Dividends resume for LBI holders.

Pretty excited to announce that the first dividend for LBI token holders in 2 years was sent out last night. This marks the last part of the short term to-do list since my taking over the admin of the LBI project. Now, things are set up in full, and everything is running as I hoped it would.

The first dividend that went out was for the last 2 weeks of profit share. A first test transaction was run, to test out the bot. Some errors were noted, mainly around the calculation of LBI tokens held in the liquidity pool - a very important component of the new set up for dividends. The bot was reworked, and then a second test run was successful. Finally, the remaining funds that were held from the last two weeks of earnings where sent out - without an issue.

Including tokens in the LP is an important part of the plan, as it means that there is no disadvantage for people adding their LBI's to the pool. The goal of the liquidity pool is to improve access and invest ability for people to get into LBI, and also to provide an option if people wish to exit at any time, for a fair price. Now, the incentive is tipped in favor of adding LBI tokens to the pool, with those tokens still counted for dividends, plus earning the LP rewards on top.

Why are dividends so important.

My personal belief is that paying dividends show that the project is making money, and it adds an incentive for people to hold LBI tokens. I know there has been a school of thought that paying dividends takes funds away from the growth in asset value. LBI holders voted 2 years ago to suspend dividends. I understand that perspective, but I think that the way LBI is set up now, we can have both growth and income.

Layers of growth have been built in to the project, before any income is taken. Whether it is our DAB wallet, where RUG tokens mint DBOND, and most of that DBOND stays staked to mint DAB. The DAB is all held as another asset. Finally it produces a daily HIVE drip, which counts then as income. Same goes for EDS, where EDS tokens are minted each week, and stay on the balance sheet, before they then produce an income.

These are just two examples and I have posted about all this before, so I won't repeat myself any more. The point is that asset growth is the priority, and lots of LBI's "income" is not even counted as income. If you look back at LBI reports from a year or two ago, things like Hive inflation, curation and so on where counted as income. These arrive staked, and part of the reason for suspending dividends back then was that all these incomes where hard to pay out as dividends. The liquid funds were all being used pretty much, as so much of the funds "income" was not liquid.

Under this new set up, we avoid all those problems, and only consider a narrow range of funds as income.

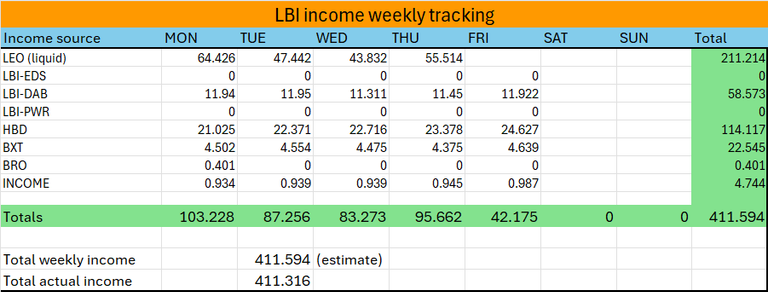

Here is this weeks income tracking sheet, with running tallies so far:

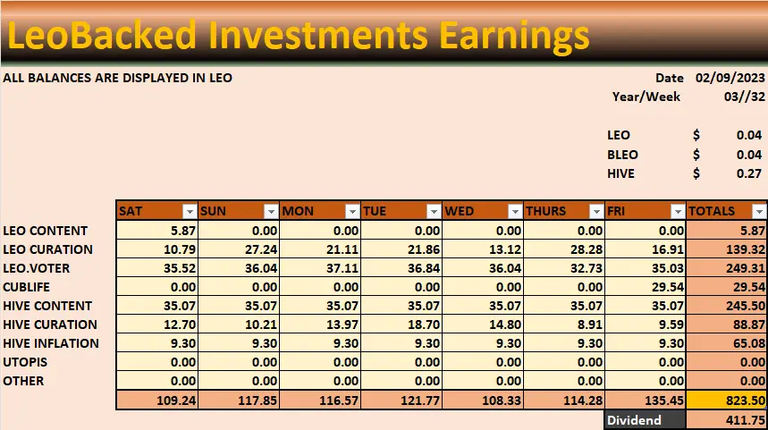

Let's compare that with an income report from 12 months ago:

Now, we are showing less income - this week will likely finish up around 550 - 600 LEO, compared to 823 this time last year. So on the surface, that is not great. But a deeper look will show that things are actually much better than they seem now. Let's just use "Hive inflation" as one measure. In last years update, this is recorded as 65.08 LEO value as income. On our income sheet this year it is no where to be seen. In fact, if we did record this, it would be over 100 LEO of income, between our main wallet with just over 20K HP, and the EDS wallet with 5K. But recording that as income poses a problem. It isn't, really, as it is not liquid. To convert Hive power inflation into income, we would have to power down permanently.

