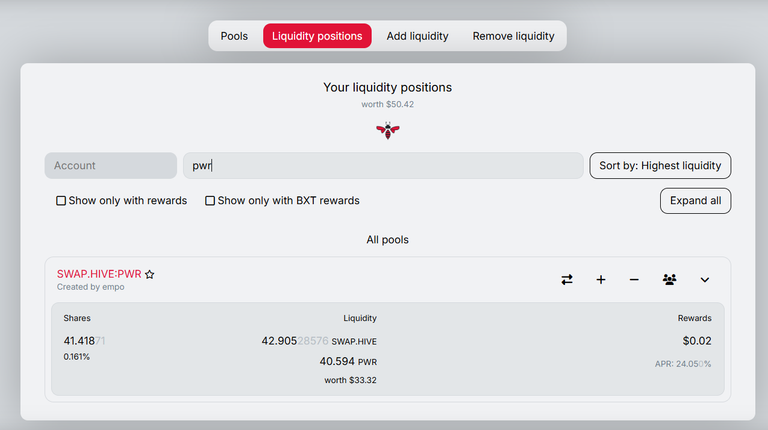

Investment in Beeswap pool - Pair SWAP.HIVE:PWR - week 34

News

This week has not been so good in this liquidity pool and I am still not clear on the reason. Even so, I have managed to add 0.139 PWR and 0.146 Swap.Hive to the pool. As you can see, PWR is above parity with Hive. I think this will be the case in the medium and long term.

The profitability of the liquidity pool has barely changed this week, just a small drop. I think that from now on it will be more stable, taking into account that there is another investment alternative within the same token.

I have to look for more solid power sources for this pool

Performance remains in line with the previous week.

I'm going to expand the type of investments I make in Hive and have chosen pools as a good way to increase the returns I get on-chain.

Why use pools? Because they don't require a lot of time to manage, I don't have too much free time, and because I think they offer good performance.

My investment strategy in Beeswap pools:

- I will choose pairs that have currencies that I like and think have a good future.

- The minimum performance has to be higher than the 20% that can be achieved in Hive.

- If it is possible that they have good liquidity.

- Have daily transaction volume

- If possible they are linked to Swap.Hive

- 7 pairs maximum

First pair - SWAP.HIVE:PWR -

- Liquidity - High

- Negotiation - High

- Profitability - 23,97% APR

- Linked to Swap.Hive - Yes

Token Name

Hive Power Ventures

Supply (Circulating / Total / Max)

60000.000 / 60000.000 / 1000000.00

Issuer

@vventures

Website

https://peakd.com/hive-167922/@empoderat/introducing-hive-power-ventures-pwr

Description

Backing the PWR token with HIVE.

Precision

3

Staking

No

Delegation

No

!hiqvote

!BBH

@tokutaro22, the HiQ Smart Bot has recognized your request (1/1) and will start the voting trail.

In addition, @tokutaro22 gets !PIZZA from @hiq.redaktion.

For further questions, check out https://hiq-hive.com or join our Discord. And don't forget to vote HiQs fucking Witness! 😻