LBI Weekly Holdings and Income report - Week 22 - week ending 29 December 2024

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

A day late - these numbers in this update are a little outdated now. Anyway, it's a busy time of the year, so a day late is better than no report at all.

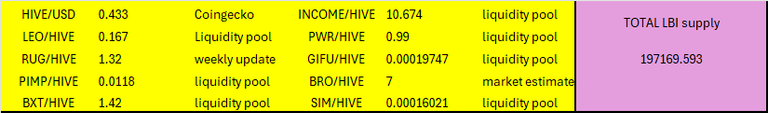

Asset prices at the report cut off time (Sunday 29 DEC 9pm roughly Sydney time)

Was during the last HIVE pump, so things have settled back a bit since these prices, but it's fun to see how the fund looks with HIVE over $0.40

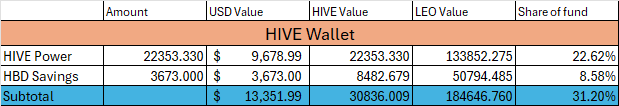

HIVE Wallet.

Lot's of change since this time. Our HBD unstake has happened since this update. For this report there is not much change, but next weeks will see HBD down to 2000.

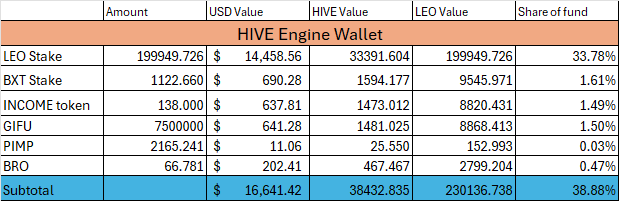

HIVE Engine wallet.

Again, small changes this week, big changes to report in next weeks update. Leo has settled back a bit from recent highs, certainly in terms of its HIVE value.

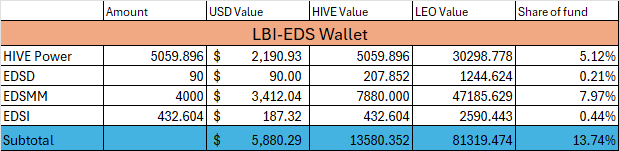

@lbi-eds wallet.

Another wallet that has had a boost since this report cutoff. Nothing much exciting in this report, but check back next week for all the updates.

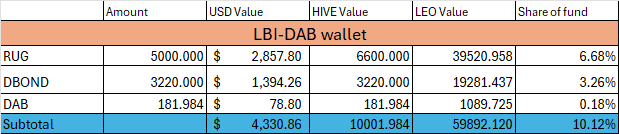

@lbi-dab wallet.

Small mintage of DBOND from RUG this week. It's smallest yield week I think so far, but still 34% - which is still excellent.

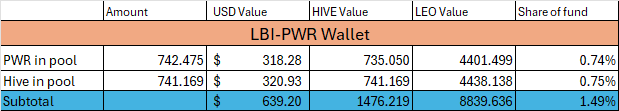

@lbi-pwr wallet.

The usual steady growth here. The yield from the pool has been drifting lower, but it's still working for us. I have added 500 HIVE to this wallet since this report, all into the pool, so next week this wallet will see more growth.

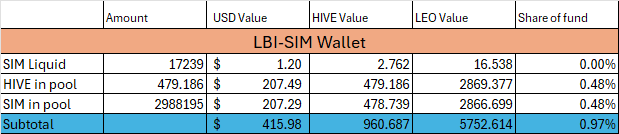

@lbi-sim wallet.

It's been tough times for this wallet lately. SIM has dropped steadily for a while, and we are bleeding HIVE out of the LP from Impermanent Loss. I do feel that the bottom might be in for SIM's HIVE price, and that this is the worst of it. Income from SIM power (our 30 day average SIM holdings) took a significant cut, and I do think the final SIM sell off may have been caused by this unexpected move. Short term pain here.

