HBD is an Anchor on HIVE and Hive Engine

I made the mistake of writing down what I really feel about the absurd interest rate on HBD. I am now seriously depressed.

The HIVE Blockchain uses HIVE to guarantee the price of HBD. This guarantee places a huge weight on the price of HIVE. I asked DALL-E to produce the image above of an old man being weighed down by an anchor to emphasize this point.

This weight is not theoretical. The name "HIVE Backed Dollar" tells the world that the value of HBD is derived from the price of HIVE. HBD derives its price because the conversion utility will convert HBD to a dollar equivalent of HIVE after a three day wait.

If you are wandering. This game where the price of one entity is derived from another entity is called a derivative.

If you are interested derivatives I suggest you look up Enron. Mortgaged Backed Securities, Lehman Brothers ... the list of groups ruined by derivatives is huge.

Currently, the witnesses are using the HIVE eco-system to fund an absurd interest rate on a derivative.

Geek Girl reports that the system paid $115,907 HBD interest in May. This come to $1,390,884 if carried over a year. The page shows that HIVE has paid over $1,185,853 since the beginning of the interest rate experiment.

CoinGecko says the HIVE market cap is currently $109,851,318. We currently paying over a percent of the marketcap reported by CoinGecko.

The Ausbit Bank HBD Monitor said the HIVE MarketCap was $150,389,227.196 and the HBD MarketCap was $11,127,561.333 a second ago. The page said "HBD Marketcap is currently 7.399% of HIVE Marketcap"

I watch the Ausbit page daily. I wish that it would showed historic data.

What I've noticed is that everytime there is a drop in the price of HIVE there is a drop in the HBD marketcap. There have been three big dips since Christmas. In each of these dips, users convert over a million HBD to HIVE.

Converting a million HBD to HIVE at $0.3 produces 3.3 million HIVE. We've seen over ten million HIVE produced during the last three dips.

To put this in perspective. The HIVE dolphin level starts at around 5,500 HIVE. HIVE would need to attract about 1,800 dolphin level accounts to absorb the ten million HIVE produced by the HBD conversion formula.

The HBD guarantee floods the market with newly minted HIVE every time the market gets weak.

BTW: If you think that the price of HIVE is low. The smart move is to withdraw your HBD from savings and convert it to HIVE. If the price of HIVE rises; then you could buy back the HBD and make more than the 20% interest.

The HIVE algorithm backs the price of HBD with HIVE. There is an incentive to perform this conversion when the price of HIVE is low.

Fear the Haircut

The HIVE algorithm has a strange feature called a "haircut" that will kick in if the reported marketcap of HBD rises to over 30% of HIVE MarketCap. This used to happen at 10%. The price is current at 7.399%

HBD investors fear the hair cut. I suspect that serious HBD investors will start dumping their HBD when if the marcap ratio was above 15%.

Did HBD Interest Bring in New HIVE Users?

The witnesses claimed that the rise in HBD interest would bring in a flood of new users.

I think it is worthwhile to ask: Has this happened yet?

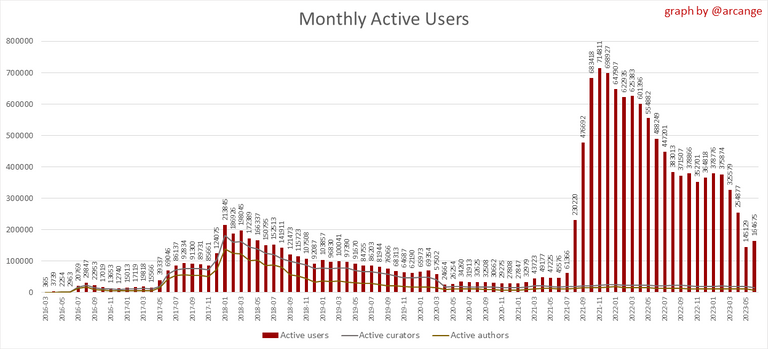

The Hive Statistics by @arcange shows that there has been a steady decline in HIVE users during the HBD experiment.

I have watched numerous companies fall into bankruptcy. What often happens is that a company will take on debt during a period of irrational exuberance. This irrational exuberance and influx of cash leads to a financial flurry that appears to justify the debt.

In most cases, the period of exuberance lasts for a year or two. It is usually in the third year that the weight of the debt really starts kicking in.

This is why I am depressed. We are still a good year away from the time when the weight of the HBD debt really kicks in.

Every word I say against the debt will be put down by people still floating on the high that they get from the narcotic effect of debt.

