🚀 Introducing the DLMMQB DCA Bot - Hive/HBD Dollar-Cost-Averaging Strategy on the internal market! 🐂 🧸

Happy Labor Day Bot Release!

While many are kicking back to celebrate Labor Day, my mind has been on one thing: launching a new project that has consumed my time and energy for the past 2 months. It’s been a while since I've posted about Hive.trading, but that's only because I've been a busy bee building a new, special trading bot for the HIVE blockchain. All that hard work has finally paid off today!

It all started a year ago when my friend, @dlmmqb, shared an idea for a simple DCA bot. I had to put his request on the back burner while I worked on other bots. After releasing five projects, including the Hive-Engine market maker, DLMMQB showed up again, still committed to his idea. With a little more time on my hands, I decided to finally take on the project with him.

This bot is a true collaboration. DLMMQB provided the initial vision and logic, and I built it out. We started simple, but we couldn't stop coming up with new features, settings, and modes. Today, the DLMMQB DCA Bot is the most advanced bot on Hive.trading. It's designed with three main settings: a Bull Mode, a Bear Mode, and an optional AUTO AI Mode that intelligently switches between the two based on the HIVE market trend.

What is the DCA Bot?

The DLMMQB DCA Bot is designed to help traders accumulate or distribute HIVE using systematic dollar-cost-averaging. It automatically executes trades based on price movement, user-defined percentages, and advanced safety logic.

It runs 24/7, randomly iterates through user list with bag randomization once every 4.20 minutes, integrates directly with the internal Hive DEX, and stores every trade in MongoDB for running all our calculations.

For smooth operation, start with at least 10 HBD or 50 HIVE. For best results, aim for 20+ HBD or 100+ HIVE. Smaller balances may technically work, but you’ll often hit dust thresholds and see skipped trades.

Key Features

✅ AI-assisted mode flips (auto switch between Bull & Bear if enabled)

✅ BULL / BEAR strategies:

Bull Mode: Accumulate HIVE on dips, sell into single or multiple profit-up targets.

Bear Mode: Short HIVE on rallies, cover into single or multiple profit-down targets.

✅ Dynamic reseeding after liquidations or completed targets

✅ FIFO-lot breakeven tracking (resets anchors properly)

✅ Auto-heal if target % values change or drift

✅ Slippage & depth-aware chunking (avoids thin orderbook traps)

✅ Dust protection (skips tiny trades below thresholds)

✅ MongoDB logging → everything queryable by account & botType (this is more for me now but plan to use this for users in the future)