Same goes for Hive Content. Last year, Hive content was almost the biggest income category, in the new system it does not exist. Half comes powered up - so that leads to the same problem as I mentioned above. The half that does come liquid, as HBD, is currently used for two purposes. One is to pay for LEO premium, and now that dividends have started, ongoing maintenance of that service. Any spare liquid HBD after those expenses is used to buy EDSD and add assets to our EDS wallet. So even HBD liquid post payouts are not counted as income.

So what happens to the stuff that does count as income?

In the above image, you can see what is being classed as income. The next image shows what we do with those funds. These details are all published weekly in the update post. Based on the above (partial) income report, here is the split of how those funds are allocated:

So as you can see, only 40% of what is counted as income gets paid out as dividends. 40% get sent back to @lbi-token (the main wallet) to be re-invested. You can see the other places funds get allocated in for yourself.

Two points I want to highlight

5% LP rewards. As I said previously, I have focused on building the LBI/LEO liquidity pool. The 5% profit share going to that is a small amount, but the difference between our pool and most is that the yield on the pool is 100% sustainable. It is funded from our income, not token inflation. There is no dilution for anyone through LP incentives.

2.5% Buy-back and burn. LBI's token supply is capped. All tokens are in circulation and no more can be minted. Each week we are buying back a few tokens, out of this small portion of income. So, every week the number of circulating LBI tokens drops, just a little. LBI is deflationary. We are not doing any big buy backs, funded by selling assets. Just a little bit, every week, funded by a tiny portion of our income.

In conclusion - dividends have resumed for LBI token holders. They are not big, to begin with, but the project has lots of built in asset growth in place that should feed income growth over time. The incentives are in place to encourage holders to put their LBI tokens in the liquidity pool, without missing out on dividends. In fact, tokens in the pool earn more, as they get the dividend plus the LP rewards. LBI is now deflationary, with a few tokens bought back and burnt each week.

Now, it's just a mater of time before this process yields a steadily growing income, and a steadily growing base of assets. Value may fluctuate from day to day, week to week. But each week we will have more assets, and less tokens to divide those assets by.

If you want to learn more about the LBI "Flywheel" the following post covers it in more detail:

https://inleo.io/@lbi-token/dare-i-say-the-word-flywheel-lhw

Everything is now in place. I for one can't wait to see how this set-up plays out.

Thanks for reading, I hope all you LBI holders have found your first dividend, and look forward to seeing it grow each Sunday. I'd love to here your thoughts in the comments section.

Cheers,

JK

@jk6276

To learn more about LBI, here are some more posts to read up on this project:

https://inleo.io/@lbi-token/never-enough-hive-power-lpv

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-4-26-aug-2024-f9f

https://inleo.io/@lbi-token/leolbi-liquidity-pool-dm

Posted Using InLeo Alpha

Did the divs have an impact on Leo:LBI pool liquidity?

In the short run, not significant. I'm hoping people take their div's each week, and pair them with some LBI tokens so the pool grows a bit - but it's really an individual choice.

The whole point of paying dividends is to give LBI holders a choice of what to do with the returns.

But the good news is that we got the bot to take LBI in the pool into account, so that isn't another disadvantage of being in the pool.

the more explicit and transparent, the more adoption you get

My goal has been transparency from when I took over.

Sweet! I need to check out my wallet tomorrow!

It's not big money, but it all counts and we have to start somewhere, right?

For sure. I don't mind seeing an extra 4 LEO in my wallet!

🎉

Nice, I'm going to pool all my Leo earnings!

Feels good man !BBH !DOOK

You just got DOOKed!

@pepetoken thinks your content is the shit.

They have 12/400 DOOK left to drop today.

Learn all about this shit in the toilet paper! 💩

@lbi-token! @pepetoken likes your content! so I just sent 1 BBH to your account on behalf of @pepetoken. (11/100)