"Don't be a downer. Just let me get one more toke of this beautiful, beautiful, beautiful debt."

Unfortunately, too many people fail to understand the cost of debt until they are in bankruptcy and all is lost.

Trying to Sell People on Hive

I suffer from a streak of honesty. I could never sell used cars.

Anyway, I've brought up HIVE to a few business. In every case, I've been put to the door the moment that I show them the 20% interest on the HBD debt.

I am told that the high interest on HBD will attract millions of new users into HIVE.

I pointed out above. These millions of people did not show up. There are fewer users on HIVE than when the witnesses began their stupid experiment with 20% interest on our debt.

I contend that debt is a double-edge sword.

Yes, some people are attracted by debt. More people are repelled by debt.

The people who are repelled by debt tend to have more money than those who are attracted to debt.

The Theoretical Maximum of HBD is $45 million

I've been told that we need to have billions of HBD in play before HIVE will be considered a contender by the big guys.

Sorry to burst bubbles ... but the current HIVE marcap is $150; So, the theoretical marcap max for HBD $45 million. We are a quarter of the way there.

We can't have the billions of HBD needed to become a contender because HBD depends on HIVE for its guarantee.

The effect of HBD Interest on Hive-Engine

HIVE is a cryptocurrency. The way one adds value to a cryptocurrency is to create mechanisms that encourage use of the currency.

For this reason, I believe that Hive Engine should be the primary focus of the platform.

HIVE Engine is the marketplace where people use HIVE.

One can prove this by following the transactions of honey.swap. Prior to the raise in interest rates, many HIVE users were moving their HBD earnings into #hive-engine.

After the interest rate increase, the flow of funds stopped. In some cases it reversed. That is: people started selling their HE coins in favor of HBD. The change accelerated the decline of the HE coins.

Yes, most of the tribal web sites are marginal. But the developers were depending on the value of the coins to fund the development of the sites.

Development on HE has slowed dramatically on HE.

The high interest on HBD is driving developers from the Hive and #Hive-Engine platforms. This is a huge cost!

BTW: If HIVE wanted to do something innovative. The system could start offering SWAP.HBD pairs on Hive Engine. If there were SWAP.HBD pairs on HE, then we would see people wanting to buy HIVE to participate in the the trades.

This Last Section is Really Depressing

The solution isn't simply to lower the interest rate on HBD. The solution is stop paying interest on HBD altogether.

The witnesses could declare that the high interest rate failed to have the desired effect and that they want to try other things.

The value of HBD comes from the conversion formula and not the interest rate. The historic price of HBD reported by Coingecko shows that the interest rate did not dramatically change the peg.

NOTE: The conversion used to be one way. One could convert HBD to HIVE. There was a spike of HBD. The developers corrected this by creating a two way conversion.

Let's Be Innovative

There is nothing creative about a high interest rate. Raising interest rates is the type of things do in ecosystems that lack creativity.

I would prefer to invest in a creative platform than one that uses financial shenanigans to attract interest.

I think that the conversion formula is extremely interesting.

One could use that formula to create pegs to any currency.

hhhhmmmmm

Instead of doing something dull like funding a stupid interest rate, HIVE could do something innovativge like create multiple pegs.

HIVE is an international formula.

Instead of just having a peg to the US dollar. HIVE could use its formula to create pegs to different currencies.

Imagine if HIVE had formulas for a Hive-Backed-Euro or other currencies?

If we had conversion formulas for different currencies, then HIVEans around the world could start using the platform for their daily transactions.

HIVE could create pegs for precious metals. We could have a HIVE-Backed-Gold which would peg to a troy ounce of gold or Hive-Backed-Silver which pegged to a troy ounce of silver.

Creating Hive Backed Currencies would allow #hive-engine to offer different trading pairs.

This would make HE a mini foreign exchange market.

If I had influence; I would eliminate the interest on HBD and start offering conversions to different currencies.

Unfortunately Nothing Can Happen

Unfortunaly, many of the whales on HIVE are married to the high interest.

My experience with debt is that people often have a honeymoon period with debt. The real cost of debt doesn't start kicking into until three to five years into the experience ... at which point is too late.

I suspect that many HIVE users are staring at their portfolio. They see HBD as the only positive thing in their portfolio.

How could the only positive thing in my portfolio be bad?

The reason HBD is the only positive thing in your portfolio is because the interest is guaranteed by the other of the things in your portfolio.!

It will take another six months or maybe a year and maybe some people will realize that 20% interest on HBD was a bad idea.

The high interest accelerated the decline of the tribal coins on HE and puts a downward pressure on the price of HIVE.