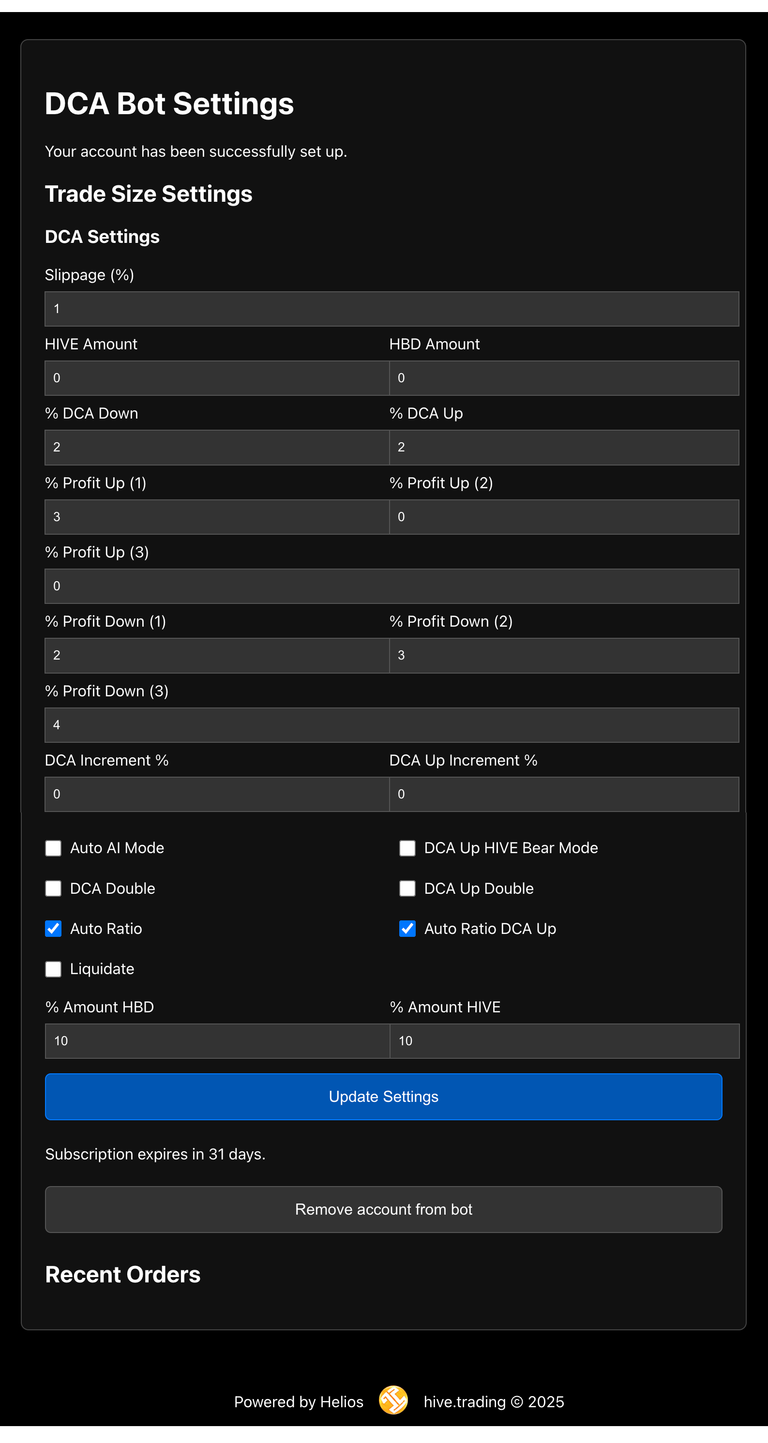

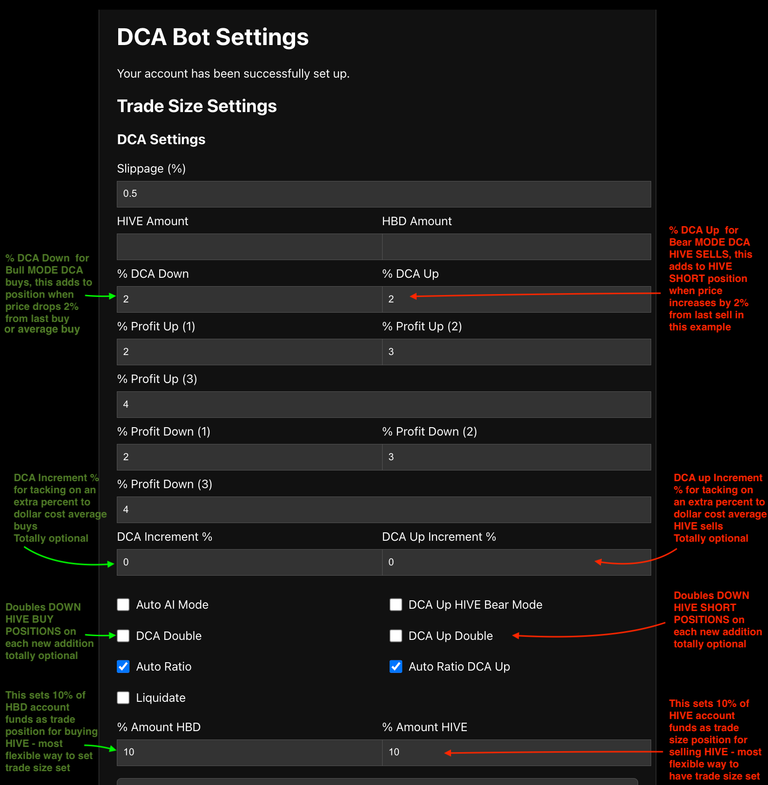

Explanation of Settings

Setting slippage to zero is allowed, feel free to test your strategy with no slippage, but all trade executions won't be guaranteed. Here's more information about the slippage setting below:

slippage → % tolerance for trades (default 1%)

Feel free to experiment with other various slippage settings below:

