Taking a look at our wallets - Part 2 : Token

As we approach twelve months since re-launching the LBI project, it is probably a good time to check through our wallets and review our progress so far. It's been an interesting year, and the wallet we will look at today is our primary wallet, the @lbi-token account.

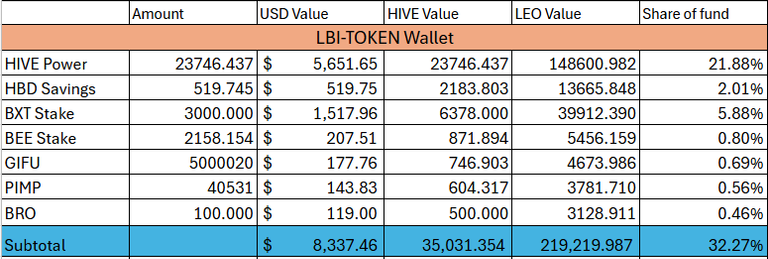

So here is what our token wallet looks like today:

HIVE Power

We are currently grinding our way towards 24000 HP in this wallet. A big chunk of that growth depends on getting some regular content out. We obviously gain 3% from inflation, and a little from curation rewards. But the difference between a good week and a bad one comes down to content payouts. Much of this HP is delegated out, mainly to @empo.voter to earn PWR. We have some HP leases also which are currently bringing in around 1 HIVE per day. I am winding back these as they expire, and moving more delegation into the better paying PWR delegation. This HP represents a bit over 20% of our fund's total value at current prices.

HBD savings

Our HBD balance declined since I took over running LBI. I have sold it off in chunks here and there to fund other investments. To be honest, it is probably time to either bump it back up by taking some profits on other things, or sell it all and go all in on an expected alt-season. My timing with trading is usually crap, so I am hesitant to sell things to early in a potential bull run, but then again, maybe I should set some targets and stick with them. Overall, our HBD is not really enough to contribute significantly to income, but maybe something we should build back up over the second half of this year.

BXT Stake

We built up a decent sized stake in BXT over the first few months after taking over LBI. This has done well for us, giving a nice reliable daily income, and some small value gains also. Our last buy was early May, where the price was just under 2 HIVE each. All our BXT was bought below 2, and if I had to guess our average buy would be around 1.6-1.7 HIVE each. The yield we get has dropped, it was running just over 2 HIVE per day for a while, and has drifted lower to around 1.3 currently. I'd assume that this id just down to a lower utilization of the Beeswap HIVE/swap.HIVE facility, as that is where the BXT yield is generated. Overall, this has been a nice, reliable investment for us.

BEE Stake

A small, and more recent addition to this wallet. We have our BEE delegated to @bee.voter and the yield it pays us is very nice. Our holding is worth 871 HIVE and earns good. Last week, we received 4.879 HIVE. By my math, that works out at 253 Income per year, at an APR of 37%. I have no idea how they are able to pay out that kind of yield, but I'll take it. Would like more at these yields, but finding the funds to buy more is tricky at the moment.

GIFU

We are in the red on our GIFU holdings. We bought in around 0.00024 and they currently trade around 0.00014. This is one we just sit on, and probably sell down the track if the project revives. @raymondspeaks has said it is still firmly in his plans, just quiet times at the moment. Time will tell, but no point taking an L on this yet.

PIMP

We are probably in the black here, with our purchases done below the current prices. It generates a small yield for us, and we earn a little more each week. Not a focus for us, but the position is enough that it is worth keeping on the balance sheet.

BRO

The last token we keep track of in this wallet is good old BRO. We only hold 100, and these are basically a free-role position. When the BRO market went a bit nuts a few months back, I sold and bought and basically we ended up with this 100 as pure profit. Not super excited about the position, and very unclear of how BRO holders will financially benefit from Ray's grand plans, but the community is fun and keeping these tucked away in our wallet is harmless as they were essentially free.

There are lots of other minor assets in this wallet, mainly Tribe tokens from various projects. The sizes are not worth tracking in our weekly updates, and I'm not real excited to buy into any of them tbh.

So there is a little deep dive into our key positions in our primary wallet. More BEE, more HBD and more HP would be the priorities for this wallet moving forward. I'd love to have a few thousand HBD so when opportunities come along we have quick funds available. Maybe if I learn to sell during the bull run, instead of after it, then we can put some profits into HBD and build it up.

Thanks for checking out todays post.

P.S. I put this notice in our discord, but figure I'll mention it here on chain also. I have made the decision to withdraw from the Leo strategy deal we had on the table, rather than putting it to a vote. I liked the deal, but it was proving to be very contentious, and I didn't want to bring lots of drama and negativity on-chain. LEO is going extremely well at the moment, and @leostrategy is gaining some strong momentum, and I'd hate to do anything to disrupt that. I wish Leo Strategy all the very best, and hope for them to have great success.

Cheers,

JK.

If you missed it, here is the post we did last week, with a deep dive into our LEO wallet:

https://inleo.io/@lbi-token/taking-a-look-at-our-wallets-part-1-leo-dkc

I just want to note that in the week since that post came out, the wallet has gained around $3700 (up over 50% in a week)

LFG LEO.

Posted Using INLEO

Congratulations @lbi-token! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 24000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPThanks for the update!