LBI Weekly Holdings and Income report - Week 19 - week ending 8 December 2024

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Another week under our belt, and we have seen some significant price moves, particularly from HIVE this week. The fund has doubled in value over the last month or so, which has been fun to watch. Lets get in to the numbers:

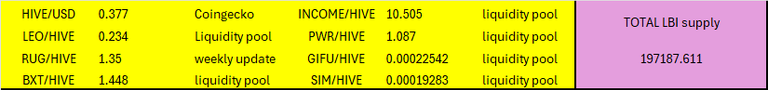

Here are the asset prices at the time of this update:

And here is the link to last weeks report for comparison:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-18-week-ending-1-december-2024-evb

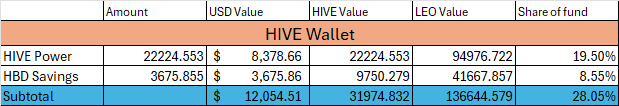

HIVE Wallet

50 HP added for the week - pretty standard with not a lot of content coming out, just some curation and inflation. The Dollar value of this wallet is up $2000 over the week, thanks to the HIVE price gains. It's all paper values, as we don't have any plan to sell, but it is still nice to see increasing values. I am starting to feel that taking some profits from other assets (mainly LEO) and boosting our HIVE and HBD balances might be a good thing. Personally been burned by not selling in previous bull runs, and feeling like locking in some gains would be prudent. Maybe too early in the cycle for this, but its just a thought for now.

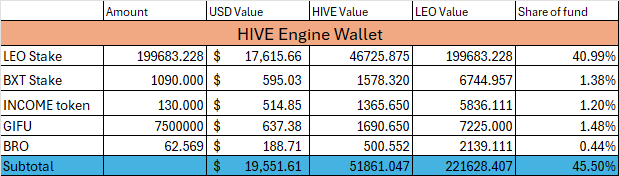

HIVE Engine wallet.

Big increase in value here from LEO - up by $5000 for the week. It's only a couple of months ago that our entire LEO holding was worth around $5000, now it has increased by that much in one week - pretty crazy. The temptation is growing to unstake some and take profits. Let me know what you all think - LEO is up to 41% of our total fund, should we sell a bit to rebalance that proportion? Everything else here is up a bit in USD terms, as it is benefiting from HIVE's gains.

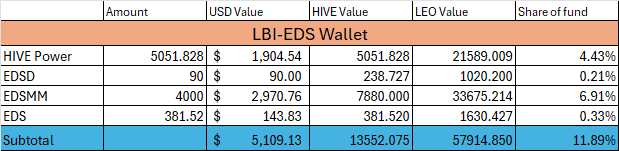

@lbi-eds wallet.

The boring wallet - it picks up another 22 EDS for the week. The USD value here is also up, as the assets are priced on HIVE values.

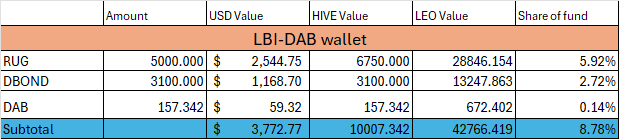

@lbi-dab wallet

Another good week for RUG, with us earning almost 100 DBONDS for the week I used some to top up the weekly income for the fund, and we gained 9 DAB for the week.

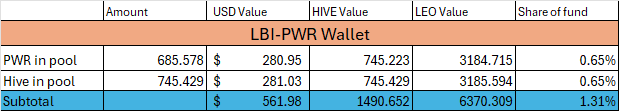

@lbi-pwr wallet.

PWR spent a portion of the week over peg, trading at 1.08 HIVE each. This doesn't really change anything for our values, but it just shows that the token is performing well. It adjusted back since the cut off for this report. Steady growth as always for this wallet.

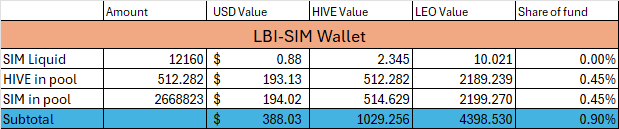

@lbi-sim wallet.