I am in discussions with @ecoinstant around a project he runs called ARMERO. It is basically a tokenized dCITY corporation with a profit share. He knows much more about dCity than I do, and it could be a very good move to shift our exposure here over to the ARMERO token. More updates to follow.

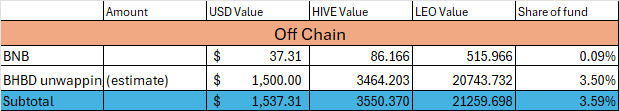

Off Chain.

Week 22.

I have had fresh contact within the support ticket. Everything I can do has been done, and we are in the queue and will receive a resolution in time. I can't give a timeline, but all we need to do is remain patient. I know that is displeasing to many of you, as LBI holders, but it is what it is.

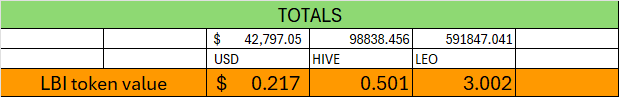

Totals

Lovely to see LBI's total fund value over $40,000 on the back of the high HIVE price. The pump has faded away since then, but it feels like each pump raises the floor price a bit. LEO has adjusted back a bit, so the funds LEO value is up.

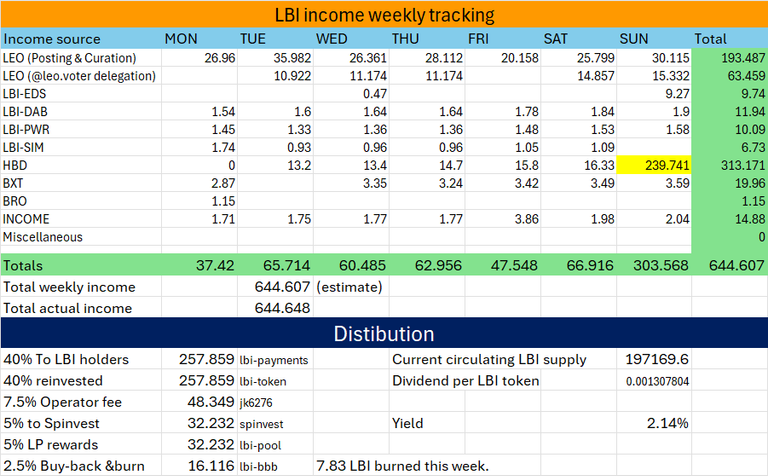

Income statement.

Had a day missing from BXT, SIM and leo.voter for income this week. Bumped the total up a bit using some spare HBD. 7.83 LBI burned from this regular buy back.

Other news.

A little while after this reports cut off, I had the HBD unstake come through. Aside from what I have alluded to above, and will update fully soon (at the latest in next weeks report) I have also made another move. The LBI price in the liquidity pool was way below the asset backed value for the token. I took the opportunity to buy a chunk of LBI, rebalance the pool price a fair bit, and burn the LBI purchased. This one off burn has removed 933 LBI from circulation, and sent them to null. Each week we buy back and burn a small number of tokens, but the opportunity to do a bigger burn while resetting the LP value of the token was one I wanted to take.

The burn removed roughly 0.5% of LBI tokens from circulation forever.

If you want to learn more about our plans for 2025, this post covers my current thinking:

https://inleo.io/@lbi-token/lbi-2025-plans-epz

I've already started working on some of the goals, and have taken onboard the feedback regarding HP delegations and will adjust the plan accordingly.

Here is to an awesome 2025 for the LBI token and it's holders.

Cheers,

JK.

Posted Using InLeo Alpha

Cheers to you!

!hiqvote !BBH

@lbi-token! @chaosmagic23 likes your content! so I just sent 1 BBH to your account on behalf of @chaosmagic23. (2/50)

Thanks for Dividends. !LOL

lolztoken.com

I told him that's the last thing I need.

Credit: reddit

@lbi-token, I sent you an $LOLZ on behalf of r1s2g3

(2/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.