BTW, I am not opposed to stupid ideas. People grow through the process of missteps and corrections.

The question is what should a person do after making a mistake. The witnesses could say: The interest rate did not do what we wanted. Let's eliminate the interest rate altogether and try adding pegs to different currencies instead.

I will end with my DALL-E picture of an old man. What is his best option?

ahem, the best option is to lose the anchor. Of course, he won't. He is attached to it.

Sorry about the depressing post.

i am barely a dolphin but have almost 3 times the value in HBD because of the high interest rate. it is luxurious and i have taken advantage of it but it is not what attracted me to join Hive.

i also have about 1/3 the value of my Hive in HE tokens. while i enjoy the 20% interest at present i intuitively understand that it cannot last forever. not just because of the drain it creates on Hive but also the consequences of the growing de-dollarization worldwide. in theory i would be very interested in a peg to freely traded silver or even gold but at least at present the price determination of both metals are manipulated in the derivatives futures markets. given the turmoil in the global financial system a peg to alternative fiat currencies would likely be short-lived.

as for the tendency to convert HBD to Hive when the price is low, of course, I also have done so to some extent recently. some has become HP but much of that conversion has gone into HE.

i thank you for your thought-provoking post. it is a subject that absolutely needs some reconsideration, better sooner than later

The major thing I love about HBD is the fact that we can make 20% at the end of every month

This opportunity is rare in other blockchains

Unfortunately, since the blockchain guarantees the price of HBD with HIVE, the 20% comes by lowering the price of HIVE.

The blockchain paid 113,000 in HBD interest last month. If converted to HIVE at 0.033; that would produce 342,424 HIVE.

This HIVE is destined to go onto the open market.

What I wanted to point out is that users tend to hoard HBD when the price of HIVE is high. They convert their HBD to HIVE when the price of HIVE is low.

The 20% interest on HBD comes at the cost of lowering the price of HIVE.

!PIZZA

Interesting writeup. It is tough to quantify where we would be at with or without the 20% APR in this particular cycle during the highest inflationary situation since 1980 with a housing collapse starting in bubble cities and American consumers tapped out.

Some of the benefits not mentioned are the fact that this allowed more economic activity to bridge back and forth from the Binance Smart Chain through CubDefi.

I have assessed other setups and through inflation other platforms like BiSwap and Pancake swap are essentially paying around 20% to stake their tokens. Also with old masternode systems like Pivx it is paying out right around 20%. Those systems clearly have more risk from price depreciation.

It seems like 20% is the equilibrium point currently because inflation in the US has been running at around 20%.

I think overall the benefits of 20% APR haven't been fully realized because enough systems haven't been built to take advantage of it.

For the 20% to workout in the long run I feel that the growth has to outpace that payout which you detailed. That's unlikely in a bear market where there is an unprecedented attack on crypto from the SEC.

We are making strides towards the ecosystem building out more.

This is truly the best Web 3 ecosystem.

First, the value of HBD is derived from the price of HBD. It a derivative.

Yes. There are a few people who are making a huge passive income. But by paying 20% on a derivative, HIVE is repeating the fiascos of Enron, Mortgage Backed Securities and other financial fiascos.

The justification for this is that a few whales believe that it will improve HIVE's position on centralized exchanges.

This courtship of centralized exchanges creates dependencies that undermine HIVE's status as a decentralized exchange.

If this was true then we would have seen a huge influx of users. The data shows a steady decline of users.

We have seen a collapse of coins on Hive Engine. If you followed the transactions on Honey.Swap you would see that users stopped putting their HBD earnings in HE and put them in HBD savings. This accelerated the decline of the HE coins.

Which matters more to the long term success of HIVE: The success of HIVE-Engine or HIVE's inclusion in centralized exchanges?

Even if HIVE got better play on centralized exchanges, it will never be more than an also ran on the platform.

I know that you don't mind being a cuckold, but I would prefer to see HIVE maintaining its independence than serving as a whipping boy for Binance, Bittrex or the other centralized exchanges.

Seriously, does Binance care more about BUSD, its own stablecoin, or its brief dalliance with HBD?

I would prefer to see HIVE establish itself as an alpha-blockchain than to see it devolve into some beta-blockchain that has to bend over and pay 20% on a stablecoin to get attention.

What you are saying about being a cuckold and various other stuff doesn't make sense ultimately.

Dogecoin is merge mined with Litecoin yet is holding a higher market cap than Litecoin. Was it a cuckold mutt puppy or is it becoming the top dog?

All roads lead to the DOGE.