No changes over the week - this wallet is a minor part of the fund, but contributes daily to the income flow while slowly growing. No changes planned for the short term.

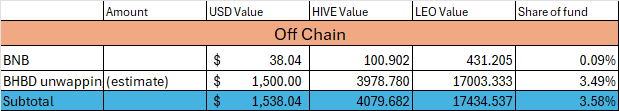

Off Chain.

Week 19 .... 😞

Totals.

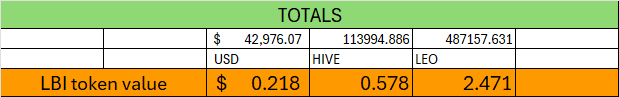

The fun part:

The fund is now worth almost $43000 in total. this is an almost $10K gain for the week. 🤑

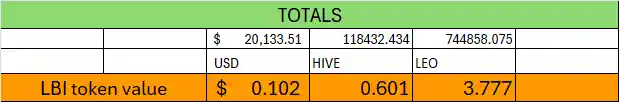

In fact, lets just remind ourselves of how fast this run has happened. Here are the values from just a month ago:

In that weekly update post - week 14 for us just 5 weeks ago, I was talking about the fund holding its value above $20K. Now we are at $43K - pretty crazy hey?

Income

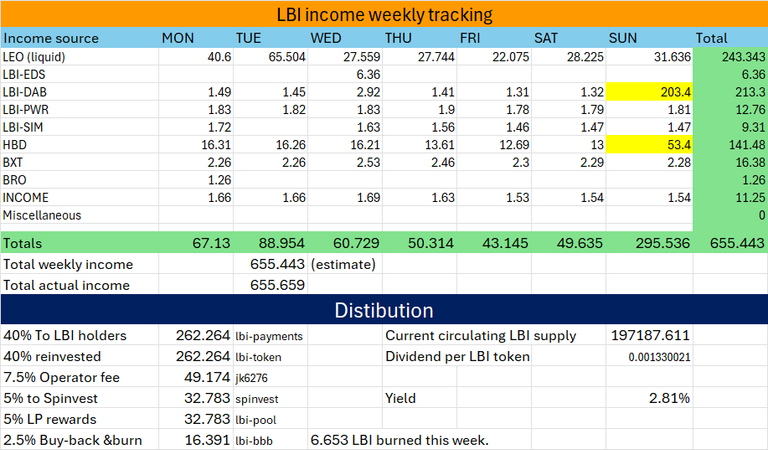

If there is a bad news part of this report, well this is it:

I was not able to maneuver funds around to maintain our 800 LEO per week target. with income coming in the form of HIVE and HBD, these are converting to less and less in terms of LEO, so it is harder to hold that target level. Anyway, the value of the LEO we are redistributing each week has gone up, so its not really a problem. 650 LEO at $0.09 each ($59) is actually much better than 800 LEO at $0.03 each ($24 total). Maybe I should add in a USD comparison on this table so I don't stress so much about the number of LEO's in the pot.

Anyway, dividends have gone out for another week, the LP is still yielding over 18% APR - paid in valuable LEO tokens, and we burned another 6.653 LBI this week. Just a reminder that tokens in the pool are included in the dividend calculation, so the dividend yield is a bonus on top of the pool yield. The fund is worth double what it was a few weeks ago, so overall it has been a terrific run lately.

Thanks for checking out this weeks report, have a great week everyone.

Cheers,

JK.

Posted Using InLeo Alpha

take profit on LEO, use it to pay the divs and reinvest. Honestly you have saved this project.

What did you ever do with those !pimp tokens? 🤣

Yeah, I'm thinking of unstaking and selling some of the LEO. I know that will upset some of the LEO maxi's, but that's ok. Just not confident with market timing - definitely a weakness of mine.

I stake all the !pimp that we get - just haven't added it to the included assets list. Might buy some one of these days and make it a proper position for us.

check the range and buy near the bottom if you do!