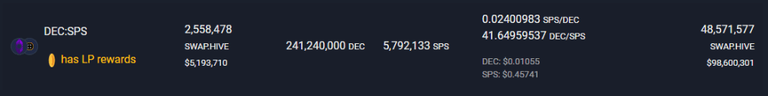

DEC:SPS Pool has 5M$ Liquidity -- Why exactly is that pool so full? Do ...

DEC:SPS Pool has 5M$ Liquidity

Why exactly is that pool so full? Does anyone have an idea?

#tribaldex #hive #dbuzz #twitter #askhive #palnet #neoxian #hive-engine

Posted via D.Buzz

5.07349642 BEE

One of the major considerations for LP providers is Impermanent Loss (IL) when the balance of tokens becomes skewed. Let's consider Hive/SPS. When hive spiked in price over the last couple days while SPS remained relatively stationary, aside from ranging between say .44 to .58, the massive price fluctuation in Hive would have created a significant amount of IL if one were to remove their LP to say, cash in some Hive during the pump.

The nice thing about Dec/SPS is that the price of assets is directly correlated, and tends to move in relative unison. Because DEC leads directly to daily airdrops in SPS if one asset moves the other is likely to move in a similar direction. This price correlation reduces risk from IL. As other comments mentioned, providing the LP doubles Dec airdrop points for the amount of DEC staked in the pool.

Their price is so closely related it's may be better in many cases that providing LP on a volatile asset paired with a stable coin.

Hope this helps.

Yeah, a lot! But doesn't it also decrease my voucher drops at the same time, as well as the extra SPS earned from basic SPS Staking? The Math behind that for sure can't be easy.

Well I know the APR from staking sps is around 50%, but I don't believe that takes into consideration vouchers. I also don't think that providing LP with SPS yields vouchers.

There is definitely math to be done. I'm not sure what the voucher price would need to be at to make staking SPS the most profitable option. I imagine all options tend to move toward a baseline profitability. If providing LP for instance gave 2x more rewards than raw staking, people can just dump their daily airdrop to buy vouchers for instance, or just compound their position for increased upside.

As complex equations are a little out of my grasp, I can only give answers that raise more questions.

View more

My best guess, based on why I have liquidity in it, is getting double DEC credit for the airdrop, and having SPS on hand due to the airdrop, it's a quick way to get more airdrop points.

Plus the convenience of it helps.

I earn DEC from playing and send it to HE between claims. I stake SPS but I use it in pools, on BSC, sometimes I use it to pay for stuff from other HE projects, if it's crazy high, so I send some of it to HE, also. Need a quick pair for DEC before the next airdrop? Boom! Ready to go.

I don't want to think about how I'm probably losing my ass in arbitrage. This is my happy place.

EDIT to Add: !BRO I noticed you're using TribalDex. I !LUV TribalDex, but I just discovered...

https://beeswap.dcity.io/swap?pools

And it's Beautiful!

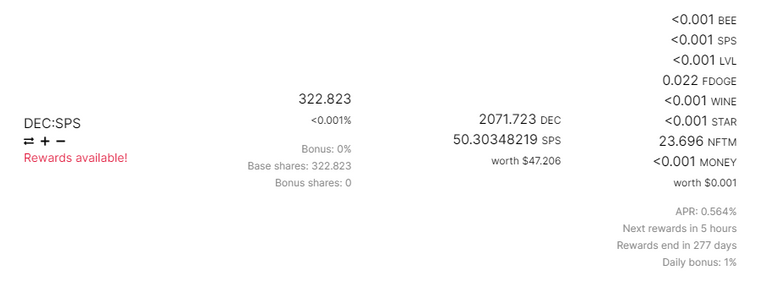

It also has better info than TribalDex, including how long the rewards will be in place. I don't know how long it's been up but I wish I had been using it all along, especially now that BXT is a thing, !LOL

lolztoken.com

He drank his coffee before it was cool.

@manniman, I sent you an $LOLZ on behalf of @sinistry

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (1/10)

@sinistry(1/4) gave you LUV. | wallet | market | tools | connect | <><

Yeah, Bee Swap is slick, beats me how I didn't use that...

And there you can see it, the APR.. .

Yeah, I noticed that, too. Such a lousy return. I've been thinking if it's worth it for the DEC boost and I don't think so. I don't see any rewards in there that I can't get from somewhere else, and I can pool both elsewhere. It seems I have a bit of homework to dig into in a few.

View more