Despite all these other chains being technologically superior growing the ecosystem is hard partially because of first mover advantage of some of these other chains and other various factors.

Binance provided a service that people like and also provided essentially Ethereum 2.0 way before ETH could actually make those steps. People like the Binance Smart Chain. The market has spoken.

HIVE has the best Web 3 implementation but because of community fracture with Steem, DTube, DLive, Appics, Blurt, Serey it makes it tough to have the proper momentum.

It needs more development and marketing.

View more

I think having the HBD at 20% is cool especially since we are in a bear market. Maybe you have some good arguments that you are someone who does not like HBD.

The 20% interest comes at a cost. It created downward pressure on HIVE and HIVE-Engine. I believe that the downward pressure cost more than we received in interest.

I think that most of the HE coins are marginal. The coins were bound to slowly lose money.

The funds for HIVE-Engine comes almost entirely from the HBD earnings on HIVE posts.

That is a huge number of users were moving their HBD earnings into HE.

It is easy to prove that this flow stopped by analyzing the actions of Honey.swap. Honey swap is the primary mechanism for moving funds from HIVE to Hive-Engine.

After the witnesses raised the interest rate to 20%, the flow stopped. In some cases it reversed. People dumped their SWAP.HIVE and moved it back into HBD.

Again, I think the HE coins were marginal. But it was possible to make a little money. But when we stopped the flow of money into HE. All the coins went into free fall.

Even worse. There was a dramatic drop in the development of products on HE.

The 20% interest has come at a huge cost.

!PIZZA

You are more knowledgeable than me in this area of the flow of money related to the consequences of the 20%. Thank you so much for this in-debt explanation.

👍🏻 Your arguments are pretty good. I was btw never a of of HBD and convert every one I get from my post to Hive. Also was doubtful from the start of a 20% interest rate of HBD would be sustainable. Well, they are not if one reads your post and the goal, to attract many users, did not turn out.

Prior to the interest rate rise I was working on a web site to integrate with HIVE-Engine; So, I was converting my HBD into SWAP.HIVE on Hive-Engine.

After the raise, I realized that the coins on HE were doomed to collapse and anyone who developed programs for Hive-Engine would lose their investment.

The whales that wanted passive income from HBD claimed that the 20% interest would bring tens of thousands of people into HIVE and it would lift all boats.

Some thought the high interest would bring in merchants and establish HBD as alternative to the US Dollar.

This hasn't happened.

The current possible maximum HBD is $45 M. If it didn't happen when there was $14 M HBD, then it is not going to happen.

Since the price of HBD is dependent on the price of HIVE. The HBD marketcap really can't rise much higher than it already is.

This is not enough for businesses to replace the USD as a primary means of exchange.

Just as it would be foolish for a company to integrate their business with Hive-Engine. It is too risky for businesses to integrate with HBD.

Unfortunately, it will take another six months or so for the witnesses to realize their mistake.

!BEER

View or trade

BEER.Hey @borsengelaber, here is a little bit of

BEERfrom @yintercept for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.The HBD is a vestige from the

STEEMera and should be reexamined. I can see the advantage of converting normies with something familiar, but that hasn't brought people in as you note. I argue we should de-couple from government as much as possible, including pegging to dollars, Euros, Pounds, or anything else.That is the reason that I mentioned pegging to silver and gold.

A conversion formula for silver would basically be the same as the one for dollars.

Creating a peg to the spot price of Silver and Gold would attract people interested in monetary reform. It would allow people who want to do transactions in silver to engage in online commerce.

Need I mention: People who stack silver are more likely to stack HIVE than people who want a forum for discussing food.

Pegging to Currencies

Of course pegging to currencies helps people with local transactions. HBD is convenient for me because I have to pay taxes and other bills in dollars. But that is just a convenience.

I'd be on board with a Hive Silver Gram or Hive Silver Ounce metric. I don't think gold is a good option, and I definitely don't want bimetallism.

View more

Realy good post. Thanks.

That is true, but the problem is that a crackdown is coming. Cryptocurrencies are being corralled online, and convertibility is being eliminated so that it cannot serve as a refuge from inflation.

20% interest on HBD is a rational response to inflation in the double digits, IMHO.

I recommend that instead of changing that interest rate, we eliminate curation rewards and the perversion of curation that causes. Eliminating that and opinion flagging would still provide a chance for Hive to attract a larger community. However, that isn't happening because it's a threat to the oligarchy, as Steem proved.

Thanks!

$PIZZA slices delivered:

yintercept tipped chesatochi

@yintercept(1/5) tipped @rafzat

Congratulations @yintercept! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 16000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: