LBI Weekly Holdings and Income report - Year 2, Week 22 - week ending 28 December 2025

Welcome to the final weekly update post for 2025. Let's jump straight in and see how LBI has performed over the last week.

So here is the link to last weeks report:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-year-2-week-21-week-ending-21-december-2025-3ge

And here are the token prices at cut-off time this week:

Assets

@lbi-token

Bought a decent amount of DUO this week. I plan to keep building up this position into a significant one for us, possibly 10 - 15 thousand DUO tokens. I like it because it pays solid yield, is reliable and is a project that seems to be in for the long haul. We have seen so many Hive Engine projects wind up, close down or drift over the course of 2025, but this one seems rock solid like us. I'm keen to back fellow builders that stick through the tough times.

You may notice a little less HBD this week. I pulled some out mainly to buy some RUG tokens. I bought off the market, and acquired a chunk from our friend @trumpman at a small discount to fair value. @silverstackeruk gave an up-to-date valuation for the token in Discord of 0.83 HIVE per RUG. Most of the HBD unstake (150 HBD total) went on RUG, and some DAB, and then the rest went into DUO. We finish the week slightly up in value from last week, just $130.

@lbi-leo

This wallet gains $1,000 in value over the week. Almost all of this is the result of TNVDA value being re-rated now that there is a live LP for it as opposed to the presale value. We continue to use half the income we receive from the Leostrategy tokens to compound, and slowly grow our TTSLA position. TNVDA should start contributing yield this week, and as a reminder we have locked in yield boosts for this and for TGLD for life.

@leostrategy put out an interesting post this week looking at having a redemption process with the aim of improving the peg mechanism. Obviously there would be two effects for us if these tokens do perform better and trade closer to peg. Firstly the asset values we hold will increase as the tokens move up towards peg. Secondly, the yields we generate will decrease, as the higher yields (not including our early staking bonus) are a function of the price being well below peg. In the long run, given the size and significance of these positions in relation to our overall fund, it is in our interest that the peg mechanism works well and confidence grows in these tokens. I do just want to note the potential for lower yield.

Future @leostrategy pre-sales will be harder for us to get a big position in. We won't have the significant amount of capital to go big at the start of the pre-sale. So don't expect in future pre-sales to see LBI buying in big. We are moving now to slow, steady accumulation and DCAing rather than the big initial investment.

@lbi-eds

No new funds added this week. We gained 48 EDSI from our range of sources (EDSMM, EDSD and HP delegation). Did you know we are the third biggest holder of EDSI, second for EDSMM, biggest for EDSD and seventh for HP delegation? Over the coming year, my goal for this wallet will focus on what we can do to help the EDS project hit the flippening faster, where the APR stops dropping and starts climbing. The main ways for us to do this would be more HP delegation and more EDSD.

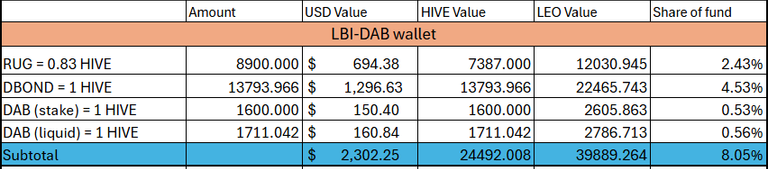

@lbi-dab

Over the week I purchased 1,650 RUG, and 250 DAB for this wallet. I have set a goal to boost our organic growth to over 100 HIVE per week as a mix of DBOND and DAB. This week, aside from those buy's, we grew by 32.887 DBOND and 53.28 DAB giving a total of 86.167 growth. The 100 per week is not too far off. We are now the number 2 wallet for RUG, number two for DAB, and the biggest holder of DBOND.

This wallet also had an updated valuation for RUG, with a clear asset backed value update provided by SSUK, as mentioned above.

@lbi-cent

This little wallet is virtually unchanged in value across the week. I'd love to add some extra funds in here to boost the income and compounding we do, but there are lots of places I'd like to add funds so it isn't easy to allocate more. I would like to note that we pull out a yield to the income wallet that works out at 12% APR, and we compound back into the pools more than that. So while it may not look like much, the wallet pulls it's weight well.

@lbi-pwr

This wallet is in power-down mode and the HIVE is re-allocated to other parts of LBI as they come liquid each week.

Totals

An overall gain of $1,500 in dollar value for the fund across the week. The single biggest contributor was the re-valuation of TNVDA, adding $800 of the total gain this week. Next was the DAB wallet, which benefited from new funds allocated.

LEO based holdings (LEO, LSTR and the various Leostrategy tokens) continue to be our dominant position, accounting for over half our total fund. I don't expect to see any change in this in the near future.

Income

We nudge over 500 LEO total this week, with the Leostrategy tokens contributing the biggest portion. The combined value of these tokens is 156,847 LEO, and the yield we pull out works out to be nearly 10%. Reminder here is that this is only half the actual yield we receive, as the other half gets compounded. So these assets are generating currently 10% income yield, and 10% gets re-invested so they are doing wonderfully for our long term goals of asset growth with a growing income over time. The challenge remains to keep this income growing (especially if these tokens do move closer to peg) and to boost other sources of income.

I'd like to quickly mention the benefit to the LEO economy we provide by being a steady buyer of LEO tokens. While we have invested in a number of "non-LEO" projects, the income those produce all gets used to buy LEO and then added to this pot of funds. We bought 100 LEO from our HBD interest, 39 LEO from our BEE investment delegation, 37 LEO from the EDS wallet just to name a couple examples. This is the benefit LBI brings to the LEO economy, we generate external income and buy LEO with it.

Here is how this income was distributed this week:

206 LEO sent out as dividends this week, with another 206 added to the @lbi-pool wallet to fund liquidity provider rewards. This week we burned 20.329 LBI tokens.

Liquidity

Very slow week for trade through our liquidity pools. Not a lot of volatility for LEO or HIVE, so fairly static prices mean less trade happening.

This week there are 22,175 LBI across all the LP's, a small increase of 152 for the week. 11.3% of all LBI are in pools.

Conclusion

I steady week overall for LBI. Not a lot of price movement, so valuations remain similar overall to last week. As the last report for 2025, it will be interesting to look back on this post this time next year to assess our progress. I will do an annual review post during the week, to see how we are positioned now compared to the end of 2024.

Thanks for checking out this weeks update, have a very happy new year everyone.

My hope for 2026 for everyone is for happiness, good health and prosperity.

Cheers,

JK

@jk6276 for LBI.

Posted Using INLEO

Are people buying LBI? Are we seeing new holders or is it basically just the same big accounts that have been holding the majority since the beginning?

Overall there has been very little change to the top end of the rich-list. The only significant shift really has been onealfa exiting completely, and jelly13 buying a big stack. Things like the #cent pool have bought in new holders, but small positions. The BRO pool brought in hurtlocker for a little while, but we all know how BRO ended and it looks like hurt has exited his position.

So to sum up, we have attracted one new significant holder over the last year, to the best of my knowledge. 😞

Okay, that's cool. Too bad it isn't more, but I guess at least we aren't bleeding out. I just wondered how much people actually care.

May I ask how @onealfa had cash out? I mean did he use market or used any other way?

View more

Forgot to mention that bulliontools bought a few LBI.

Gotcha, thanks for the info!

Cheers, thanks for running this and I feal good vibes for the New Year!