Monday Market Musings | Week 47 | 2024

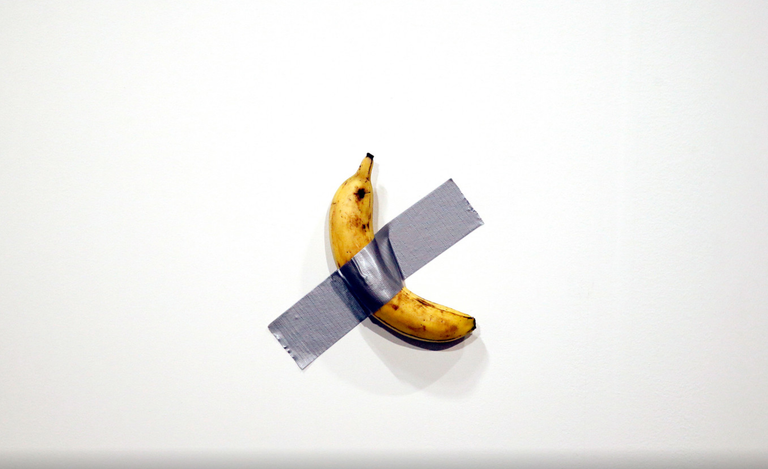

There are people for everything, and we’ve known for a long time that Justin Sun is always willing to throw money around to get attention. But honestly, would you be willing to pay $6.2 million for a piece of art that consists of a banana duct-taped to a wall? And then eat that banana? I’ll be candid and say that I have no idea what the “value” of this kind of “art " is. If I want to eat a banana, I’ll just get one from the grocery store. Now, call me an art/culture barbarian… but to me, it’s just ridiculous. Duct-tape a banana to a wall and then see it sell for $6.2 million.

The next thing that goes through my mind when I see this is the turbulent time we all left behind when Justin Sun bought Steemit. And what about the witness capital, the lawsuit, the ninja-mined stake? Anyway, Justin Sun has had his share of attention. Quickly on to other things that have kept the crypto markets busy this week.

The American states of Texas and Pennsylvania are the first states to seriously consider keeping a Bitcoin reserve. In Texas, discussions have recently started about possible legislation to establish a Bitcoin reserve, and in Pennsylvania, they are already a bit further, there is already a bill ready to allow 10% of the treasury to be held in Bitcoin. That is not all, because, at a national level, it is also advocated that the US should hold Bitcoin as a reserve, as protection against an astronomically high national debt. Trump's 180-degree turn towards crypto is therefore no coincidence.

Now that these messages are coming out, it is worth thinking about what the effects of this could be on the crypto market. Let's take a look, Texas alone, in terms of Gross Domestic Product (GDP) can be compared to the eighth-largest economy in the world. If Texas alone were to hold a Bitcoin reserve, this could already have an effect. But if we are talking about a national strategic Bitcoin reserve for the US, this will certainly be noticeable for the crypto markets. Here are some things we can think of:

Increased Legitimacy for Bitcoin: A move by the US to hold Bitcoin as a reserve asset would send a strong message about Bitcoin’s value and potential as a store of value. Bitcoin is often compared to gold as “digital gold,” and this could reinforce that status, leading to wider adoption by other countries, businesses, and institutional investors.

Positive Market Impact and Value Increase: The US government’s purchase of Bitcoin would likely cause a huge increase in demand, resulting in a price increase. This could set off a chain reaction where other countries and institutions would also want to buy Bitcoin, fearing that they would be “left behind” in their reserves.

Inflation and Dollarization Protection: If Bitcoin is used as a hedge against rising government debt and associated inflationary risks, it could impact the dollar’s position as a reserve currency. This could lead to a rethinking of the role of fiat currencies and increased demand for alternatives like Bitcoin in times of inflation and economic uncertainty.

Less Central Bank Manipulation: Bitcoin is not controlled by a central bank, meaning the U.S. government cannot influence its supply or value through interest rates or money creation. This could weaken central bank control over the entire financial system, which is seen as a disadvantage by some policymakers but an advantage by decentralized currency advocates.

Acceleration of Crypto Regulation: A strategic reserve in Bitcoin would likely come with the need to better regulate the crypto market. The U.S. would likely develop a framework to integrate Bitcoin more securely and stably into the financial system, which could boost the sector’s growth but also potentially impose more restrictions on crypto holders.

Globalization of Bitcoin as a Reserve Asset: Other countries would likely be inclined to follow suit, especially those with weaker currencies or with high inflation, such as some emerging markets. This could cause a shift towards Bitcoin as a global reserve asset alongside gold and the US dollar, with major geopolitical implications.

Volatility and Speculation: While the intention is to use Bitcoin as a hedge against government debt, this move could also bring additional volatility to the market due to speculation and traders anticipating further price increases. The volatility may not be immediately attractive to the US as it makes it impossible to predict the effect on government debt. The volatility also makes it difficult for investors to get in, but it could also create additional opportunities.

In short, a strategic Bitcoin reserve by the US could significantly strengthen Bitcoin’s status as a store of value. In addition, it could potentially lead to broad acceptance and larger price increases. And finally, it could even lead to changes in the global financial system.

You could say that we are on the eve of possible major changes. Perhaps we can even say that crypto is starting to leave its childhood behind and is slowly becoming an adult. It is also clear that this will not happen without trial and error. Adults who fall, often fall harder, the damage is greater, and getting up and continuing is less easy ... Will this be the same for crypto? The future will tell us!

correct, btc future looks bright