Splinterlands || Liquidity Pools

We are watching some good news lurking in the crypto realm. BTC ETF approval is probably around the corner, BTC halving is also nearing, influencers making a shout out about crypto, all along we are probably going into the bull market very soon. HIVE is yet to catch the trend and so is Splintershards. Although, we are seeing some rise in price of SPS, it is good to be a part of that fly wheel.

The affect of SPS is being seen all through the game. Once the price reaches the phase of some acceptance the effect of it is seen in the eco system. With that being said, have you noticed, the liquidity pools of Splinterlands eco system. Lets take a dive in!

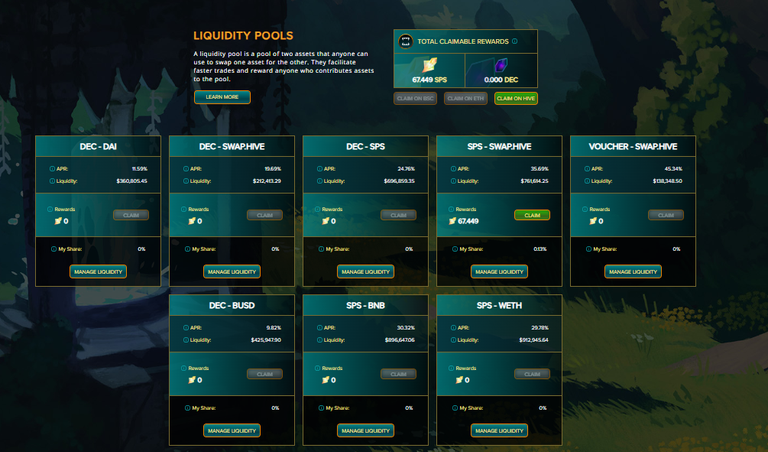

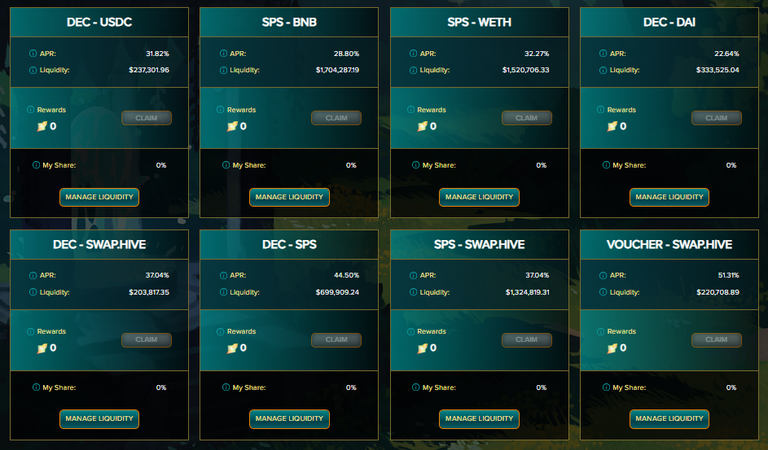

SS of Liquidity Pools

August 2023 & December 2023

|  |

|---|

Pairs | August APR | December APR |

|---|---|---|

| DEC-DAI | 11.59% | 22.64% |

| DEC-USDC | 9.82% (DEC-BUSD) | 31.82% |

| DEC-SwapHIVE | 19.69% | 37.04% |

| DEC-SPS | 24.76% | 44.50% |

| ----------------------- | --------------- | ------------ |

| SPS-BNB | 30.32% | 28.80% |

| SPS-WETH | 29.78% | 32.37% |

| SPS-SwapHIVE | 35.69% | 37.04% |

| Voucher-SwapHIVE | 45.34% | 51.3% |

As seen from the chart above, the APR has increased in majority of the pairs. This has been helpful to all those who have been providing liquidity in all those pools. I suppose the impermanent loss has been helpful and gaining them some attraction.

There has been a massive increase of liquidity in some given pairs. This has happened due to the fact of increase in price of SPS and there are users who has been giving priority to liquidity pools. Also not to forget about the rewards that are being provided for all this liquidity into the pairs. This does provides some additional benefits for us all.

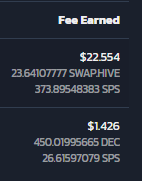

My liquidity

I have been in the liquidity pool for some months. I must admit there were times when it felt like, I should withdraw my liquidity. As the overall impermanent loss has been giving me chills. But instead I gave up on the dollar value and started to increase my liquidity into the pool. That being said, so far as of today, I am glad that I have not withdrawn my liquidity. As they are showing some promising signs in both dollar value and in terms of assets as well.

| With all these months, I have earned the fees of approximately $22 and few DEC and SPS but the SPS rewards have been really juicy over the period. I have staked most of the rewards and added in for other causes. |

|---|

Overall, I would say if you are thinking long term than providing liquidity could be one of the best way to secure both your positions in terms of $$$ or in terms of assets. I the price does not gets appreciated you get little bit more assets of the other side or if the price gets appreciated your $$ value potentially increases in far better value.

While if someone wants to play safe, they can always choose DEC-USDC pair. I suppose there are not many pairs in crypto, which can provide 31% APR for their stable coins. As time is flying by DEC is getting more and more stable. A very good side for the economy of Splinterlands.

I want to see where my initial liquidity supply fly to. As I am just going to enjoy the rewards for the time being.

Image source: Splinterlands

Best regards

Rehan

Want to play & earn from Splinterlands

Join via, My Referral link

Posted Using InLeo Alpha

!LOLZ

!PIZZA

lolztoken.com

Because they know how to multiply.

Credit: theabsolute

@rehan12, I sent you an $LOLZ on behalf of speedtuning

(3/6)

$PIZZA slices delivered:

@speedtuning(3/10) tipped @rehan12

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.