"slippage": "1" // 1.00%

"slippage": "0.5" // 0.50%

"slippage": ".5" // 0.50%

"slippage": "0.05" // 0.05%

"slippage": 0.25 // 0.25%

Auto AI Mode → let AI flip between Bull/Bear based on AI signals

HIVE AMOUNT / HBD AMOUNT → static trade sizes if auto_ratio = false

% DCA DOWN (BULL MODE) / % DCA UP (BEAR MODE) → % thresholds for additional buys/sells

% Profit UP (1–3) → staggered profit targets in Bull mode

% Profit Down (1–3) → staggered cover targets in Bear mode

DCA Increment % (BULL) / DCA Up Increment % (BEAR) → increase trade size by additional percent on each step

DCA DOUBLE (BULL) / DCA Up Double (BEAR) → double trade size on each step

Auto Ratio (BULL) / Auto Ratio DCA Up (BEAR) → size trades as % of balance instead of fixed amounts

pct_amount_hbd / pct_amount_hive → % of balance to risk (with auto_ratio) When used on static trade settings auto ratio will target HBD setting and keep HIVE and HBD balanced to HBD trade size! Dynamically keeps position size the same regardless of exchange rate between HIVE and HBD.

DCA Up HIVE Bear Mode → force Bear shorting mode manually by setting to true or false with checkbox

How It Works (Example)

Bull Mode:

You set % DCA DOWN = 2.

Bot will do an initial BUY

If price drops 2% from your last buy, the bot buys again to Dollar Cost Average more HIVE since you are bullish and into stacking HIVE.

You can then set up to 3 profit targets (configurable) to sell portions as price rises. One target the bot sells 100% at T1, If 2 Targets then bot sells 60/40 T1 & T2, Three targets the bot sells 50/40/10 % of position at T1 T2 & T3.

Bear Mode:

You set % DCA UP = 2.

Bot will do an initial HIVE SELL

If price rallies 2% above your last sell, the bot shorts more HIVE.

It then sets up to 3 cover targets to buy back cheaper later. It uses same target strategy spits as above...100% 60/40% 50/40/10% Minimum 1 target is required for both BULL and or BEAR mode.

NOTE: You can't fill in too many targets or settings, it's best to fill them all in, especially when checking auto AI mode, so bot is ready for anything. All settings that are not needed or in use will be ignored.

Auto AI Mode:

Bot checks the AI's latest directional call for BULL/BEAR. These signals don't change very often and are pretty stable not leading to chop, they follow the daily trend. Trend changes tend to happen once a week, or once every two weeks, but that ultimately depends on the price trends of HIVE. Trends are based on the Ai's interpretation of SMA moving averages, fibonacci rsi etc.

If AI says flip → bot executes a one-time INITIAL trade in the new direction, then continues normal DCA.

liquidate → close all positions and reset (auto reseed next loop) When you set liquidate to true bot will sell everything and wait until you flip it back to false. I.E. if you are in BULL mode which buys HIVE with HBD and you set Liquidate to true it will SELL all your HIVE. Vice versa if you are in BEAR mode, set to liquidate, it will sell all your HBD. This sounds backwards, but it is intuitive, a bear trader is shorting HIVE for HBD, when he wants out it means he wants to flip back to HIVE since he is feeling the squeeze of not having HIVE. This setting is for someone that wants to switch / flip modes manually at any time, or just wants to take a break.

NOTE: If you are planning on withdrawing funds once you've begun a loop and are still in mid loop, it's advised to set liquidate to true since this clears out all old targets and resets bot for whenever you want to begin trading again with different funding sizes.

Notes on setting targets:

In the settings above I show percents as whole numbers for simplicity, like 1% 2% etc. however settings as small as 0.0001 or 0.01% will be accepted too. i.e. Percent Profit Down: "0.0001" → target is valid, & will trigger almost immediately if price moves even the tiniest fraction. So the bot is capable of doing small micro trades too if desired.

Strategy Building Requirements

From the way your DCA bot handles dust thresholds and non-FOK orders (the bot cancels or skips if order sizes fall under exchange minimums), a “safe minimum” balance should:

Clear dust checks (dustUp, dustDown) so trades aren’t skipped. Your logs show dust values on the order of 0.002–0.02 HIVE, so you don’t want trades rounding down to that scale.

Satisfy the Hive internal market's minimum trade amounts, which are typically ~0.001 HIVE or HBD. Anything smaller won’t post.

Leave room for splits: because your bot divides entry positions into multiple targets (T1, T2, T3), starting too small means each split may be below the tradable threshold.

Allow slippage safety (1% default). If balances are too tiny, slippage protection (if set) can block orders.

Suggested safe starting balances

If starting in HBD (bear mode):

At least 10 HBD so that the bot can buy multiple HIVE increments and still clear dust thresholds. With 3–4 target splits, each leg would still be ≥2–3 HBD worth.If starting in HIVE (bull mode):

At least 50 HIVE so that DCA-down or profit-up legs aren’t reduced to dust. At today’s ~0.20 HBD/HIVE, this is about 10 HBD worth — symmetric with the HBD case.Recommended sweet spot: 20–30 HBD or 100–150 HIVE.

This ensures each DCA step is comfortably above the exchange minimums and makes the strategy “feel alive” (multiple fills, not just one).Absolute floor:

~5 HBD or ~25 HIVE will technically run, but you may see skipped targets.

Below that, users will mostly burn subscription without seeing meaningful trades.

Data & ROI Tracking

All trades saved in OrderHistory

Deposits/withdrawals saved in DepositHistory

Balance snapshots every hour in BalanceSnapshots needed to calculate ROI

ROI calculated with Modified Dietz method (time-weighted)

ROI to be available on frontend soon!

Why It Matters

Emotion-free trading: DCA works even in sideways or choppy markets

Flexibility: choose between fixed amounts or % of balance

Transparency: all trades visible via hive frontends + ROI dashboard (coming soon)

Safety: slippage, dust limits, reseeding logic prevent runaway loops!

Next Steps

Take it for a live test spin on https://hive.trading The bot already handles:

✅ Live AI suggestions (or fallback to stored mode)

✅ Dynamic userlist (Instantly to add/remove accounts, no more wait time, new accounts and settings go live on very next bot run)

✅ MongoDB logging for performance review

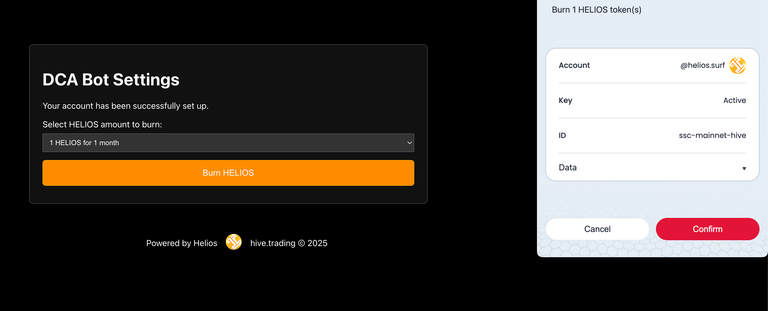

The DLMMQB DCA bot is now open for public subscription via HELIOS token burns. 🔥

Final Thoughts and Guidelines

If you're still on the fence about setting up your bot, here are a few final thoughts to help you get started.

