Persistence and Reciepts 120525

I needed a new system, one that works for me and my busy life.

I can do this, and you can do it too. Its easy, and it makes a lot of sense to me.

I practiced it all last year, with mixed results, but this year I am doing it.

I keep practicing it and every time I complete the task I feel better.

Knowing, is half the battle. And you can't get to knowing, without truth.

My first theory is, if I spend a Dollar, the Reciept also must be worth at least a Dollar.

How much more, if that reciept is for something expensive like an Air Conditioner?

We think, I need this reciept so I can return it! But not, I need this reciept, as a record of this!

Well, perhaps you do, but we are now letting other systems keep track for us.

Spreadsheets! So quick and convenient! The numbers, they must all add up.

But to what? And am I even involved? Do I know my uhh epida.. what was it... Earnings Before Tax Expenses.. /Googles, "Earnings before tax (EBT) is the amount of profit remaining from total revenue after interest expenses have been deducted but before income taxes are deducted."

No my new system had to work for me, because it had to be something simple I could do.

1 - Every reciept is worth as much as the cost.

I need to value every reciept, where some say 'no thanks' I say 'can I get two copies please?'

and by doing this, I know that I can do the Daily Reciept tracking that I need to do.

2 - Life gets busy, catch up every 5 days.

Make sure that you are caught up by double recording your expenses.

( This is what BTC solves, but it's a good practice to do it anyways.)

3 - Record the date, time, business, summary

So that I know where the heck all my money is going!! I work too hard to feel broke. Every purchase you make is a vote in the system you live in. If you dont like a company, don't buy their product.

4 - Balance the Budget and get out of debt!

Find out exactly how far behind you are, then compare that with the expenses you have tracked and see where you went wrong! It is only a mistake to keep the same habits for no good reason.

5 - Build an Emergency fund of savings

Once you see where all your money is going, you can see how much extra money you really have to budget! Save 10% of every paycheck to build up funds for when you need it most.

6 - Invest 10% (Buy Bitcoin)

But there are also other ways to invest and you can do your own research. 20% is a good number, but some friends suggest 30% is a more aggressive investing target when you have a goal.

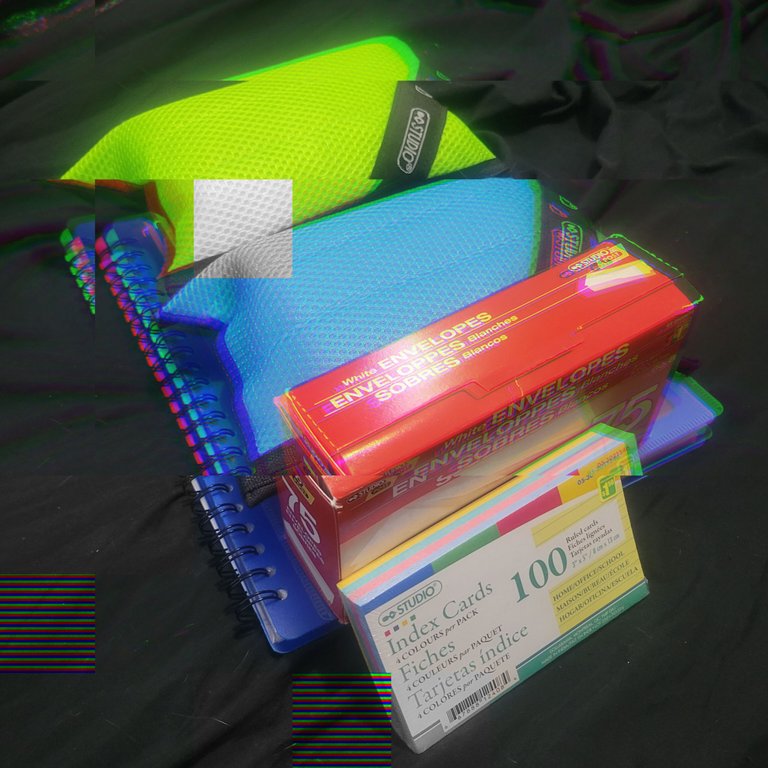

5:34 I begin by gathering my tools, for the job. I get my Daily Transaction binders, my monthly receipt envelope (pencil case zipper pouches) and my index cards, pen and paper clips, and then I find my wallet and pull all the recent reciepts out and look at each one. I ensure they are unfolded and organized by time, then I start writing the important information out on the Day's index card.

6:07 - I have completed 1/3 Index cards for the days that I am recording, every day that I don't spend any money is considered profit, and I am going to have to double check that I didn't spend any money for 4 days in a row! Wow score!! I have all the days tx on the index card, next I double record it onto the daily tracking sheet and that way I know it is accurate and can check both for reference.

6:28 - I have completed 2/3 Index cards for the days I am recording, and I also found some double entries I missed for 2 past days. I have just one day left, only 2 receipts to go. I've been feeling tense all day so I may be taking my sweet time, but I am detailing my process here. Do it faster yourself!

6:48 - Alright, it's done. I have caught up. Every single Transaction I have made this year, has been recorded twice. In my books and on index cards, all zipped up and organized now. I feel a lot better having done this, now there's no mystery about it. I know exactly what I spent.

Aren't there apps you can use to take photos of reciepts to keep a record for tax reasons.

https://play.google.com/store/apps/details?id=com.easyexpense&hl=en_GB

Yep there definitely are, but I am doing it manually so when society collapses I am not like, "ahhh my tax app!"

some have an offline mode and you can take a note of a whole day as reference

View more