-control will go a long way in helping.

Design by me using Canva

MAKE A BUDGET:

If there is something I learned from Economics is Opportunity Cost. Opportunity cost helps reduce certain costs. Getting a proper insight into opportunity cost would help you make important decisions that would aid in making a budget. You have a certain amount of money kept aside for your December expenses, make a list, consider the value of those things, and then make a decision to rule out those that are of less value.

When you Budget you consider the opportunity cost of your expenses, the one which brings you more value, through this means you tend to stay in line with your financial goals and then save a lot during the festive season. For instance, if you need to decide between buying food items or paying for a concert ticket, you should be aware that buying food items is of more value to you, so you rule out getting the ticket that way you try not to be in debt.

TAKE ADVANTAGE OF SALES:

It is a common thing that most people have December sales, where you have discounts on clothes, jewelry, shoes, and so many items. If there is one way to ease our spending for December then taking advantage of sales would be very important as things happen to be expensive during this month.

Budgeting in December is something we should be prepared for before December. There are so many Black Friday sales in November and we could buy things during that period to help us save a lot before December. This is one great way to ease ourselves from much burden during this period.

December is all about having fun and staying within your financial means.

KEEP TRACK OF YOUR EXPENSES:

One thing that is likely to happen during December is impulse buying and that is one thing to avoid. Avoid buying things that are not included in your budget.

From time to time, make a review of things you have spent and try to stay on track with your spending. If there is one month you would see things that would catch your attention easily then it is December. If you didn’t plan for an outing on your budget then don’t attend, this way we stay within our budget and we stay happy.

There is nothing as great as not being in debt. You would gain nothing from having a fun December and having a January filled with regrets and debts.

All Images used are mine except otherwise stated

Thanks for stopping by💕

Cheers 🥂

I love that you included the budget chart image. I would LOVE to see document template creators on hive.

Posted using Neoxian City

Oh, thank you so much for this nice words.

Your emphasis on avoiding impulse buying and keeping track of expenses resonates well with maintaining financial control during the holiday season. Wise words on enjoying a fun December without the burden of regrets and debts in January. Cheers to a financially savvy festive season!

This is our goal this December, Hopefully we have fun and stay free from debts

It's easy to just overspend out of excitement this period. But it's very important that we make lists and discipline ourselves enough to stick to them. The days run fast and soon it becomes January. World make no sense that one has to start from point zero especially realizing that there's usually lots of bills to cater for in the new month.

You are right, this is the month of excitement and we just have to be careful with how we spend so as not to go broke in January.

Thank you for stopping by ☺️

This is aa well strategies plan on how to stay in line with our budget and not go broke by January.

I guess I'll need to take keeping track of my expenses into account because I hardly do that.

Well same here but as I kept on writing I said to myself this would be the best method.

Thank you so much for stopping by☺️

I Really Agree with you on How tricky Spending during December can Be,

Honestly Am even Sceptical about the budget I made for myself this December,

Crazy expenses do come around,

May God Save me, as I work Strictly on Budget 😂😂🎶

Amen😂😂😂 We all pray to be on track with the whole spending stuff.

I really like that budget and sales part. Budgeting helps to keep us debt free. No matter how long the festivities last, we would sooner or later go back to work. Life should be progressive not backwards.

#dreemeeforlife

You’re right, life should be progressive. Thank you for stopping by

You're welcome