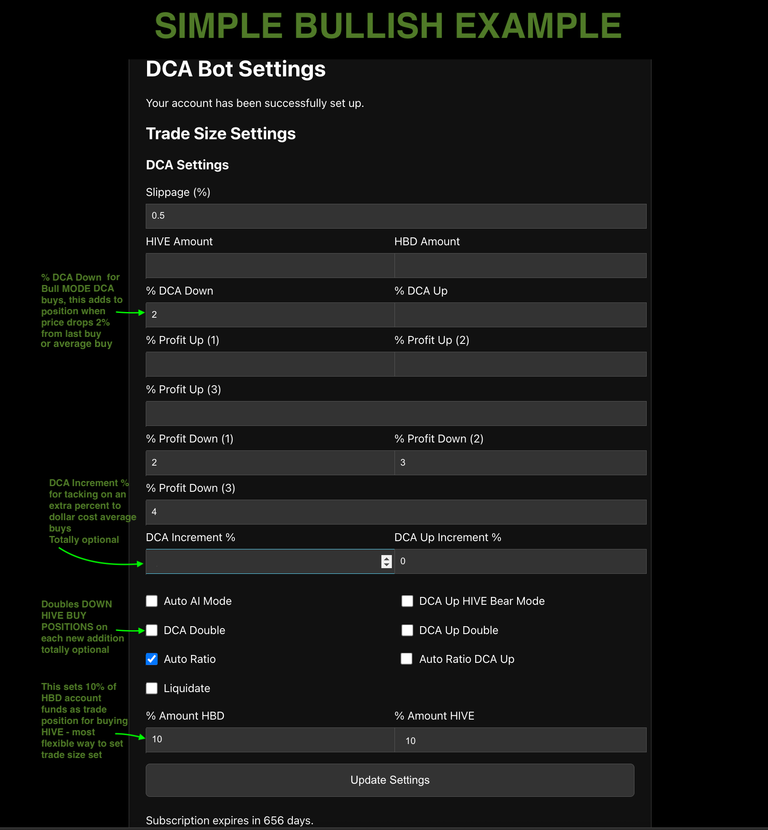

Both the Bull Mode and Bear Mode can be profitable in any market condition; the key is that one mode may outperform the other when market trends align with its strategy. If you're a long-term bull who believes HIVE is on a permanent upward trajectory, simply run the bot in Bull Mode. It's the default setting, so you don't even need to check any boxes or use the Auto Ai Mode.

Here's some food for thought on strategy:

- If you have a lot of liquid HIVE and no HBD, you'll need to start with the Bear Mode or the Auto Ai Mode (when the market is bearish).

- Conversely, if you're holding a lot of HBD with little or no HIVE, you'll definitely want to begin with the Bull Mode (or let the Auto Ai Mode run until a bullish trend emerges).

Don't let the names Bull Mode and Bear Mode fool you. All the bot does is dollar-cost average either HIVE or HBD, taking profits at preset targets along the way. Both coins have their own strengths, and the modes are simply named to align with the general direction of HIVE. This terminology helps with programming and strategy, so don't be intimidated by it.

If you're serious about taking full advantage of this bot, I suggest running all three strategies on separate accounts—one for Bull Mode, one for Bear Mode, and one for Auto Ai Mode. By doing so, you'll be set up to make money no matter which way HIVE is trending.

Important Settings Examples with descriptions

These are typical settings that will work great in all scenarios, whether you are bullish, bearish, or select auto mode this covers all the bases.

Simple Bullish Example

Simple Bearish Example

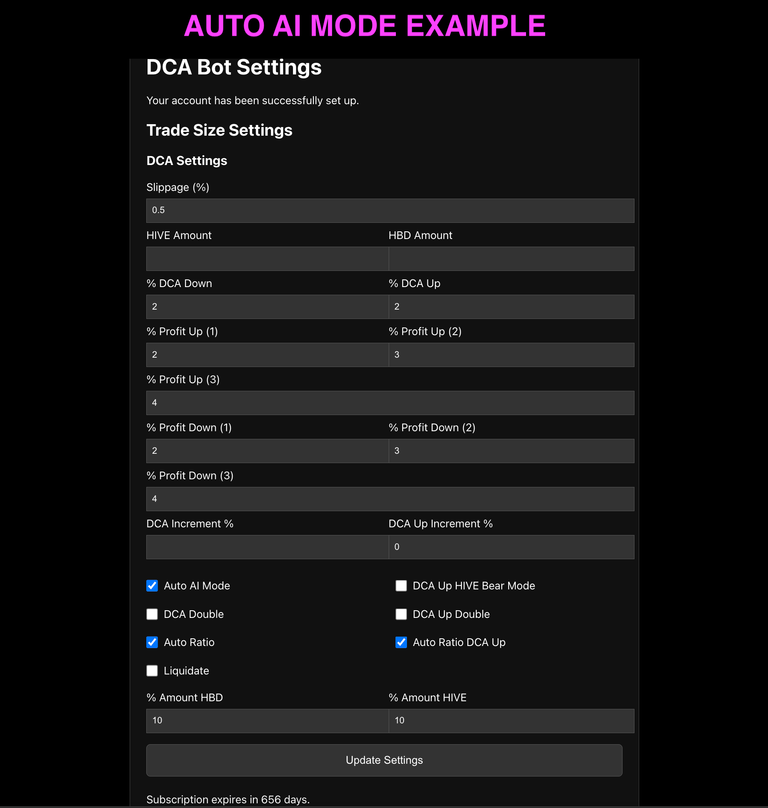

AUTO AI MODE EXAMPLE

This Labor Day, while everyone else is taking a break, your bot can be hard at work for you. Happy Labor Day!

