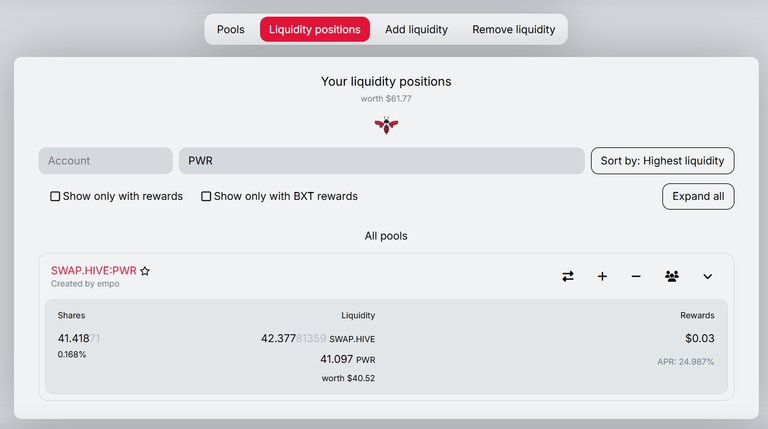

Investment in Beeswap pool - Pair SWAP.HIVE:PWR - week 33

News

I've been investing in this stable liquidity pool for half a year now and the results have been very good overall. This week I managed to add 0.217 PWR and 0.223 Swap.Hive to the pool. It's a similar amount to last week.

The liquidity pool's profitability has been good but not as extraordinary as last week. This is normal because after the Stake news things are falling into place. Let's hope it's a stable and long-term profitability.

I have to look for more solid power sources for this pool

Performance remains in line with the previous week.

I'm going to expand the type of investments I make in Hive and have chosen pools as a good way to increase the returns I get on-chain.

Why use pools? Because they don't require a lot of time to manage, I don't have too much free time, and because I think they offer good performance.

My investment strategy in Beeswap pools:

- I will choose pairs that have currencies that I like and think have a good future.

- The minimum performance has to be higher than the 20% that can be achieved in Hive.

- If it is possible that they have good liquidity.

- Have daily transaction volume

- If possible they are linked to Swap.Hive

- 7 pairs maximum

First pair - SWAP.HIVE:PWR -

- Liquidity - High

- Negotiation - High

- Profitability - 24,98% APR

- Linked to Swap.Hive - Yes

Token Name

Hive Power Ventures

Supply (Circulating / Total / Max)

60000.000 / 60000.000 / 1000000.00

Issuer

@vventures

Website

https://peakd.com/hive-167922/@empoderat/introducing-hive-power-ventures-pwr

Description

Backing the PWR token with HIVE.

Precision

3

Staking

No

Delegation

No

!hiqvote

!BBH

@tokutaro22, the HiQ Smart Bot has recognized your request (1/1) and will start the voting trail.

In addition, @tokutaro22 gets !WEED from @hiq.redaktion.

For further questions, check out https://hiq-hive.com or join our Discord. And don't forget to vote HiQs fucking Witness! 😻