Recharging & Living On.

One thing I've come to realize over time is that “money is never stagnant somewhere.” It has the ability to travel fast and as far as it can. So, I can say money is like a flowing waterbody; it flows from one location to another.

Another important thing I have realized through my existence is that there is no way you can stop spending. No matter how hard you try, you can't put a halt to your spending. All you can do is keep finding a means to earn and make sure your source of earning never stops.

Even the rich never stops finding means of continuous earning because it’s certain that if money is not properly managed it will find its way somewhere with time.

Spending is inevitable

Since it has been crystal clear that spending remains inevitable, I have tried to learn a lot of things so as to keep myself in check and not go beyond my limit. You have to spend on families, settle bills, feed, spend on budget and gadgets, recharge appliances and subscriptions, and a lot more. So what way do I go about it?

Saving for Emergencies

We can’t foresee tomorrow or the future, so the only thing we can talk about is the past and our present time. In preparation for the unknown and living a minimalist lifestyle, it should be clear that I don't have to spend my last penny since I can't predict what will even happen in the next minute.

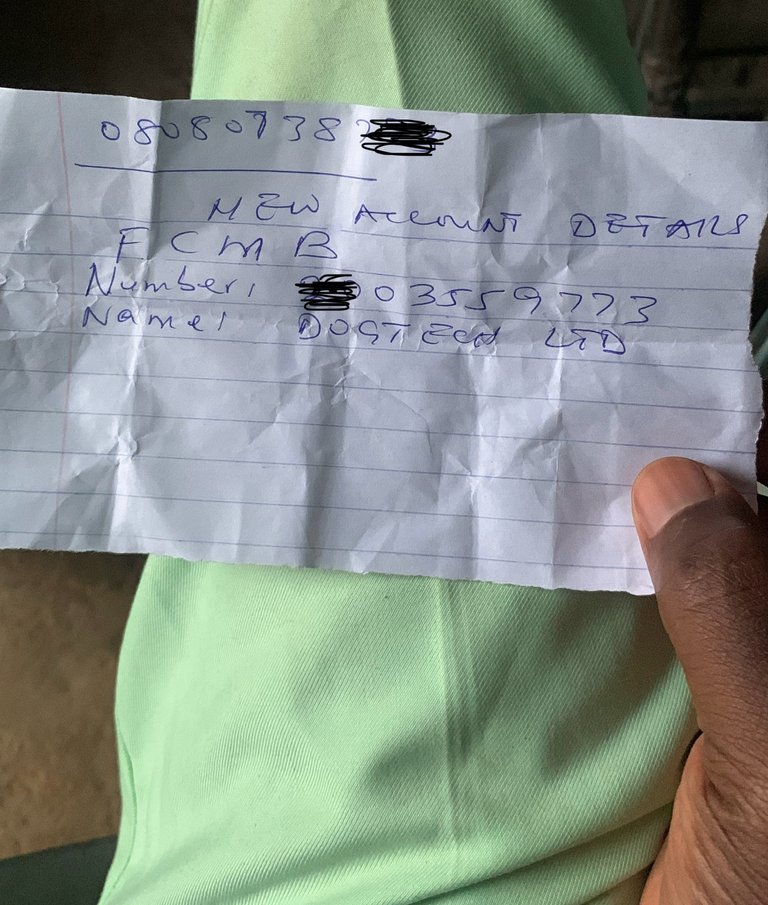

There was a time when I got a payment for the goods I sold. The money came in time as I needed to spend more and also sort some bills. I quickly attended to those as I had set them my priority. Then I have some money left untouched. I decided to cut it in half and save a part of it.

A few moments later I got a text from my brother, he was in an emergency need of funds. I sent some of the money I had left without touching my savings. He was relieved of that and settled his emergencies at the right time. Only if I knew that my savings would be what would save me.

Due to the stress I encountered from work, I began to feel ill all of a sudden. I didn’t know what was going on. But I began to spend my money on medications so that even to get better I had to make use of my savings. Health became a priority.

Avoiding Debt

As a minimalist one thing I try as much to avoid is getting into heavy debt. Debt at times becomes inevitable when you have your budget surpassing your earnings. You might have to get out of the box to secure the budget. This is where getting into debt comes in. I have always tried not to go beyond my capacity even when I want to spend on budgets.

Cutting a line between wants and needs.

Wants are different from needs. As a minimalist, I have learned to make my needs a priority. This way I can have other things to attend to. My needs are the compulsory aspects of my life like feeding, clothing, shelter, and some others. Whereby my wants are just the necessities of my life.

I have found it much easier to navigate my spending even when I have a long list of budgets to tend to.

Business and Family

I have also tried as much to keep my business life so separate from my family life. They are two different things. I spend on my family out of my pay from the business. But running a business in a friendly or family-related way is something I have realized to be the key to business ruins.

As business owners there is a trap between spending your profits and spending your capital. Once you don’t differentiate between these factors it will be much difficult to keep a balance in recharging one's budget and also living a minimalist lifestyle.

All images are mine

Please vote for the new Ecency Proposal.

Please vote for the new Ecency Proposal.