📥 Get Started

Log into https://hive.trading

I almost don't want to give this any attention so I can keep it for myself !LOLZ but I will be testing it out later this week and am in the process of setting up a dedicated account. Looking forward to see how well it works !PIMP !UNI

lolztoken.com

Steal her blanket.

Credit: reddit

@coininstant, I sent you an $LOLZ on behalf of enginewitty

(1/1)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

I tested this technology for over a month and felt it’s far too advanced for such an affordable subscription. However, the more bots we activate, the healthier the market becomes, allowing us to push prices higher.

For example, suppose you start with 100 HBD and buy on every dip. As the market grows, your 100 HBD becomes 110 HBD, and your trade size increases from 10 HBD to 11 HBD. Let this strategy run for a few months, and you’ll likely see bullish momentum return.

To drive the market upward and outpace dumpers, we need more people using this technology. Increased adoption will boost the value of our hive, benefiting everyone with significant HP holdings as prices rise.

What is the cost to access the bot? Like 1 HELIOS like the market maker?

View more

really awesome! :) I was just thinking, I wish their was a bot to Autotrader the HIVE/HBD for me.. :P

and wa la! thanks!!

Thanks! 🙏

😊👍

I suggest running all three strategies on separate accounts???

three Hive accounts?

Yes

You should run 3 different strategies on 3 different accounts.

Also, don't try any automation on your main account @cositav (it will be risky).

Okay...okay... I understand. Anyway, I'm getting into the nitty-gritty. And if anything comes up, I'll let you know first. Thanks.

I think I understand, but I'll double-check. Those profits look very tempting. Thanks @dlmmqb

It's very important information, but a bit overwhelming for those of us who aren't familiar with it. I'll study it.

Take it little by little, once you decide on your strategy there is minimal setup, and after that it becomes a stream of passive income.

Great work 👍

!PIZZA

I like that the bot ignores the extra side and just pulls the settings it needs, so filling both bullish and bearish won’t trip it up. The BULL vs BEAR contrast makes the logic easier to reason about. In AI Auto mode, how quickly can it switch regimes, and is there a way to tame whipsaws?

It can switch regimes instantly once the new signal is detected, so pretty much on the very next round after the signal. The signals are stable so no whipsaws, or way less since the ai is looking at the larger daily trend. Usually trends continue so most of the time there will be ample time to make money after a switch. For instance right now it's been bearish for a while and will continue to be bearish until the price can prove otherwise. Eventually we'll break out and flip though and that will be a good thing. On average I haven't been seeing signal changes that often, the shorter trends last about 1-2 weeks, so not so much whipsaw action. The other good part is both the bull strategy and bear strategy can work in either trend. On a major downtrend the bullish mode can be buying massive dips, and taking advantage of dead cat bounces along the way, and vice versa.

That helps a lot. When Auto flips, do you cancel any open ladder orders and reseed for the new mode, or let the old ones finish while placing a new set? Is there any cooldown or hysteresis so a couple of borderline days don’t cause back-to-back flips? Also curious how you handle slippage and dust on a breakout at the switch, and if the Mongo logs record regime timestamps so we can line up ROI around pivots.

View more

very cool!

!pimp

Everyone needs to know about these types of trading strategies and this is an educational post and hopefully we will all benefit from such dollar cost averaging if we can apply it correctly. Thank you.

Woo, incredible tool, thanks for giving us recommended and minimum amounts to start trading, thanks

Wow that's sounds great contribution on hive Blockchain. DLMMQB is a man of wisdom and principle he know what is the need of hour.

I'm glad to know about the automate option in trading bot because I have time management issue with my hectic routine..

More Power To You Mate. Wish you great progress ahead. I'm proud of you boss.

Thanks for your kind words!

REMEMBER: USE ALT ACCOUNT FOR TRADING!

Noted ☺️

alternative account means creating another account to be able to participate and do this type of operations?

Yes, this bot operation will take active key permissions

So it can mess up with financial side of that account. You don't wanna do that with @cositav account. Try @cositav.trader maybe? I can give u new accounts if u want.

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited.

$WINE

@tipu curate

Upvoted 👌 (Mana: 40/50) Liquid rewards.

$PIZZA slices delivered:

@wildlifelover(3/15) tipped @coininstant

Come get MOONed!

Congratulations @coininstant! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

I'm curious how the bot is performing since Sept to now. Has anyone who uses the bot has published the outcome of their trading?