Congratulations Leo on overtaking Hive !

On the onset let me clarify. It is not about any sense of competition that I chose the topic of this post.

If hive blockchain were to be seen a the mother or a parent (keeping it gender neutral;) )

Then every parent would be proud when the child or offspring does well and earns accolades.

On a more practical, less emotional front if we talk in terms of tokenomics and the blockchain level then no doubt Hive is the parent blockchain and the inleo platform is built over it and the leo token is the layer two token.

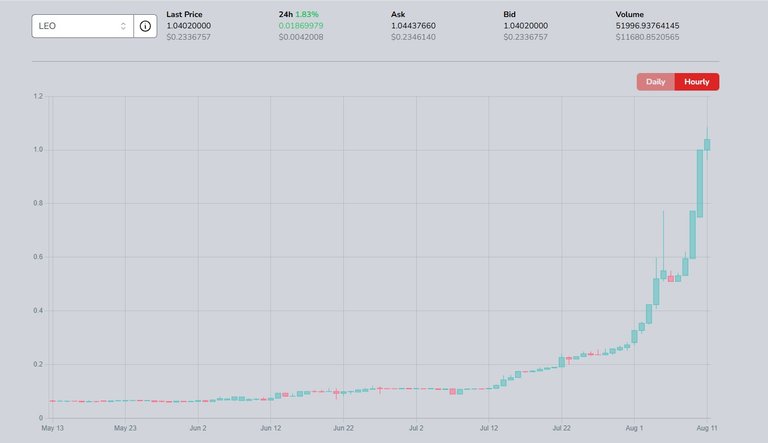

The LEO token chart looks impressive

The green candles are a treat to watch specially for those who have been holding and staking leo since the very beginning.

The similarity ends here

The inleo platform has started doing something that hive has still not done.

This is that it has tweaked its tokenomics and made the supply fixed to 30 million. So no more new tokens would be minted.

Demand Demand and more demand for the Leo tokens

Ever since the launch of leodex.io there is a lot of demand for the leo token. The leo token and inleo in general has been getting a lot of spotlight as more and more leo tokens are being bought and locked away for staking by the community members.

Another important pressure comes from the leostrategy account that is powering the LSTR project.

The LSTR sale is done and dusted

The initial sale of 100,000 LSTR tokens was completed and was transferred to the initial investors.

The LSTR project has a unique approach to generate buy pressure on the ever shrinking LEO pool of tokens.

The LSTR sale which happened at a sub $1 price in dollar terms has seen substantial increase in the price of the LSTR token.

On the hive engine each LSTR token commands a much higher price and is already up more than 4X the initial sale price.

Currently with all these green candles the LSTR chart looks nothing short of a blockbuster.

With the money raised in the initial sale the proceeds would be used.

To buy leo tokens and stake them permanently in the LP pool.

The rewards of the pool would be earned in the stable coin USDC

The model works on the idea where LEO thus acquired is staked as sLEO to earn USDC on https://leodex.io/leo

The USDC thus earned are again used to buy more LEO that are turned into sLEO and permanently staked in the LP. This created perpetual buy pressure on the LEO token supply and kept sucking out the supply pushing the prices up.

The current frenzy to buy leo tokens may perhaps be only a precursor to more price increase as the month of September is likely to see the start of the yield farming giving USDC rewards.

Main image created with AI

Posted Using INLEO

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Aapko bhi badhai ho bhai

https://www.reddit.com/r/CryptoNews/comments/1mo2kkc/congratulations_leo_on_overtaking_hive/

This post has been shared on Reddit by @thetimetravelerz through the HivePosh initiative.