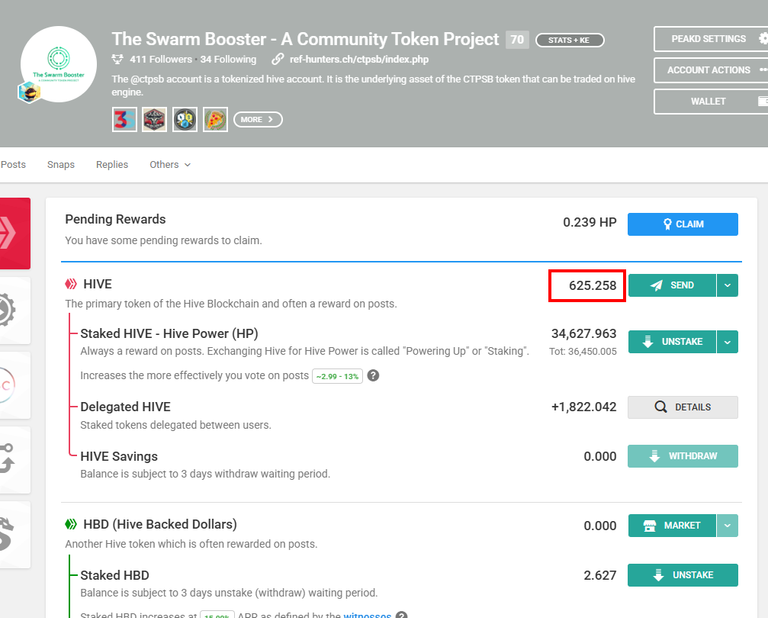

Over 600 Hive as reserves

In last weeks post, we spoke about the utility to build some reserves for CTPSB by unstaking and selling LEO tokens. The purpose of these reserves is to keep the apr of the CTPSB token at 15%, even if the weekly return is lower.

At the moment we are 2 third through the unstaking and selling process of Leo tokens. Thanks to these sales, we managed to increase our reserves from around 380 Hive to over 600 Hive. This is a nice puffer that we can use in the future.

Where can I find these reserves?

The reserves are the liquid hive tokens on the @ctpsb account.

How are the reserves used?

Let's say the project doesn't manage to generate a 15% return one week. Maybe there was no post payout or maybe the apr for curation was lower. In this case, we simply take some Hive from the reserves and power it up to push the apr to 15%. In weeks, where we are way above 15%, we take some of the liquid post rewards and add them to the reserves. Thanks to this puffer, we manage to keep the APR stable over time, even if curation apr on hive is decreasing.

Here the numbers of this week

| Assets | Amount | Increase over last week |

|---|---|---|

| Hive Power | 34627 | +90 |

| Tokens in circulation | 9237 | -2 |

| Burnt tokens | 2261 | +2 |

| Token value | 3.749 | +0.011 |

| APR | 15.0% | -0.0% |

Learn more about the CTP Swarm Booster:

A project run by @liotes

thanks for the update. It's good to have reserves to adjust and maintain the apr.

keep up the good work.

!BBH

!ALIVE

!PIZZA

Thanks!

Thanks for the news.

!BBH

!STRIDE

You are welcome!

I am guessing that buffer is to maintain the CTPSB price through a buywall right?

Not really. It's rather available money that we can use to push APR up. Let's say curation rewards and organic growth in one week was only 14%. We can use this money to power up some more HP and the token value will go to 15% like that. It's a way to keep growth stable and compensate for weeks without post payouts for example.

Great news. Thanks for the update.

Thanks for stopping by!

$PIZZA slices delivered:

@imfarhad(1/5) tipped @ctpsb

Come get MOONed!

Congratulations @ctpsb! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking