Fintech is not disrupting banks

Fintech has been around for the best part of the last 3 decades and the world was betting on them to disrupt traditional institutions but that does not seem to be the case.

Sure, Fintech has made several contributions to the financial market and they are challenging banks in some areas but they haven't been able to challenge the core aspects of banking model - deposits and loans.

Deposits and loans - the key banking model

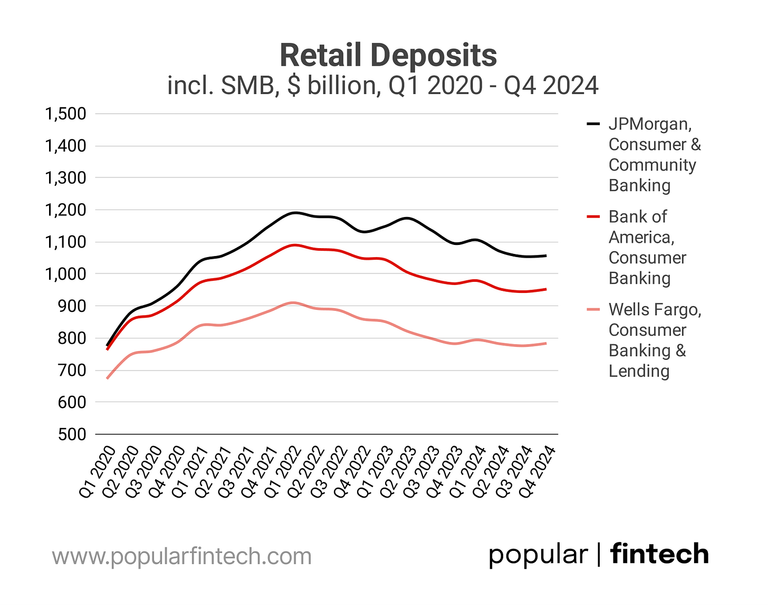

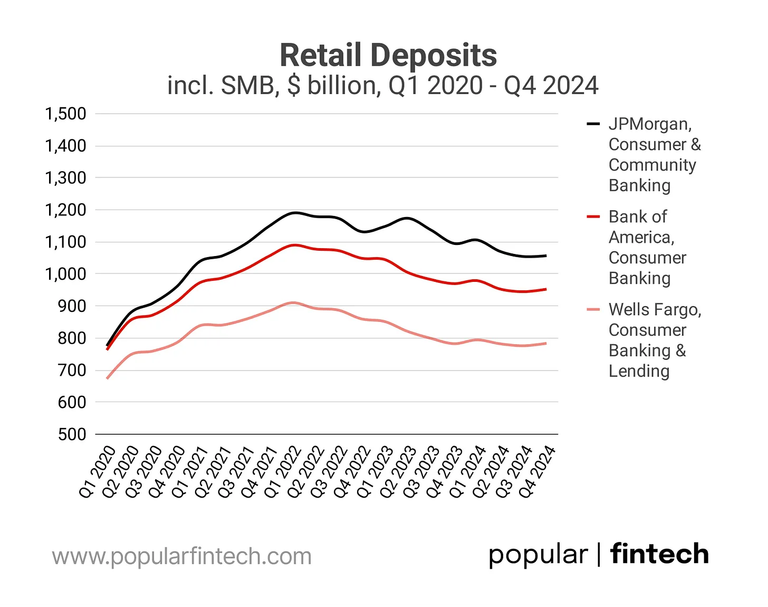

Fintech companies tried to take a share of deposits by offering high-yield saving accounts, and while that did have a localized effect, the main financial institutions survived this deposit flight and already reported recovery and projected to grow steadily over 2025.

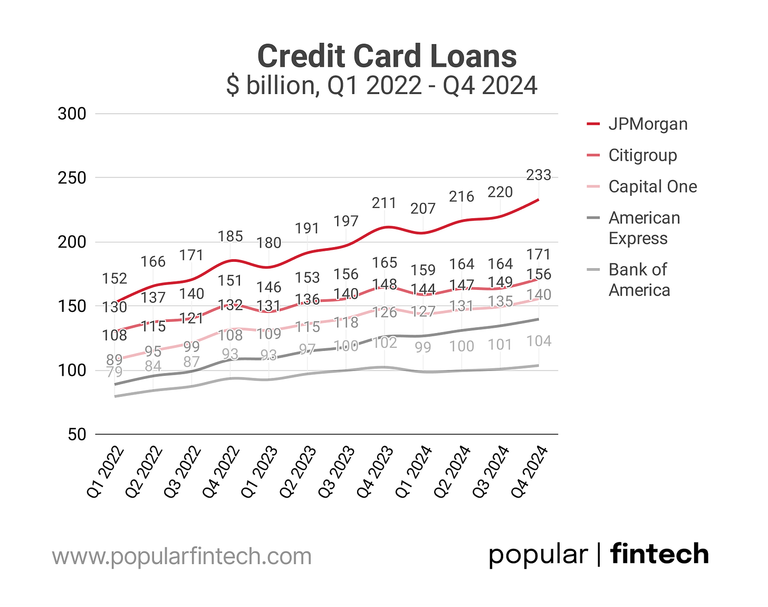

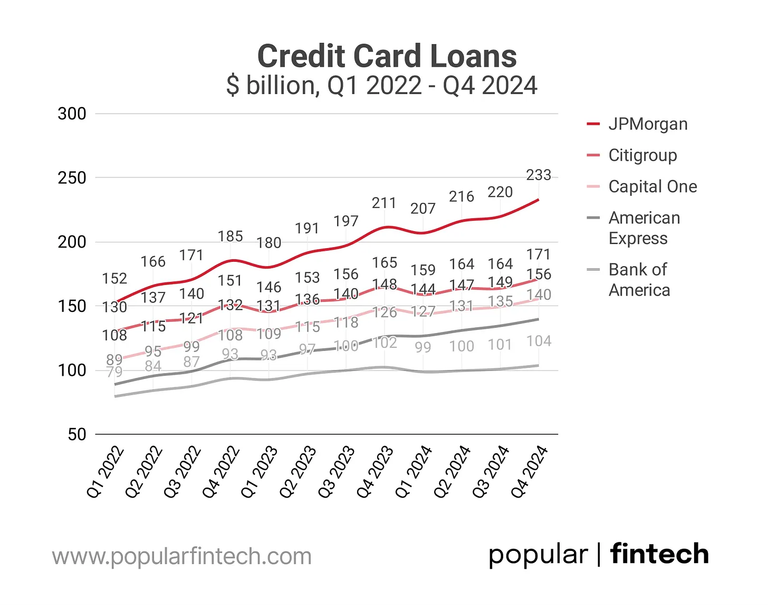

Another area where fintech made a massive push to try and take customers from the big players was credit card lending. Robinhood, for example, launched its Gold card last year offering 3% cash back and they claim 2 million people are on the waitlist for this card. That's not something to look away from but, this number gets a lot less exciting when compared to the performance of the "big guys": mex opened 13 million new card accounts, Chase opened 10 million, Bank of America opened 4 million, and Wells Fargo opened 2.4 million.

The digital narrative

One of the strongest selling points of fintech was the digital/mobile narrative.

The idea was that since fintech was born in the digital era and most companies are available exclusively in digital format, they would provide much better UI/UX and, therefore, would be much more appealing to an ever-growing digital audience.

That may have been the case at first, but traditional banks had a lot of money at their disposal, which they used to catch up with fintech companies.

JPMorgan Chase reported 58 million active mobile users in Q4 2024, Bank of America 40 million, and Well Fargo 31 million. That's more than most fintech, with a few exceptions such as Cash App and Venmo.

It's not all bad news

Despite not being able to really "Move the needle" in key areas, fintech did accomplish a lot.

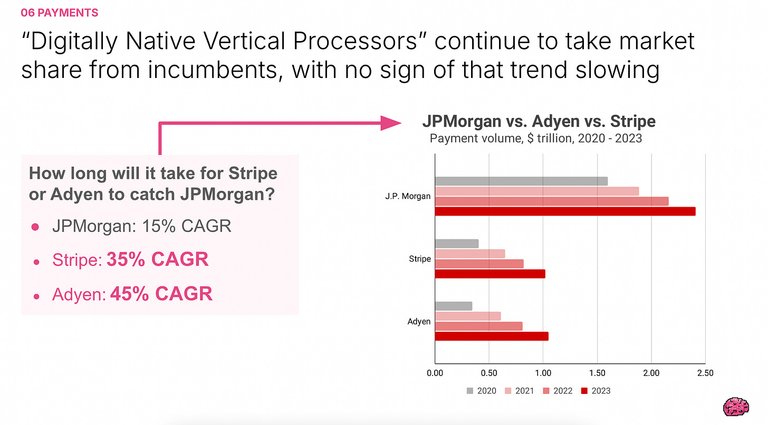

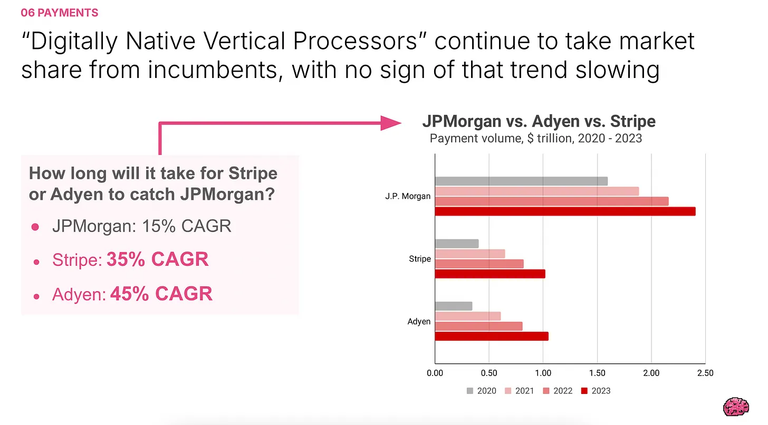

Fintech is doing pretty well in payments, where it loses only to JPMorgan. Small business loans are also promising as Square is already generating more small business loans than Chase and cross-border payments is also another area where fintech shines thanks to companies such as Wise and Remitly.

Final thoughts

In the 30 years fintech has been around, these companies achieved a lot and actively contributed to changing the landscape of the financial industry.

Many of them were able to survive beyond the startup stage and turned into unicorns that made a name for themselves.

However, a lot of people expected fintech would disrupt traditional banks, but that has yet to happen. Sure, banks were impacted by the rise of fintech and had to adapt to catch up with their more technological counterparts but they did adapt and, at least the big ones, continue to thrive and outperform fintech startups in all aspects except for a few areas where fintech seem to have solidified their leading position.

But will these companies setlle for the niches where they outperform banks or will they have another go at really disrupting the system? That remains to be seen.

Posted Using INLEO

It seems good to have more competition for the banks. Keep em on their toes! 😉😎👊

That's true. Gotta give banks a run for their money

There could also be some cross over between the two, banks buying fintech startups and vice versa. I think what I appreciate most about fintech companies is some are able to serve customers that bank would traditionally not serve. This contributes to creating more financial inclusion for the global population.

That's true. I think crypto does a better job at serving the unbanked but it's still too complex for most regular people to use

Especially the onboarding part. The abstraction meta may help in that part.

View more

Quite interesting that these disrupters have never been able to crack the big markets, moving from niche operators to major service provider is a big leap !BBH

yea, I think the task turned out to be harder than most anticipated!

Deposits and prices are the most unique thing in each bank unit. They used to give credits and loans, especially to buy cars and houses, I hope they restart it.

Congratulations @tokenizedsociety! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP