25 BPS Rate Cut and Market Volatility - Stay away from FOMO and Plan your exit Strategy!

Welcome back,

It has been 24 hours since the FOMC meeting took place. The 25 BPS rate cut has already happened and that is something bullish for the entire crypto market. The market is already seen pumping and responding to the news as expected. While a lot of people might think whether it is the right time to buy a new token or not, here is what I personally think based on my experience and technical analysis.

The market makers are still going to try and trap retail investors because that is what they are best known for. In my personal opinion, if you are someone who is going to hold on to your bags, you are not going to get affected.

If you are someone who is going to get trapped in greed, or if you are someone who is going to get trapped in fear of missing out, then there is a high chance of losing money or living in regret for the gains you might miss.

The good thing is that Fed has hinted towards another 25 BPS rate cut and maybe before November we are going to see another rate cut. If that is going to happen, the market will start to respond even better. The money printing is still important to take care because that is how the fresh liquidity will get injected into the market and that is what will boost the market because for now the money is rotating among different tokens.

When one token goes down, the other goes up because the liquidity is just rotating from one token to another token. So the fresh liquidity is really important and for that money printing has to start. I expect that to happen this year itself if another rate cut happens.

Anyways, let us get back to the topic of what we should do right now. I think the best thing to do is divide your portfolio in two parts, one portfolio that will hold your long term assets and the second portfolio that is going to be used for short term gains.

Now, you do not have to divide them equally and the percentage for long term portfolio is obviously going to be more, so keep the ratio 80 20 or maybe 70 30 or anything you want and go with the plan. For me, I am targeting 20 to 40 percent gains on my short term holdings and 3 to 4 times gains on my long term holdings, so that is how I am planning to book profit on my portfolio.

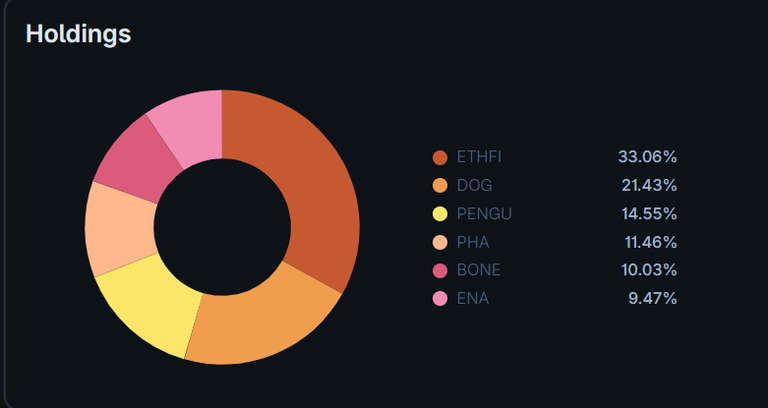

Recently, I made 40% profit on PENGU and I sold 25 percent of it already. I also sold DOG token which I shared in one of my blog recently where I was testing few tokens on the market and the experiment is going quite well. So that is what you have to do at this moment, divide your portfolio in two parts and play with the market. If you are someone who does not know trading, then simply make sure to stick to your long term holdings and not get involved in trading at all.

At the end of the day, I am just a normal human like everyone on the other side of the screen. So, make sure you do your own research before taking any decision. I might be wrong, my experience might fail, because nothing is foolproof. Everyone in this world has some imperfections and flaws, and so do I. So please do your own research and plan accordingly.

Thank you and happy trading everyone.

Posted Using INLEO

Interesting thoughts. The 25 bps cut surely gave some fuel to the market. I also feel it’s smart to keep a balance between long term and short term bags. No one can time the market perfectly, but discipline really makes a big difference.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.