SBI Crypto: The New Leader in Bitcoin Cash Mining

SBI Holdings, a banking behemoth and Japan's biggest broker announced this September the selection of five cryptocurrencies that would help it expand in crypto investing.

Lead Image Source: Unsplash, by Deon Hua (modified)

SBI included Bitcoin Cash as an asset offered to Japanese investors seeking crypto exposure, also including four more cryptocurrencies in its crypto fund. (read more: Bitcoin Cash was selected by SBI Bank for the First Crypto Fund In Japan).

SBI Crypto, a subsidy of SBI Holdings, has been operating a cryptocurrency mining business since 2017 and mines Bitcoin Cash, BTC, and BSV.

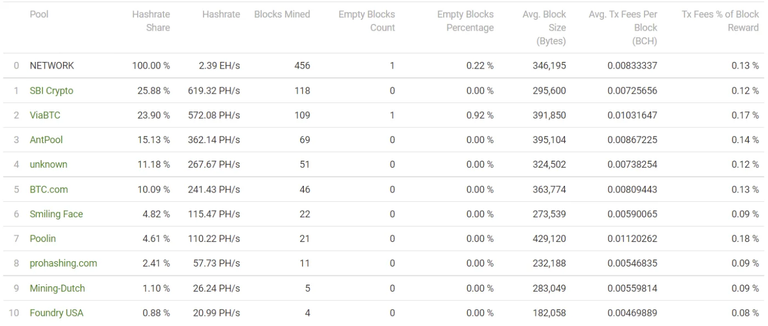

The SBI Crypto pool provides 1% of the total BTC hashrate (that reaches about two Exahash of computing power currently), and it has also increased its hashrate contribution to Bitcoin Cash recently.

SBIcrypto is a miner that capitalized on the Chinese mining crackdown that started in May, this year, and since then it has vastly expanded its mining operations. SBIcrypto launched its mining pool publicly in March 2021, and it has more than doubled its hash rate since then. It was self-mining until that point.

An old player with experience in the cryptocurrency mining field that starts growing in significance lately.

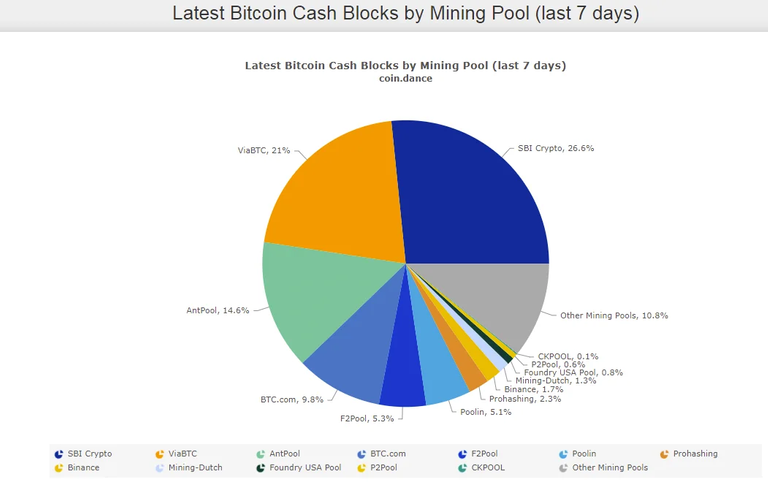

SBI Crypto is the current Leading BCH mining pool

Source: Coin Dance

On a first look, the mining map for the last seven days gives a clear picture of increased mining decentralization. in previous years, BTC had a way worse distribution of hashrate between different mining pools, and Bitmain-related pools used to exceed 50% of hashpower.

Source: btc.com

SBI Crypto is producing 619 Petahash of computing power for the Bitcoin Cash network and has mined 25% of the blocks in the last 7 days.

While SBIcrypto is mining BTC, Bitcoin Cash, and BSV, since 2017, it did not have a large share of the hashpower in BTC or BCH before. Lately, though, we watch a keen interest in mining Bitcoin Cash.

We can guess the reason since Bitcoin Cash has been slightly more profitable on average, but perhaps there is also sentiment towards increasing the share of SBI Holdings in Bitcoin Cash as an asset.

Since SBI has a profitable mining department, it is likely it recognized the future potential of Bitcoin Cash and pursues a strategic share in BCH mining.

We can suspect that SBI is using its crypto department to mine and hold BCH since it is exploring and offering cryptocurrency investments to its customers.

Bitcoin Cash Is Secure and Reliable

In the past, the BTC narrative machine was often leaking fake news of Bitcoin Cash being on the verge of a 51% attack, something that wasn’t true. Attempts were made, of course, as with all networks, but were always unsuccessful.

Hayden Otto, (in this post at bitcoinbch.com, (2020)) explains why a 51% attack on the Bitcoin Cash network is highly improbable.

An important date was May 15, 2019, as Hayden Otto writes:

The hard fork upgrade introduced the ability to retrieve Bitcoin Cash sent to BTC SegWit addresses.

After the upgrade, an unknown miner attempted to claim over 3000 BCH which were previously stuck in the SegWit addresses. In response, honest miners BTC.Top and BTC.com were able to orphan the unknown miners blocks and returned the Bitcoin Cash to their intended recipients.

Miners have a natural incentive to protect what they’re invested in; as long as the value of Bitcoin Cash continues to grow, miners will continue to protect it.

Source: Bitcoin Cash 51% Attack Claims are Blatant Fake News

We often read comments even from individuals that are supposed to have acquired vast knowledge in the cryptocurrency field, claiming Bitcoin Cash is susceptible to a 51% attack. Can’t be more wrong than that.

Bitcoin Cash has the second-highest hashrate of all cryptocurrencies.

If Bitcoin Cash was ever in trouble, then the same is for all PoW networks. Bitcoin Cash miners are also BTC miners and as businesses, they wouldn’t try to harm the networks that profit them.

The Bitcoin Cash network, since the fork, has always been operational and completely secure. All the blatant fake arguments from the competition have been unfounded and mislead newcomers.

In Conclusion

We watch today, new mining pools like SBI Crypto bring more diversity and increase the decentralization of Bitcoin Cash mining operations. It is another positive sign that enhances the image Bitcoin Cash and increases network confidence for all participants and investors.

The Chinese crackdown on cryptocurrency mining had a diverse effect on the industry. Initially, the market reaction was to panic. Although the concentration of mining in one country was always an issue often mentioned by critics. BTC, Bitcoin Cash, Ethereum, and most other proof-of-work-based networks used to be mined mostly in China because of the low energy prices and the whole mining infrastructure industry of ASIC manufacturers.

The Chinese government's decision was always expected and some miners relocated to other countries, while others sold their equipment and stopped their business. Some have gone rogue and the Chinese government is still clamping down the industry until it completely eradicates those remaining.

Bitcoin Cash looks even better with a more diversified hashrate, produced by various pools and having no clear leader. However, the security of Bitcoin Cash is always of paramount importance and the higher hashrate than other blockchains (LTC, Ethereum, etc.) is proof the BCH network security has always been robust.

Originally published at Read.Cash

Writing on the following networks:

Noise Cash - Read Cash - Hive - Medium - Vocal - Minds - Steemit - Den.Social - Publish0x

Follow me on social media:

Don't forget to Subscribe/follow if you enjoyed the content!