LBI Weekly Holdings and Income report - Week 58 - week ending 07 September 2025

Time for this weeks LBI update post. I missed last weeks, and pushing this one out in a rush also, so if it seems rushed, that is because it is. Before I get into the details, a little reminder that we have 4 Liquidity pools for LBI, all of which earn LEO as a daily reward. Check our pools out on Beeswap or Tribaldex, and see if any of them may be suitable for you.

We have the only way available to earn a yield directly on your LSTR tokens if you have invested in that project. The LSTR/LBI pool brings a yield. It is also important to understand impermanent loss, and that you could "lose" some LSTR if it's price moves up relative to LBI. If you understand the risks, do have a look at the yields on offer in our pools. Can't think of any other ways to earn LEO at a 20% APR currently?

Anyway, on with this weeks update post.

Prices at cutoff time:

Link to the last report 2 weeks ago:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-56-week-ending-24-august-2025-ffj

@lbi-leo wallet

Sold some LEO and LSTR over the last 2 weeks, and bought a bunch of SURGE. I've also moved some funds to our other wallets, to further boost our portfolio of assets. You will see when I cover each of our wallets how they are benefiting from this, which ultimately will grow our income over time. 150,000 LEO is our base we won't go below. We have also sold our LEOM, as the yield they where generating was very small.

SURGE yield came in for us for the first time this week. It adds very nicely to our income as you will see below. Overall, the wallet's USD value is down a bit over the last two week

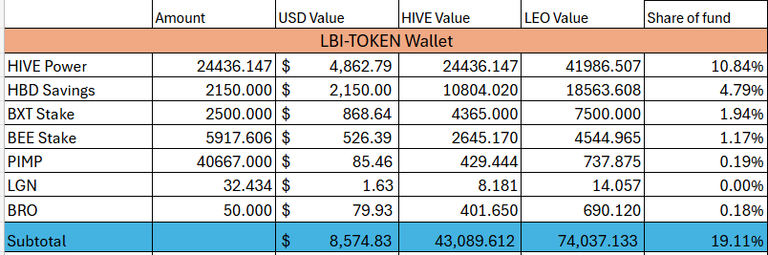

@lbi-token wallet

HBD in savings is up over 2000 again, for the first time in many months for us. Been adding some to it from profit taking from the LEO wallet. My goal with LEO's rise has been to solidify some of the gains. We were a $20,000 fund overall a few months ago, now we are pretty close to having $20,000 if you exclude the LEO wallet. Added a few BEE, and made a new delegation to @legionsupport to build a new asset. It fits our method of using an asset to build a second asset, which then earns an income. @raymondspeaks has plans to revive LGN, and if he can do it we should do very well. If not, our only loss is the opportunity cost of the other ways we could have delegated those funds.

@lbi-dab wallet

Over the last two weeks, I've bought a bunch of DAB, and moved to staking half to keep growing our DBOND. We have more than doubled our DAB from growth and purchases. The wallet is looking solid now, and income is slowly growing.

@lbi-pwr wallet

Increased our HP a bit, bought a few more PWR and grew the LP position a bit also here. A nice solid 2 weeks of growth combined with some extra funds added.

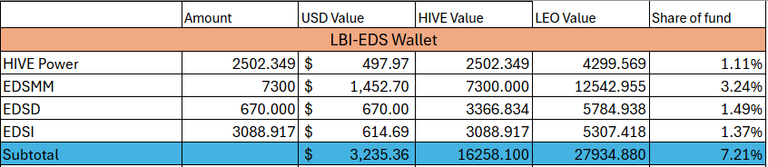

@lbi-eds wallet

A bit of love for the EDS wallet also over the last 2 weeks. Bought a bunch of EDSI off the market, and have added some of our LEO gains here also with EDSD. We now have a good stash of EDSI and it will benefit us to help the project become more profitable and reach the point where APR stops dropping for EDSI and moves to growth phase. EDSD and HP delegations help the EDS project a lot, which will flow through to us in years to come. Expect more funds topping up this wallet in future reports.

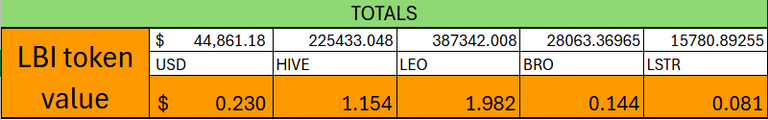

Totals

Total fund is around $45000 at cutoff time, down a couple thousand from 2 weeks ago. As LEO fluctuates significantly this value also varies a lot. Be nice to see HIVE do something, but not sure that is likely tbh.

Income

A better week for income with the new SURGE position contributing nicely to the total. I definitely aim to keep growing this, but the number of LEO we can earn depends heavily on the price.

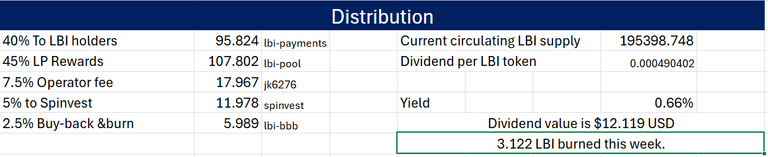

There you have the details of where the income we generated goes this week. 3.122 LBI burned for the week.

Conclusion

A solid couple of weeks, I continue to strengthen our balance sheet by boosting each division from LEO profits. This will end soon, as we will reach our new baseline for LEO assets soon. It's been a fun ride lately, and I think we are in a much stronger position than we were just a couple of months ago.

Thanks for checking out this weeks update.

Cheers,

JK.

Posted Using INLEO

I wish I had done a bit different when LEO was a bit higher. I as kind of behind the curve though and now I am in a worse position.

No kidding about that, you have to like both tokens for sure!

Congratulations @lbi-token! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 90000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Thanks for letting us know. I've shifted my position from Leo into swap.hive pool. As I understand things, there are Leo rewards still for providing liquidity

Yes, this pool does have some LEO yield attached. I only set it up with a small amount to begin, and will add more to keep it at a decent reward over time.